2025: the great Asset Management bifurcation? (part 1 of 3)

UK-listed asset managers had wildly differing fortunes in 2025. Was it the year that revealed winners and losers? Or has it left some richly valued, and others trading at bargain basement levels?

TheInvestors.blog is not investment advice. Please read the disclaimer here.

Note of edits: This post originally referred to an upcoming ‘part 2’. That has been updated to refer to ‘parts 2 & 3’. Part 2 started becoming very long, so was split to become parts 2 & 3.

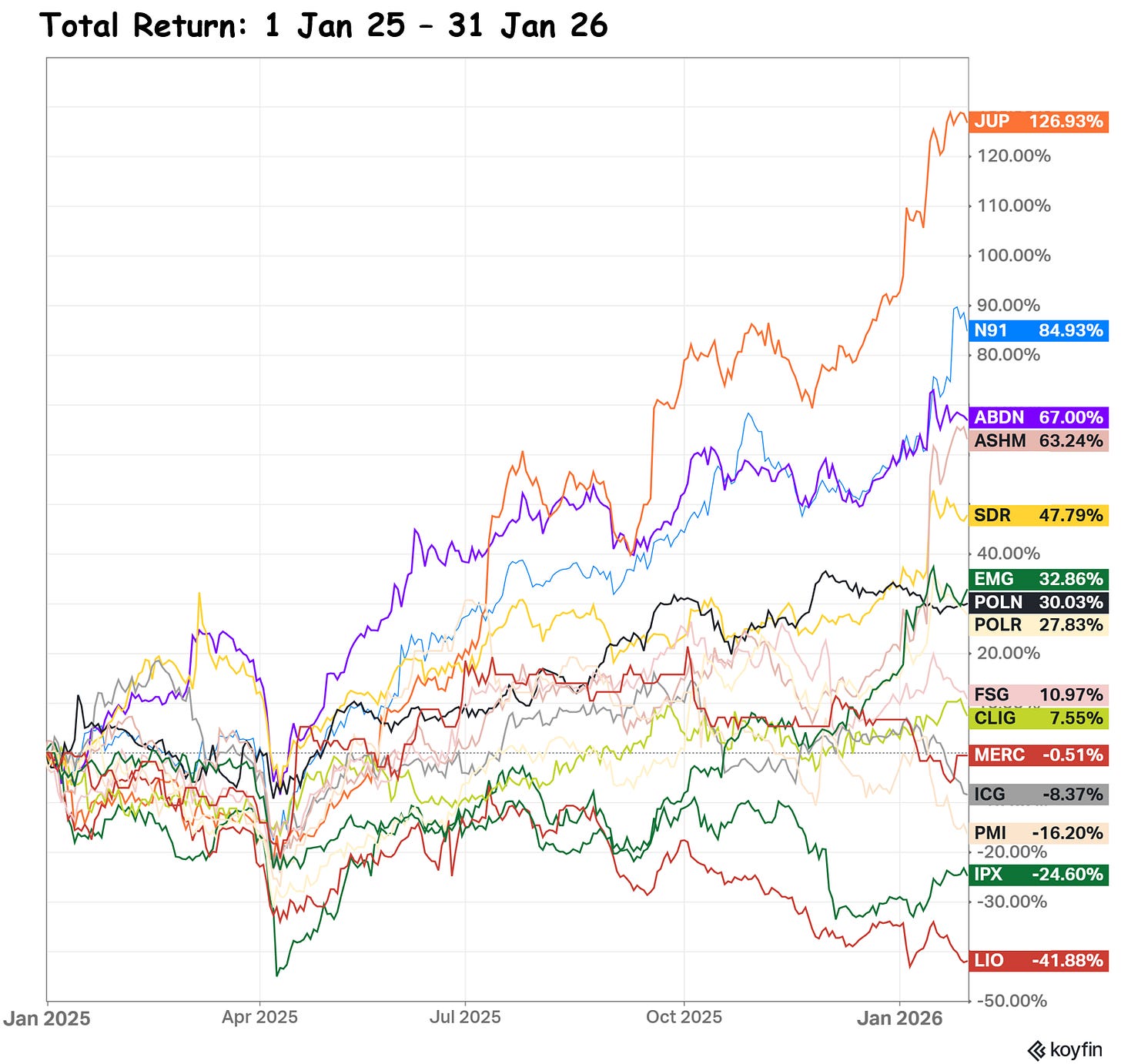

During 2025, and into January 2026, shareholders of UK-listed Asset Managers experienced wildly divergent fortunes.

In this part 1, I look at assets under management (AUM) movements over 2025, and the impact it has had on asset managers’ share prices. Spoiler: Often, the impact is huge, and changing AUM fortunes, especially net flows, can have a VERY rapid, and VERY large impact on share prices (more detail below).

