Interest rates & nervous investors key themes of recent wealth management results

Hargreaves Lansdown, Brooks Macdonald and Mattioli Woods reported full-year results in September. Here's a summary of how they are coping in a changed wealth management world.

The last two weeks offered some great insights into the UK wealth management space. Three listed companies with very different business models reported results:

Hargreaves Lansdown (LSE: HL.), the UK’s largest direct to consumer investment platform;

Brooks Macdonald (LSE: BRK), which manages investment portfolios for (mostly smaller) independent financial advisers, as well as having a private clients financial planning business, operating in the UK, Channel Islands, and Isle of Man; and

Mattioli Woods (LSE: MTW), with in-house advisers, administration, and its own investment products, ranging from more-traditional multi-asset funds through to to specialist private equity and property funds.

New exec team at HL, business-as-usual it’s not

CEO Dan Olley (appointed Aug 23), CFO Amy Stirling (Feb 22), and Chief Client and Commercial Officer Ruchir Rodrigues (Oct 22) presented their take on the FY23 results (to 30 Jun 23) and their plans going forward on Tuesday the 19th September.

Looking backwards, it was a cracking year for HL with revenue up 26% to £735m, revenue margin +33% to 57bps, and PBT +50% to £403m.

The standout feature of the results was the revenue boost from the higher net-interest-margin (NIM) earned on cash held in clients’ investment accounts, with NIM dwarfing the revenue yields earned on fund and share investments.

While the average AUA of client cash increased only slightly from £13.6bn to £14.0bn, NIM shot up from 37bps in FY22 to 192bps in FY23, resulting in revenue from cash increasing more than five times from £50m to £269m and making up 37% of total revenue (FY22: 9%).

The average AUA of funds reduced from £65bn to £61bn, generating revenue of £236m (FY22: £254m), with a revenue margin of 39bps (FY22: 39bps). Shares’ average AUA reduced from £52bn to £49bn, generating revenue of £148m (FY22: £195m), with a margin of 30bps (FY22: 37bps).

Interestingly, HL reckons that as long as base rates remain above 2%, NIM should be sustainable (source: HL FY2023 Annual Results Presentation).

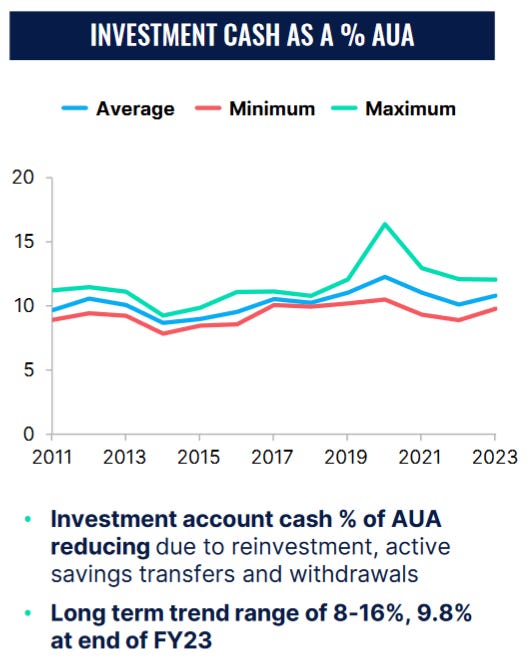

Also, investment cash as a % of AUA tends to be pretty stable over the longer term, so a flood of client funds from high-yielding cash to low-yielding funds or shares doesn’t look to be on the cards when interest rates fall (source: HL FY2023 Annual Results Presentation).

With that in mind, growth will probably be more dependent on HL winning new clients and increasing the average AUA per client.

CEO Olley is certainly bullish, emphasising that the market opportunity in the UK is still huge, and citing an addressable and growing market of over £3 trillion (which suggests HL has a market share of just over 4%). He uses his experience of previously living in the US to make the point: “in the US, everyone I know invests, they’re engaged with it … what has amazed me since I first joined HL is how many people I know in the UK are the complete opposite, putting money into investments can be bottom of the list.”

There’s work to do to capture that opportunity. Right now, client growth is OK given the economic and market environment, but certainly not booming: active clients +4% (67k) in FY23 to just over 1.8m (FY22: +6%, +92k). And net new business flows are down 13% from £5.5bn in FY22 to £4.8bn.

But there is evidence of opportunities that can be captured:

HL’s Active Savings product – with clients being able to shop around for the best interest rates from 17 banks and building societies - was the focus of increased marketing efforts and saw inflows double to £3.2bn (FY22: £1.5bn) and AUA increase 70% to £7.8bn; also

HL identified Gilts as an attractive option for higher rate taxpayers and those that have used their full ISA allowance (capital gains on Gilts are tax-free), and highlighted that a personalised and targeted education-based content campaign helped to attract £430m of client investment in July 2023 alone.

At the time of writing, HL’s PE ratio was around 12, so significant growth isn’t priced into the shares. It might be worth investors’ time to dig into the growth opportunities, and HL’s chances of capturing them, in more detail.

Brooks continuing to attract assets faster than competitors

Meanwhile, Brooks Macdonald had a solid year (to 30 Jun 23) with funds-under management (FUM) closing FY23 on £16.8bn, 7.5% up y-o-y. This was the second-highest growth rate among adviser-channel-focused wealth management peers (source: Equity Development research note: ‘Revenue & profit beat forecast but outlook cautious’)

Net flows totalled +£817m (FY22: +£785m). Momentum was maintained throughout the year with positive net flows in every quarter. Investment performance added +£363m, 2.3% of opening FUM, above the benchmark MSCI PIMFA balanced index which returned 1.6%.

