D2C platforms raving at the interest rate party

What's the risk of a massive hangover if regulators intervene or when rates fall?

This is not investment advice. Please read the Investing in the Investors disclaimer here.

I am mostly bullish on the UK wealth management sector, which would include the two London-listed platforms I’m discussing in this post, Hargreaves Lansdown (HL) and AJ Bell (AJB). Simplistically, the sector benefits from a ‘snowballing’ effect as people just keep paying into their pension and investment pots. Investment returns add to this growth over the longer term (although short-term pullbacks are inevitable).

On top of this, there is potential for a further massive boost if Brits start shifting their (fairly large) piles of ‘idle cash’ into more ‘productive’ investments. AJ Bell flagged this in its FY23 analyst presentation, citing a statistic that cash held in interest bearing notice accounts in the UK had increased by 50% over the last year to £257bn. And asset manager Ninety One highlighted the scale of the opportunity of getting more people to invest (rather than save) in its recent podcast "UK savings platforms: a diamond in the rough", saying "Roughly 1 in 5 people have brokerage accounts in the US, which compares to the UK’s 1 in 20."

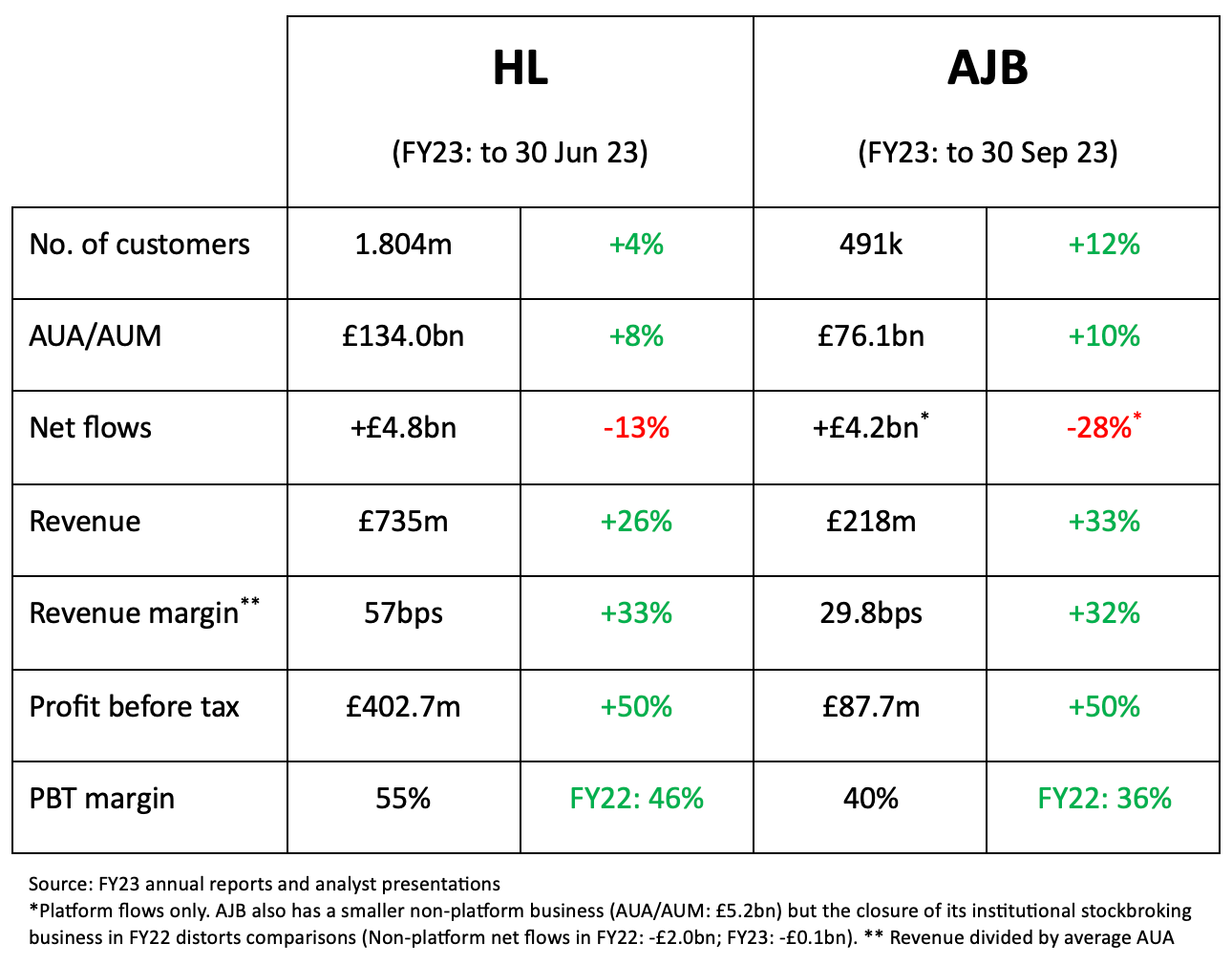

The most recent financial results of HL and AJB certainly appear to reinforce the bull case. Even in a pretty bleak economic environment, people are opening new accounts and topping up their investments and pensions (although not as much as last year), while the platforms reap the benefits of operating leverage - they grow assets under administration (AUA) and revenue, but don’t need to increase costs at the same rate.

