Sustainable Investing is not going away, but ...

... it's changing fast! Investors are demanding a step-change in credibility. There are even early signs of a 'backlash against the backlash'.

Last week I published my Equity Development research note covering sustainable investing specialist Impax Asset Management’s FY23 results. The share price has been pummelled (down around 70% since early-22), but I argue there now appears to be a mismatch between the share price and the business’s fundamental value.

Read the note to get all of the reasons for my bullishness (management’s investor presentation and Q&A with investors is also well worth a watch), but one of the key reasons is how the world of sustainable investing has fundamentally changed (and is still changing), and how this works in Impax’s favour. Below is an extract from my note (with a few additions), which hopefully makes an interesting standalone read!

This is not investment advice. Please read the Investing in the Investors disclaimer here.

Sustainable investing is not going away (but it is changing)

When it comes to sustainable investing, we think much of the media publicity suggesting waning interest (and sometimes even the demise of sustainable investing) is not grounded in facts, or at best, omits key facts. While we fully acknowledge that radical changes are afoot in the space, we believe these changes are the start of a transition.

This transition is from ‘sustainable investing 1.0’ (pre-2022), where demand for almost any funds with ‘sustainable’ or ‘ESG’ in the name or description was insatiable, and many asset managers, even those with no historical business in this space, moved quickly and opportunistically to satisfy this demand. It was also an environment of little or no specific sustainable investing regulation.

And it is to ‘sustainable investing 2.0’, where investor demand is far more sophisticated and nuanced and aims to seek out the most credible sustainable investing funds, which are also now regulated more robustly, with more regulation to come.

This is a shift which is indeed grounded in facts, as detailed below.

Demand for sustainable investments solid amid turmoil

In the European sustainable fund market (EU plus markets such as the UK and Switzerland), which makes up 84% of the global sustainable fund market [according to Morningstar: Global Sustainable Fund Flows, Q3 2023 in Review], despite net flows falling significantly since the bull market of 2021, net flows have been positive in every quarter since the start of 2021.

This stands in contrast to ‘conventional’ funds which saw huge outflows in 2022 and outflows in every quarter since the start of 2022 except Q1-23 and Q3-23 (when they were marginally positive). Moreover, flows into sustainable funds exceeded those of conventional funds in nine of the last 11 quarters (including the most recent two quarters).

The ‘most sustainable’ funds are attracting much more capital

Additionally, within the EU, there is an emerging differentiation between the most credible sustainable funds (Article 9 or ‘dark green’ funds with a specific sustainable investment objective) and those with lesser credentials (Article 8 or ‘light green’ funds that promote environmental and/or social characteristics).

This has been particularly pronounced in the last two quarters, as illustrated in the chart below, and continues a recent trend of Article 9 funds having consistently positive flows while those of Article 8 have experienced outflows in six of the last seven quarters.

These stronger flows into article 9 funds have occurred despite an anomaly arising from regulation. In its report, SFDR Article 8 and Article 9 Funds: Q3 2023 in Review, Morningstar stated that Article 9 flows had been negatively impacted by:

“the great reclassification between the last quarter of 2022 and the first quarter of 2023. Around 350 Article 9 funds were repositioned to the Article 8 category (ED note: see the Article 8 spike in Q1-23) following the European Securities and Markets Authority's clarification of the EC's June 2021 Q&A last summer. It specified that funds making Article 9 disclosures should hold only sustainable investments, except for cash and assets used for hedging purposes.”