Revenue grew 1.3% to £124m, with this growth being lower than FUM primarily due to product-mix effects. Bespoke Portfolio Services, BM’s higher-yielding ‘flagship’ product saw small outflows of -£207m (FY22: +£88m). Flows into lower-yielding Managed Portfolio Services or MPS (standardised risk-adjusted portfolios), accelerated once again, along with the ongoing market shift in favour of MPS (BM MPS net inflows for FY23: +£1,322m; FY22: +£829m; FY21: +£282m).

BM also flagged the higher interest rate environment being responsible for a number of other forces at play during the year, including:

clients tending to invest in cash or payback debt, in favour of allocating capital to stocks, bonds or fund investments;

significant interest from clients in short-dated UK Government bonds;

yields (particularly BPS yields) benefiting from a higher interest turn.

Prospects look solid in the short-term, with BM flagging a healthy pipeline for FY24, although stressing investor sentiment is still subdued.

Over the longer-term, it is well positioned in a huge and growing personal financial investment market (it has been attracting assets faster than competitors for some time now).

More specifically, it’s adviser-channel focus should benefit from the aging UK population whose financial needs become more complex closer to retirement. And advisers are continuing to outsource investment management more and more to companies such as BM as they focus more on financial planning and advice, and steer clear of the resourcing, regulatory and risk burdens of investment management.

The above commentary on Brooks Macdonald is a modified extract from my recent Equity Development research note covering BM’s FY23 results, Revenue & profit beat forecast but outlook cautious. A BM management presentation and investor Q&A can be viewed at this link.

Mattioli looking to capitalise on organic opportunity and recent acquisitions

Mattioli Woods also had a solid year (to 31 May 23) with client assets closing on £15.3bn, up 3%, the same growth rate as revenue which reached £111m.

Statutory PBT jumped 48% from £8.0m in FY22 to £11.9m, but was boosted by a reduced charge in ‘Deferred consideration as remuneration’ from £9.6m to £6.9m (charges which are effectively non-upfront tranche payments of previous acquisitions) and a reduction in the effective tax rate.

These accounting rules result in MW’s statutory accounts being less than ideal for like-for-like year-on-year profitability comparatives. As such, the business also provides a number of ‘adjusted’ metrics which are useful for such comparisons. One of these is adjusted EBITDA which provides a good comparator of underlying operating profitability. In FY23, adj. EBITDA increased 2% from £32.6m in FY22 to £33.2m, with margins down slightly from 30.1% to 29.8%.

But a point to stress about MW is that it is now a multi-faceted business, where parts of the group will do well and others less so depending on market conditions. FY23 was a prime example of this.

The pension consultancy segment saw revenue up 20% driven by increasing demand for advice as a consequence of changes to pension and tax rules. Demand for employee benefit services was also very strong with revenue up 18% and employers increasingly encouraging staff wellbeing and retirement savings in their benefits packages.

But the investment management side of things was weaker with gross discretionary assets under management reducing by 7%, primarily due to weak markets.

Associate company Amati, with a concentration of assets in UK small caps, was hard-hit by reduced valuations and outflows in this area of the market with AUM down 25% (although it’s been a huge success fro MW over the longer term). In-house discretionary portfolio management saw AUM down just a touch but private equity arm Maven grew its AUM by 8%, although performance fees were down.

Zooming out though, it’s clear to see how the group is benefiting from its increased scale over recent years and from the growth of higher-yielding products (such as private equity), with adj. EBITDA margin increasing from 21.2% in FY17 to 29.8% in FY23. (source: Equity Development research note: ‘Solid FY23, with acquisition synergies realised’)

Looking forward, MW is looking to both organic and acquisitive growth to push towards its medium-term objectives (£30bn in client assets, £300m in revenue, and £100m of EBITDA).

Organic growth has two main levers: 1) Adding new clients, with MW reporting strong momentum in new client lead generation (pipeline up 16% y-o-y); and 2) pushing to capture a larger share of wallet from existing clients - MW has calculated that its advised and financial planning clients have £3.4bn of assets invested with other investment providers – which could be moved to MW over time.

On the acquisition from, previously acquired businesses (including Maven, Ludlow, Pole Arnold, and Hurley) are delivering organic growth with MW estimating revenue and cost synergies already captured to be around £1.3m, with further opportunities from these and more recent acquisitions.

More acquisitions are expected: 1) enhancing distribution by acquiring financial advisory and planning businesses; and 2) ‘gap filling’ areas such adding new differentiated investment products (as Maven did).

The above commentary on Mattioli Woods is a modified extract from my recent Equity Development research note covering MW’s FY23 results, Solid FY23, with acquisition synergies realised. An MW management presentation and investor Q&A can be viewed at this link.

I’ll be commenting on the Q3 2023 updates of UK wealth managers in the first few weeks of October 2023. Make sure you keep up to date with these and all of my updates on the asset and wealth management sectors by subscribing:

Please read the Investing in the Investors disclaimer here.

Disclosure: At the time of writing, Paul Bryant was a shareholder in Hargreaves Lansdown, Brooks Macdonald and Mattioli Woods, and covered Brooks Macdonald and Mattioli Woods as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Brooks Macdonald here, and on Mattioli Woods here. (Please read this link for the terms and conditions of reading Equity Development’s research).