Note that HL is a ‘pure-play’ D2C platform but AJB runs a D2C platform (30% of AUA but 46% of revenue) and an adviser platform (63% of AUA but 48% of revenue). Because AJB’s adviser platform has a far lower revenue margin than D2C (22.3 vs 47.2 basis points), its overall revenue margin is quite a bit lower than HL.

Initially, financial markets responded very positively to both sets of results. HL’s share price jumped nearly 7% in the two days following the results release, while AJB’s jumped 20%.

But eagle-eyed readers will have picked up another anomaly in the table above. At both companies, revenue growth out-stripped AUA growth. By far. And that’s mostly because these platforms are earning (a lot) more net interest income on clients’ cash balances - in financial jargon, revenue margin has skyrocketed.

Which leads us to the main subject of this post. Following such a dramatic spike in revenue from net interest, is there a risk of an equally dramatic fall in revenue, either due to cash moving into lower-yielding assets such as funds or shares, to regulatory pressure trying to get more interest passed on to clients, or due to interest rates falling? And does this pose a threat to the bull case?

Note: The interest income spike is less of a feature on AJB’s adviser platform, where customers tend to hold lower cash balances (3.6% of AUA at the end of FY23). AJB’s FY23 analyst presentation says that cash on this platform is often ‘transitory’ - cash gets paid in, dividends are received, investments are sold etc, and this is then used to buy new investments, pay fees, or fund withdrawals. But it says that on the D2C platform (especially in pensions), cash balances are more of an asset allocation decision, resulting in far higher cash balances (13.3% of AUA).

Clients are not switching into cash

Perhaps surprisingly, there hasn’t been a huge move into cash from funds or equities on these platforms as interest rates have risen.

Customers seem to have mostly kept their funds invested, while using banks for their interest-bearing cash deposits (see paragraph 2 of this post). HL provides an interesting chart showing that the average percentage cash balance in client accounts remains relatively stable over a longer period.

And in its FY23 annual report, AJB said it only saw elevated cash balances in the first half of its financial year which was the particularly volatile Oct 22 - Mar 23 period (remember the ‘mini budget’?), which suggests customers may have swapped risk-assets for cash for a time, but that was a temporary phenomenon, despite interest rates continuing to rise after that period.

There are two takeaways here. Cash volumes have not played a big role in boosting revenue for platforms, and a flood of client funds from high-yielding cash to low-yielding funds or shares doesn’t look to be on the cards when interest rates fall.

A big (very big) revenue boost from interest rates

This means the financial boost to the platforms in this higher interest rate environment is almost exclusively due to a higher net interest margin (NIM). HL’s disclosures are more detailed on this point than AJB’s.

But it’s clear the situation is similar on AJB’s D2C platform.

A restless regulator - but are HL and AJB in its crosshairs?

We don’t know for sure. The regulator of investment platforms, the FCA, is clearly unhappy with some platforms but HL and AJB appear confident they are complying with regulations and guidelines. And the rates they offer don’t strike me as abnormally low so I’d be surprised if major changes to their payout rates were demanded (but not everyone agrees with this view). Here’s some more detail.

The FCA has been on the case about platforms passing on a sufficient share of interest earned on client cash to clients for some time now. But it’s ramped up the pressure recently. And if it does act to reduce the NIMs of platforms significantly, this could absolutely result in a sharp fall in revenue.

AJB usefully includes some key points from various FCA statements in its FY23 analyst presentation, including these:

This potential for regulatory action is being taken seriously by the market. UBS put a ‘sell’ rating on both HL and AJB in early-Nov 23 citing a material risk that the platforms’ current NIMs might not offer ‘fair value’.

Then on 12 Dec 23, another ‘Dear CEO’ letter landed on the desks of Investment Platforms and SIPP (Self-Invested-Pension-Plan) operators, which caused a wobble in share prices (HL fell nearly 10% from the 11 Dec close but recovered to close 6.5% down on the day; AJB also fell 10% intra-day but closed around 3.5% down).

The FCA had surveyed the practices of 42 firms and said:

“We are concerned that some firms’ treatment of the interest earned on their customers’ cash balances may not be in line with the Duty… Retention of interest by firms is generally not providing fair value to consumers.

