Wealth managers' Q3-23. What a mixed bag! (part 1)

Some flying high. Some steady-as-she-goes. Some riddled with uncertainty.

At first glance, the UK-listed wealth management sector (wealth managers, investment managers, and platforms) appeared to have a solid enough Q3-23, with most posting AUM gains.

This was in contrast to their close relatives, asset managers, which saw a sea of red (AUM falls) as investors, particularly retail investors, fled a range of equity classes and some bond classes.

People mostly continued to feed their SIPPs, ISAs and the like, although some data (e.g. from Hargreaves Lansdown, see below) and CEO comments point to a clear trend of de-risking and moving some investments funds into cash and equivalents (which doesn’t necessarily mean moving funds out of wealth managers, as some of them have cash products).

The HL CEO wrote in its 19 October trading update:

“Clients are looking to invest more in cash than risk-based investments, from our Active Savings offer, giving easy access to a range of banking partners, to Money Market Funds and short-dated bonds”

And Brooks Macdonald’s CEO wrote in the recent annual report:

“…prevailing market volatility impacting investor sentiment and higher interest rates driving increased trends towards higher cash holdings, debt repayment and investment in money market funds in the short term…”

But under the surface, performances and outlooks are wildly different between companies.

Here’s the group discussed in this post (part 1 of 2) ranked by size of their assets under administration or management.

Here’s how their AUA and net flows grew or fell in the quarter. It’s worth highlighting that AUA movements were driven almost entirely by net flows with investment performance playing only a minor role (highest investment contribution: +0.5% of AUA, lowest: -0.7%).

And here’s my summary of the main highlights and lowlights, company-by-company, in order of size, largest to smallest.

St James’s Place

It feels like SJP is at an inflection point.

The last 3 months has seen its share price crater by 46% (FTSE All Share down 5%).

The fall was almost certainly mostly due to fears it would have to cut its fees as a result of regulatory pressures around ‘consumer duty’, and obviously the impact of this on future profitability.

These fears proved founded and SJP announced details of the cuts on 17th October 2023, including: cutting initial and ongoing fees, removing Early Withdrawal Charges, and separating charges into component parts (making it easier for customers or potential customers to compare its fee structures to others).

The company’s presentation of the new fee structure stated:

Shareholders will see growth in cash profit impacted between 2024 and 2026, before accelerating over the medium term and beyond.

That remains to be seen, and investors are clearly unconvinced at this stage.

But just as worryingly perhaps, will have been SJP’s declining growth rate relative to sector peers.

It has historically been a very strong performer when it comes to attracting and retaining client assets. Look at its net inflows compared to a peer group median in the chart below, and it’s obvious that it kept its net inflow rate some distance above most peers until around mid-2022. But since then, its net flow rate has dropped off, faster than the peer group median. The last three quarters has seen its net flow rate match or dip below a peer group median.

We don’t know if all the noise around fees made clients think twice about their SJP investments over the last year or so, depressing net flows. Perhaps.

But what is certain is that incoming CEO Mark Fitzpatrick and his team have a huge challenge over the next few years to restore investors’ confidence.

At a PE of just over 9, the valuation doesn’t exactly look demanding, but there’s big uncertainty around the level of future profits. A really tricky one for investors.

Hargreaves Lansdown

In September, on the release of HL’s FY23 full year results (to 30 June 23), I wrote:

It was a cracking year for HL with revenue up 26% to £735m, revenue margin +33% to 57bps, and PBT +50% to £403m.

The standout feature of the results was the revenue boost from the higher net-interest-margin (NIM) earned on cash held in clients’ investment accounts, with NIM dwarfing the revenue yields earned on fund and share investments.

While the average AUA of client cash increased only slightly from £13.6bn to £14.0bn, NIM shot up from 37bps in FY22 to 192bps in FY23, resulting in revenue from cash increasing more than five times from £50m to £269m and making up 37% of total revenue (FY22: 9%).

This picture appears to be continuing. In calendar Q3-23, HL recorded net inflows into its Active Savings product of +£0.7bn, while the rest of its business recorded a small net outflow of -£0.1bn (overall net flows +£0.6bn).

Once again capitalising on an elevated NIM, revenue in the quarter totalled £183.8m, 13% up y-o-y (£162.9m in the same quarter of last year).

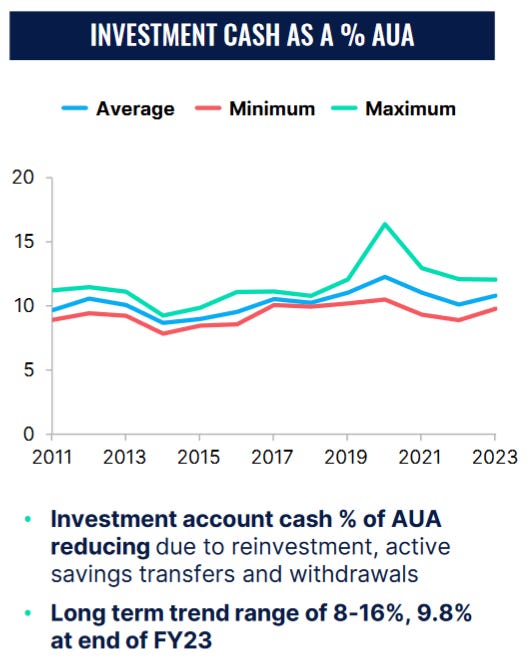

The worry is that if money starts flipping back to lower-yielding shares or funds when interest rates fall, then revenue could take a knock. HL reckon this shouldn’t happen, because cash as a % of AUA tends to be pretty stable over the longer term. (source: HL FY2023 Annual Results Presentation).

It also reckons that as long as base rates remain above 2%, NIM should be sustainable (source: HL FY2023 Annual Results Presentation).

I suppose the jury’s out on what investors do when interest rates fall again.

But on the positive side, despite being the largest incumbent platform, HL still has ample headroom for growth. Asset manager Ninety One highlighted a few key drivers in a recent podcast "UK savings platforms: a diamond in the rough" (also on the main podcast platforms), including demographics, regulation, and technology. But the one which really caught my attention was a comparison to the US :

"Roughly 1 in 5 people have brokerage accounts in the US, which compares to the UK’s 1 in 20."

HL’s CEO made a similar point in their recent analyst presentation, using his experience of previously living in the US to emphasize it:

“… in the US, everyone I know invests, they’re engaged with it … what has amazed me since I first joined HL is how many people I know in the UK are the complete opposite, putting money into investments can be bottom of the list.”

Those points look valid to me. But a ramp up of customer growth hasn’t kicked in yet. HL added 8,000 customers in the last quarter, only just over half the quarterly average of FY23 (17,000).

Be sure to subscribe to get part 2 of this analysis (out in the next few days) where I will be discussing the remaining companies in this wealth manager peer group.

Please read the Investing in the Investors disclaimer here.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of companies discussed in this post, and covered Tatton Asset Management, Brooks Macdonald, Mattioli Woods, and PensionBee as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Tatton here, Brooks Macdonald here, Mattioli Woods here, and PensionBee here (Please read this link for the terms and conditions of reading Equity Development’s research).