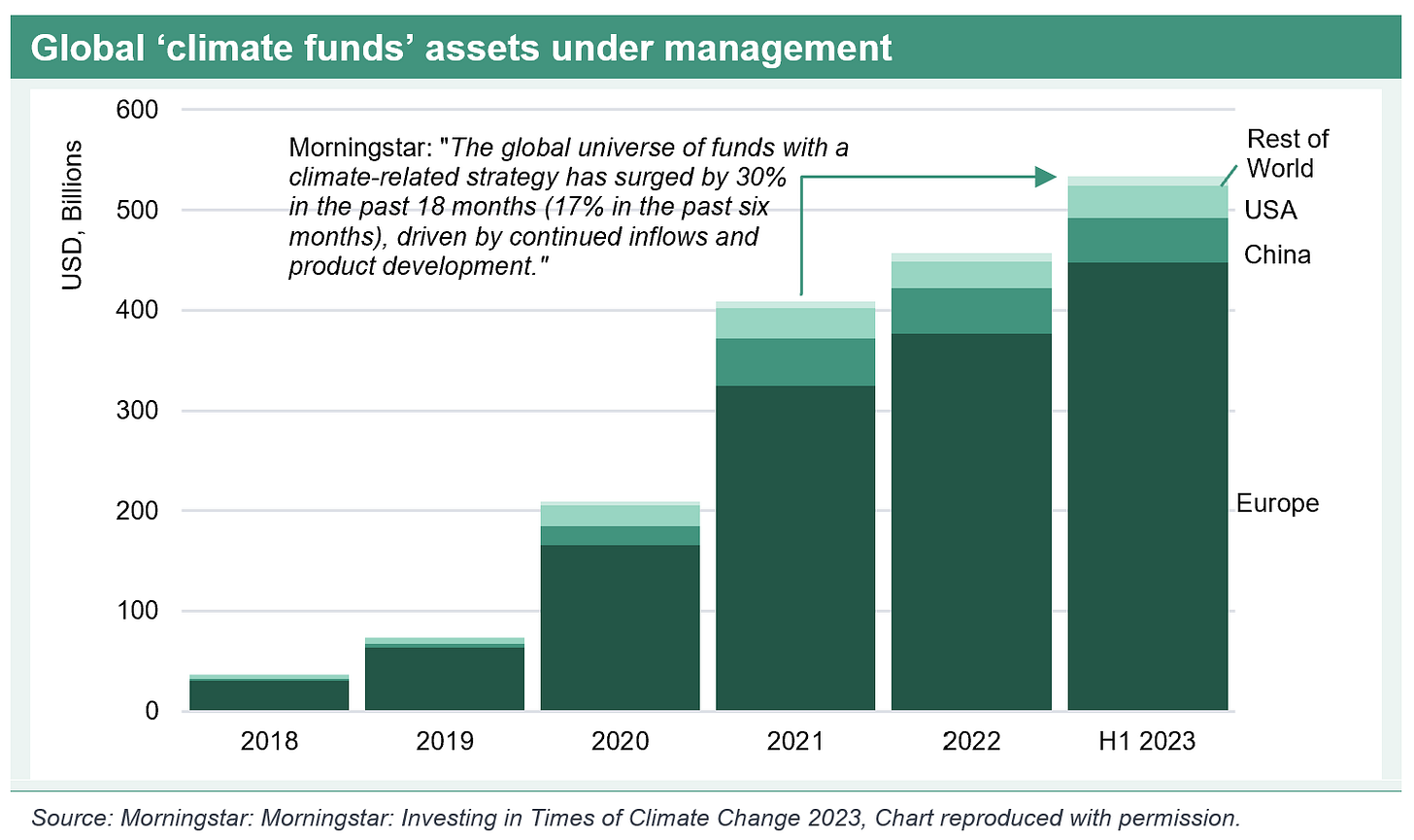

Demand for climate funds is particularly strong

Another relevant feature of the global sustainable investing market is the strong relative demand for ‘climate funds’ (around 20% of the global sustainable fund market), according to Morningstar: Investing in Times of Climate Change 2023.

It has compiled data covering five groups of climate funds, based on investment objective and policy, diversification, and sector exposure: Low Carbon, Climate Transition, Climate Solutions, Green Bond, and Clean Energy/Tech.