Investment platforms and SIPP operators should review their approaches to meet our expectations… and provide us with confirmation that they have done so along with the following information … If the firm believes their practices are already compliant with the Consumer Duty and as such the firm does not intend to make any changes further to the letter, confirmation of the reasons why not, with supporting evidence demonstrating compliance with the relevant Consumer Duty requirements. We will review the responses from firms and take further action as is necessary to ensure consumer protection and support good outcomes.”

The same day AJB put out a statement which included the following:

“Now we have clarity from the regulator, we are pleased to confirm another significant package of pricing changes which will benefit our customers to the tune of £14m a year… So, as well as improving the competitive rates of interest we pay, we are also reducing our dealing charges for D2C customers… The financial impact is fully factored into the guidance we provided in our annual results last week"

While HL had said in September:

The Board also attested our compliance with the FCA’s Consumer Duty by the end of July. I am pleased to report that our Consumer Duty programme confirmed that our existing embedded focus on good client outcomes has led to no major change requirements across all the FCA prescribed dimensions, with only minor enhancements identified to further support our clients in reaching good outcomes.

But let’s look into the actual interest rate numbers. On cash in SIPPs on its D2C platform, AJB’s interest rates now vary from 3.2% to 4.45% depending on whether the SIPP is in accumulation or drawdown, and depending on the cash balance. HL’s vary from 3.51% to 4.65%.

I know it’s not the perfect apples-and-apples comparison, but I have three instant-access bank savings accounts, which pay 2.0%, 3.55%, and 4.1%. You can shop around and get something around the 5.0% mark (and maybe 5.5% for a 12-month fixed deposit). As I wrote earlier, it’s hard to argue the HL and AJB rates are abnormally low. It just looks like a stretch to me to argue that there may be a sudden demand by the FCA to significantly bump up interest rates to customers and make a big dent in revenue.

Revenue at risk from interest rate falls (but not for now?)

But falling interest rates pose a different risk. There is little expectation of a dramatic near-term drop-off, but rates probably will start to fall during 2024 (AJB have assumed from Feb 24).

Both HL and AJB have provided a steer on how they see changing interest rates impacting their revenue margins. These guidance slides are shown below (BoE base rate at the time of writing is 5.25%). And interestingly, neither company sees any material impact until base rate drops below 3%, and even then, the impact is estimated to be quite small.

It may look strange at first glance that the base rate could drop by as much as 2.25% (from 5.25% to 3%) without impacting NIM. But it looks like there are two forces as work.

First, in a higher interest rate environment, movements in the base rate can simply be passed on to the consumer. In AJB’s FY23 annual report (page 160 - ‘Interest Rate Risk’) it states:

“In FY23, movements in the UK base interest rate would not have impacted the retained interest income earned by the Group, as any increases or decreases to the UK base interest rate when it is at higher levels would be passed to customers in the form of higher or lower pay away rates respectively.”

And second, the platforms appear to be using some forms of interest rate hedging to protect their NIMs (at least for a period of time). Some of this is fairly simple treasury management. In the AJB FY23 analyst presentation it says:

“Treasury management capability gives us time to react to interest rate changes and provides a degree of protection from future rate cuts.”

While in its FY23 annual report it says:

“Cash balances (of customers) are held with a variety of banks and are placed in a range of fixed-term, notice and call deposit accounts… the spread of rate retained by the Group is variable dependent on rates received by banks (disclosed to customers at between 1.15% below and 0.15% above the prevailing base rate) and amounts paid away to customers.”

It’s not clear if any more sophisticated interest rate hedging techniques are used by either company.

So, while there’s little doubt that a return to a lower interest rate environment will erode NIMs in time, there’s not a lot to suggest that there may be a sudden and large fall in net interest income.

Also, AJB make the point that other revenue streams stand to benefit if interest rates fall, saying:

“A significant fall in base rate would increase the attractiveness of investing – a potential positive for platform net inflows

Volatility in the market drives dealing activity – a positive for our transactional revenues as evidenced during COVID period.”

***

I started this post summarising the longer-term bull case and structural growth drivers of D2C platforms. Most of the post then looked at the risk of revenue reducing in a changing regulatory and interest rate environment.

My conclusion is that the risk is real, but will in all likelihood be gradual and occur over a period of time, and is not something that is likely to be a surprise to observant analysts and investors. I just can’t see this potentially negative factor negating the longer-term structural growth drivers.

In a few weeks, I will be posting about another risk faced by these platforms though, which may very well be a far bigger threat to their growth over the longer term … the risk posed by a whole lot of new competitors entering the market and scaling up their offerings. I might call that one “The Americans are coming”. Subscribe below to get notified when that post drops.

Please read the Investing in the Investors disclaimer here.