Brutal Q3 for UK Asset Managers

But under the sea of red, some data points and trends might pique investors' interest

Let’s start with the helicopter view of Q3-23 in four charts. The first three summarise AUM performance over the quarter:

Total AUM movement (excluding acquisitions)

Net inflows as a % of opening AUM (flow rate)

Investment performance

It’s not pretty.

A point to flag on the chart above is that there was a consistent theme in the quarter of outflows being dominated by retail investors, while institutional investor flows were more muted. This has clearly been responsible for some big variations in flow performances between asset managers, some of which have a mostly retail investor base, while others have a mostly institutional investor base.

The fourth chart below shows current PE ratios and how quite a few of these have fallen off a cliff since the ‘top of the market’ (roughly) at the end of 2021. The PE median in Dec ‘21 was 18.4 vs 9.0 today.

But let’s run through some points of interest in selected companies.

Gresham House

This is an obvious outlier from a valuation perspective, mainly because it is in the process of being acquired and de-listed (which is a shame), although that’s not the only reason. There’s no doubt Gresham House has been a very strong performer in recent years (refer back to my previous newsletter below for details).

But a key message from its valuation is that even though asset managers’ PE ratios may have overshot to a degree at the top of the bull market, the price paid for Gresham house seems to somewhat negate that argument. Its share price jumped 56% the day the acquisition was announced. There may very well be more acquirers sniffing around the sector.

MAN Group

In the recent environment of volatile and (mostly) falling markets, MAN has performed well compared to most other ‘long-only’ asset managers. Once again its absolute return strategies (designed to perform in rising and falling markets) proved popular with investors and attracted +$1.1bn of net inflows. All other strategies combined had negative net flows of -$0.4bn. This certainly suggests that its institutional clients’ market outlook is tending to be more cautious and less bullish.

Investment performance was just positive which was better than most.

It also concluded the acquisition of Varagon Capital Partners in the quarter: “a leading U.S. middle market private credit manager with $11.8bn of assets under management ('AUM') and $15.4bn of total client commitments” according to its RNS of 6th July 2023.

Also worth noting is that its share price took a heavy fall with the release of half-year results on 1 August 2023, which detailed a big fall in performance fees, although the PE ratio is now looking extremely low. And performance fees won’t disappear forever.

Jupiter

A disappointing quarter in terms of net flows which were -£1bn (although not nearly as bad as some other asset managers). The company stressed the big discrepancy between retail investor flows (heavily negative) and institutional clients (slightly positive with five quarters in a row now of positive net flows from this channel). Retail (including wholesale & investment trusts) make up 81% of AUM though so that channel has the biggest influence.

Investment returns were the strongest of the peer group and pushed Jupiter towards the top of the league table for overall AUM movement in the quarter. In a quarter of mostly negative equity markets, having large funds in fixed income, multi-asset, and alternatives probably helped Jupiter in this regard.

Despite that, the share was pummeled on release of Q3 data, down 10% on the day. The decision to cut fees in some funds will also have played a role in that fall. Management explained that many clients ‘screen’ for funds under a certain fee level so this decision was to ensure more funds pass through those ‘top-of-funnel’ screening decisions before clients’ detailed analysis of a fund takes place. This, said management, should assist longer-term AUM growth, although some short-term revenue pain is inevitable. Let’s see.

The turnaround strategy under relatively new CEO Matthew Beesley is now well underway with fund rationalisations, cost cuts, and some sharper strategic focus, especially on the institutional channel. If he gets this right, at a PE of under 9, there could be some substantial upside in Jupiter.

Polar

Net inflows and investment returns were both slightly down but better than most other asset managers.