And it is also a market that is growing and attracting capital far faster than the wider fund universe. According to Morningstar:

“The first six months of 2023 saw a recovery of subscriptions as global climate funds netted almost USD 36billion. This represents almost 15% growth compared with the second half of 2022. In contrast, the broader open-end fund and ETF market saw a minor pickup of USD 48billion after registering combined outflows of USD 427 billion over the second half of 2022. The comparison reflects the undiminished interest from investors in climate-related investments in the face of economic uncertainties.”

US sustainable market weaker, but it remains a huge opportunity

An area of weaker demand, however, is the USA, which makes up around 11% of the global sustainable fund market. Headwinds, not least of which is a political backlash against ESG and sustainable investing, have slowed progress with net outflows recorded over the last few quarters.

But the negative political headlines in the US are certainly not the dominant force.

Impax CEO Ian Simm reminded us of the fundamentals behind sustainable investing and how applicable they are in the US when he answered a question from an investor about the situation in the US during the Equity Development webinar: Investor Presentation video - 29 November 2023 (29m15s).

“What we’re doing is investing in industrial revolutions, and central transformations backed by technology change, regulatory interventions, and changing consumer demand.

What’s very clear in the US is that there’s an industrial revolution underway in the direction of clean energy and energy efficiency, the reshoring of jobs - particularly back from Asia, but also potentially back from Europe, and a resurgence in US manufacturing that’s underpinned to a significant degree by the Chips and Science Act, Infrastructure Investment and Jobs Act, as well as the Inflation Reduction Act. And that has meant that there’s plenty of opportunity to invest in both listed and private companies,

So yes, we need to be a bit careful in places like Texas or Florida, so that our investment ideas are correctly understood, but our marketing typically is focussed on the coasts (where the largest capital markets are) and the Mid-West.”

We also flag up early signs of a ‘backlash against the ESG backlash’. For example, Harvard Law School reports:

“Fiduciaries of the public (pension) plans have also pushed back on the use of these restricted lists (which restrict the use of asset managers taking ESG factors into account in their investment decisions), as evidenced by the ongoing dispute between the Oklahoma Treasurer’s office and the board of trustees overseeing the Oklahoma Public Employees Retirement System (OPERS). Back in August, the OPERS board voted in favor of a move that would exempt the pension fund from having to terminate contracts with blacklisted firms based on an exemption for plans that determine that such requirement would be inconsistent with fiduciary responsibility with respect to the investment of entity assets.”

Some of the above points were also highlighted at the FT’s recent “Future of Asset Management Europe 2023” conference, where US-based President Asset Management and GEB Lead for Sustainability and Impact at UBS, Suni Hartford said:

“The politicisation of ESG is one of the worst trends that we’re seeing. But for every Texas and Florida, there is a New York and a California.”

She also stressed that the anti-ESG movement is not active at the Federal level in the US but rather at state level, typically in red (Republican) states, led by state Attorney’s General. But even in these states, it’s not a one-way street against sustainable investing. She said:

“There is now a trend that investors such as pension funds are challenging the anti-ESG politicians. In Louisiana, the AG said that pension funds would be compelled to boycott or avoid pro-ESG asset/investment managers – but Pension funds stood up at the caucus and said he could not do that as they have a fiduciary responsibility, and that the AG could not limit that by restricting which investment managers they could deal with.”

***

A demise of sustainable investing narrative might make for great headlines. And there’s no doubt the wheels have fallen off the marketing-oriented ‘ESG bandwagon’. But the facts suggest that demise has been greatly exaggerated.

Most capital allocators and governments seem to be taking the position that capital markets still have a front-and-centre-role to play in moving toward a more sustainable economy. The argument is now around exactly what that role looks like, not if it should exist.

Please read the Investing in the Investors disclaimer here.

Disclosure: At the time of writing, Paul Bryant was a shareholder in Impax Asset Management, and covered Impax Asset Management as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Impax Asset Management here. (Please read this link for the terms and conditions of reading Equity Development’s research).