2022 bruised some UK wealth managers. It battered others.

Markets falls hurt WMs in 2022. The blow was cushioned by customers continuing to pay into pension and investment accounts, despite market and economic uncertainty. But resilience wasn't universal.

There’s no hiding from the fact that the market turmoil of 2022 hurt UK wealth managers. The median fall in Assets under Administration or Management (AUA/AUM) of a London-listed group of wealth managers and platforms was -6.4%. This has a direct impact on revenue, as fee income is mostly linked to the value of AUA/AUM.

UK-listed wealth managers & platforms, 2022 AUA/AUM movement

Net inflows hold up

However, all of the above wealth managers and platforms managed to cushion the blow of market falls by continuing to attract new investments from customers, at a median rate of +4.2% (net inflows as a % of opening AUA/AUM).

Simplistically, this means that customers continued to pay into their SIPPs1, ISAs2 and investment accounts, despite heavy market falls during the year and amidst an environment of huge economic uncertainty.

UK-listed wealth managers & platforms: 2022 net inflows, % of opening AUA/AUM

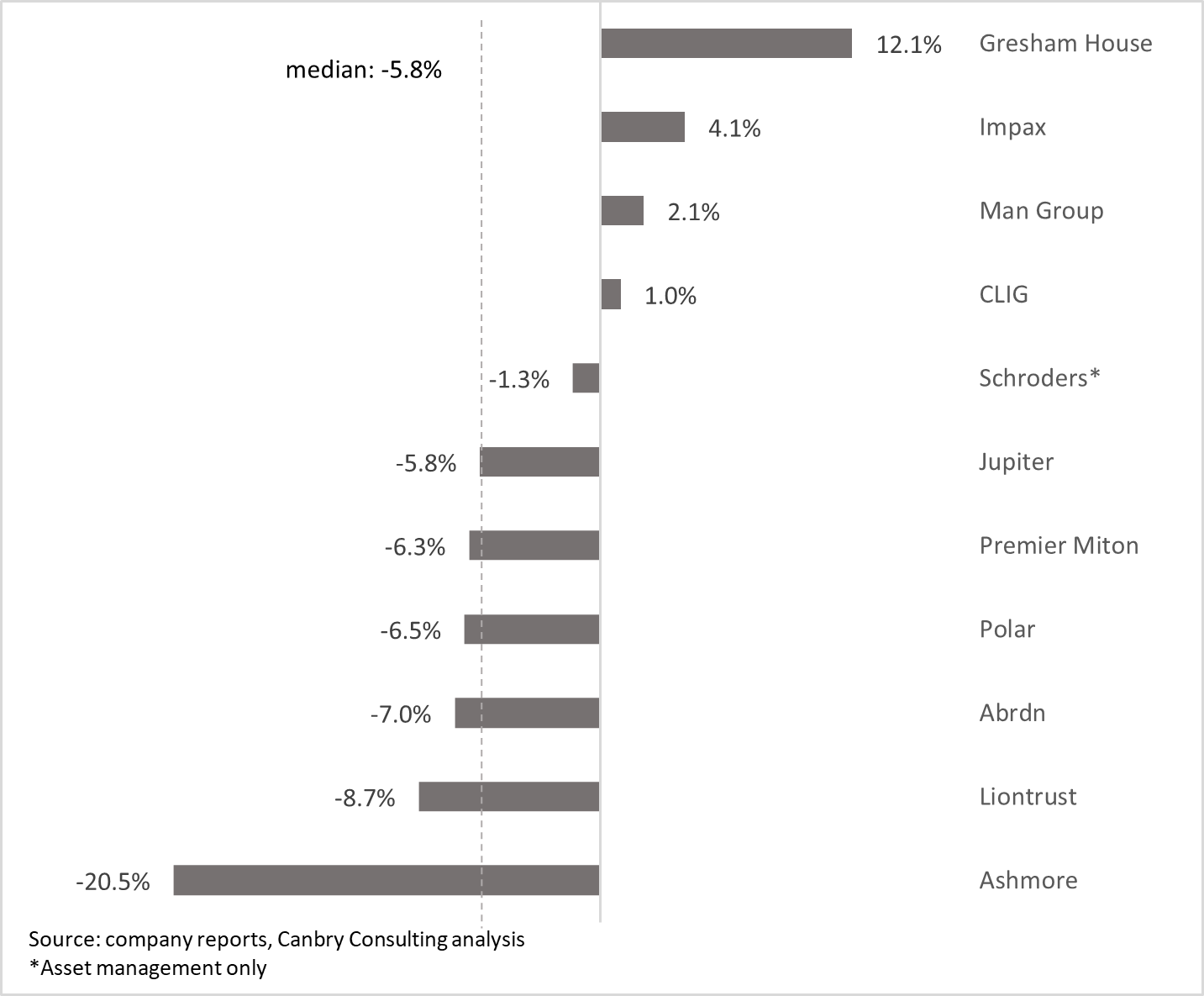

This ability to maintain positive flows stands in contrast to pure-play asset managers, many of which experienced outflows during 2022 (median outflow rate -6%).

UK-listed asset managers: 2022 net inflows, % of opening AUA

This difference in fortunes is primarily because pure-play asset managers typically run funds forming parts of portfolios, not entire portfolios as most wealth managers do. So an investor making an asset class switch would often mean a loss of assets for an asset manager. Obvious examples of this can be seen where asset managers have a concentration of assets in an out-of-favour asset class (Ashmore: emerging market bonds; Polar: technology stocks; Premier Miton: UK small-cap stocks).

That same asset class switch would probably not be a loss of assets for a wealth manager, just a switch between funds within a customer’s wealth account.

Resilience not a given

However, even though wealth managers’ net inflows remained positive in 2022, the levels of these net inflows were certainly down on 2021.

At an aggregate level, given the vastly different market environments between 2021 (a powerful bull market) and 2022 (a bear market coupled with widespread economic uncertainty) the fall in inflows doesn’t look too dramatic. The median net inflow rate inflow in 2021 was +6.5%, compared to +4.2% in 2022. In absolute value terms, the total annual net inflows of this peer group fell from £33bn in 2021 to £22bn in 2022.

But aggregate values mask the differing fortunes of these wealth managers and platforms.

While Brooks Macdonald managed to increase its net inflows, and St James’s Place and PensionBee experienced only small(ish) declines in net inflows (-11% and -10%), others experienced more dramatic falls (Rathbones: -85%; Quilter: -55%; AJ Bell: -48%; Hargreaves Lansdown: -38%).

UK-listed wealth managers & platforms: 2021 net inflows v 2022 net inflows

In future posts I’ll be digging in to the reasons behind these differing fortunes, and the impact the above performance has had on financial results. I’ll also be doing a similar exercise on pure-play asset managers soon. Subscribe to make sure you don’t miss these.

Please read the Investing in the Investors disclaimer here.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication, and covered PensionBee, Brooks Macdonald, Impax Asset Management and Polar Capital as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on PensionBee here, Brooks Macdonald here, Impax Asset Management here, and on Polar Capital here. (Please read this link for the terms and conditions of reading Equity Development’s research).

Self Invested Pension Plans (a tax-advantaged pension wrapper in the UK)

Individual Savings Accounts (a tax-advantaged savings or investment account in the UK)