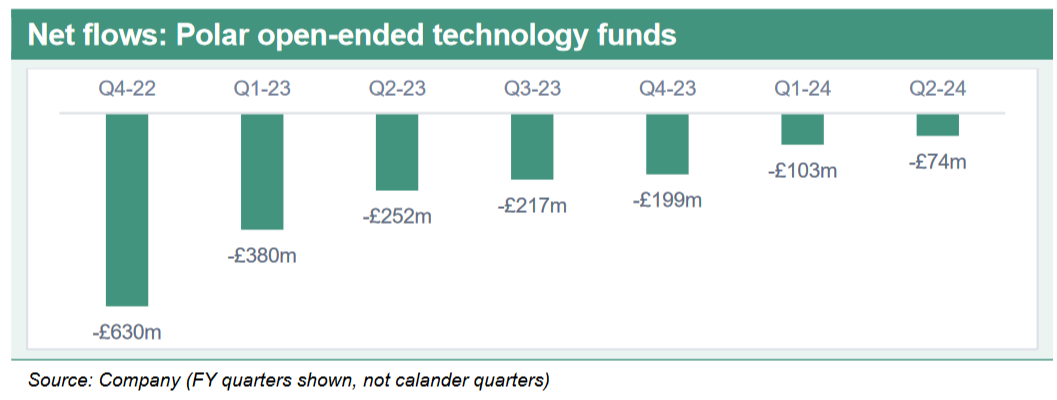

It reported continued demand and inflows into its Artificial Intelligence, Japan Value, Emerging Market Stars, Asia Stars and Smart Energy Funds. And importantly, making up around 38% of AUM, outflows from technology strategies continued to decline.

I provide a more detailed update on Polar in my latest Equity Development research note Solid H1 amidst sharp sector share price falls. The conclusion of this reads:

We think asset managers’ valuations have fallen too far and suspect that share prices may recover quite sharply should markets stage a recovery or the market outlook turns more positive.

But for Polar specifically, we think there is an argument for its share price to outperform the sector. There exists a compelling ‘deep value’ argument, given its solid net cash position of £107m on 31 Mar 23 (25% of its market cap), a forecast core margin of 27.4% (which excludes any potential boost from performance fees) and a forecast dividend yield of 10.5%.

I would also recommend reading the Sep ‘23 write-up on Polar in the Investors’ Chronicle titled: “This specialist fund manager has bottomed out”.

Impax

It was a rare tough quarter for this leader in the sustainable investing space. AUM fell 6% due to many retail investors withdrawing funds from capital markets and sharp market falls.

The share price fell more than 12% on the day, is now down 75% since 31 Dec 21, with Impax’s PE ratio slipping into the 4th quartile of a London-listed asset management peer group.

In my latest Equity Development research note, Sector-leading growth, but 3rd quartile valuation, I argue that this doesn’t make sense. (Impax’s price has fallen again since I wrote that note, hence the quartile-discrepancy between the sentence in the previous paragraph and the title of the note above). Reasons include:

Despite a weak latest quarter (Q4 of its FY23), Impax’s relative growth rate in the first three quarters of its FY23 was certainly impressive - the highest among UK-listed peers; additionally

Its net flow rate has exceeded the median of peers in every quarter since 2021 (except this latest quarter), through bull and bear markets;

Flows into sustainable funds, particularly those with the strongest credentials, and especially climate funds, have held up far better than conventional funds;

There is clearly increasing sophistication and selectivity from asset owners in choosing asset managers when it comes to sustainable investing; and

Impax is poised to take advantage of this - in addition to its 25-year track record in this space, it is among those with the very highest credentials, being one of only eight asset managers, out of 108 assessed, to achieve 'Leader' status in The Morningstar ESG Commitment Level assessment (August 2023), and one of only four to maintain this leader status from the previous assessment.

There’s lots of data backing up these last three bullets about the sustainable investing market in my Equity Development note, I’m sure you’ll find it worth a read.

Like Polar, I would also recommend reading the Oct ‘23 write-up on Impax in the Investors’ Chronicle titled: “A contrarian call on a fallen Aim star”.

Premier Miton

Another disappointing quarter from Premier Miton with no sign of a turnaround in net flows yet, with one positive quarter of net flows in the last eight. It’s exposure to UK retail investors, which withdrew capital from markets in the quarter, certainly hurt its performance relative to other asset managers.

However, it had one of the stronger investment performances, helped by its fixed income and multi-asset strategies. Additionally, 73% of its funds have delivered performance ahead of median since manager inception and, 62% over a three-year period, according to its 13 October 2023 RNS.

When investor sentiment turns, particularly among UK retail investors, it could be one of the main beneficiaries. But that’s not happening yet.

Liontrust

Another tough quarter for Liontrust with heavy outflows again (seven in a row now). The charts at the top of this post say it all.

In my preview of Q3 written a few weeks ago, I wrote:

Since the release of its Q2 trading update Liontrust has had its bid to acquire Swiss asset manager GAM rejected. The message from shareholders to management was loud and clear … that’s a good thing, focus on fixing the core business first! The share price jumped 11% in the three days following the bid rejection (but has drifted lower again since).

Liontrust is now less than one-quarter of its 2021 share price peak. Credibility needs to be re-built. It simply has to turn the net flow situation around. Fast.

So, its definitely a period of reflection and re-grouping for Liontrust, with a re-structuring and cost-cutting process now on the cards. It’s 18 October RNS stated:

The proposed acquisition of GAM would have accelerated our strategic objectives; without GAM, they do not change and our belief in them has only strengthened. The knowledge and insight gained through the GAM process is also helping us shape our future operating model for the long-term growth of the Liontrust business. This will lead to restructuring and efficiencies in some areas of the business. Our flexible remuneration model for fund managers and other staff remains unchanged in light of the headwinds we are facing; in particular, the revenue share model for fund managers ensures they are fully aligned with the business and investors.

It’s share price is badly beaten-up, with lots of uncertainty around this one.

Ashmore

The investment class this specialist asset manager focuses on - emerging market debt - has certainly been out of favour for some time now, and that has reflected in Ashmore experiencing heavy outflows and falls in AUM. Indeed, its AUM is 40% down on end-2021 levels.

In my preview of Q3 written a few weeks ago, I suggested there may be some light at the end of the tunnel:

I'm torn between putting this one in the 'changing fortunes?' or 'ongoing struggles' category.

With an emerging market debt focus - which is looking much more positive as an asset class - Ashmore delivered a strong investment performance in Q2. But investors are still withdrawing funds.

The key question is when will inflows return? Surely flows must follow returns at some point? When they do, this is one AM which could benefit tremendously.

However, in the latest quarter, investment returns turned negative again so my previous comment is looking a little weak now. We’ll have to wait and see.

In the 13th October RNS, Ashmore CEO Mark Coombs wrote:

Emerging Markets were largely rangebound this quarter and overall delivered slightly negative returns. After three quarters of positive returns, such a period of consolidation within a longer recovery cycle is normal, and there continue to be positive fundamental trends in Emerging Markets.

If you are interested in taking a deeper-dive into Ashmore, I’d highly recommend this write-up by Guy Davis, Ashmore Plc: Not Another UK Financial

Make sure you keep up to date with my updates on the asset and wealth management sectors by subscribing below. (I’ll be publishing a Q3 update on the UK wealth management sector in the next few days, so keep a look out for that one.)

Please read the Investing in the Investors disclaimer here.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication, and covered Impax Asset Management and Polar Capital as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Impax Asset Management here, and on Polar Capital here. (Please read this link for the terms and conditions of reading Equity Development’s research).

I would also recommend reading the Oct ‘23 write-up on Impax Asset Management in the Investors’ Chronicle titled: “A contrarian call on a fallen Aim star”. https://www.investorschronicle.co.uk/ideas/2023/10/19/a-contrarian-call-on-a-fallen-aim-star/

I would also recommend reading the Sep ‘23 write-up on Polar Capital in the Investors’ Chronicle titled: “This specialist fund manager has bottomed out”. https://www.investorschronicle.co.uk/ideas/2023/09/14/this-specialist-fund-manager-has-bottomed-out/