But it’s not all about AUM. In parts 2 & 3 of this series, to be published in a few days, I’ll look into other factors: cost cutting, management & strategy changes, acquisitions, asset classes moving in or out of favour, share buy-backs, and more. I’ll also present the current ‘state of play’ of valuations in the sector (it’s not just about PE ratios!).

These two posts should hopefully make it a bit clearer if 2025 has left some asset managers richly valued, and others trading at unjustified bargain basement levels.

Be sure to subscribe to receive parts 2 & 3 as soon as they are published.

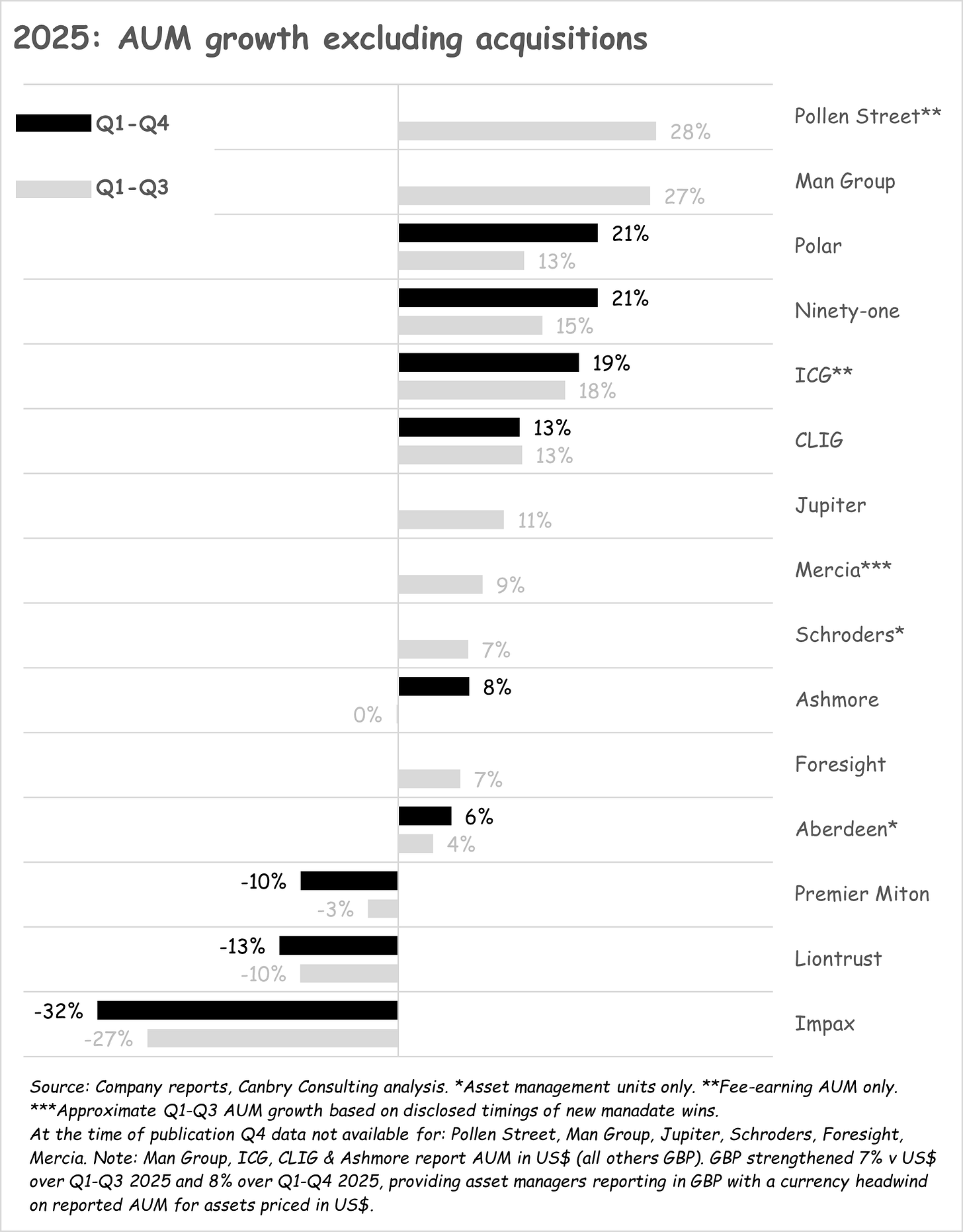

A year of AUM growth (mostly)

2025 was a year which saw most UK-listed asset managers grow AUM, but the variance between managers was enormous.

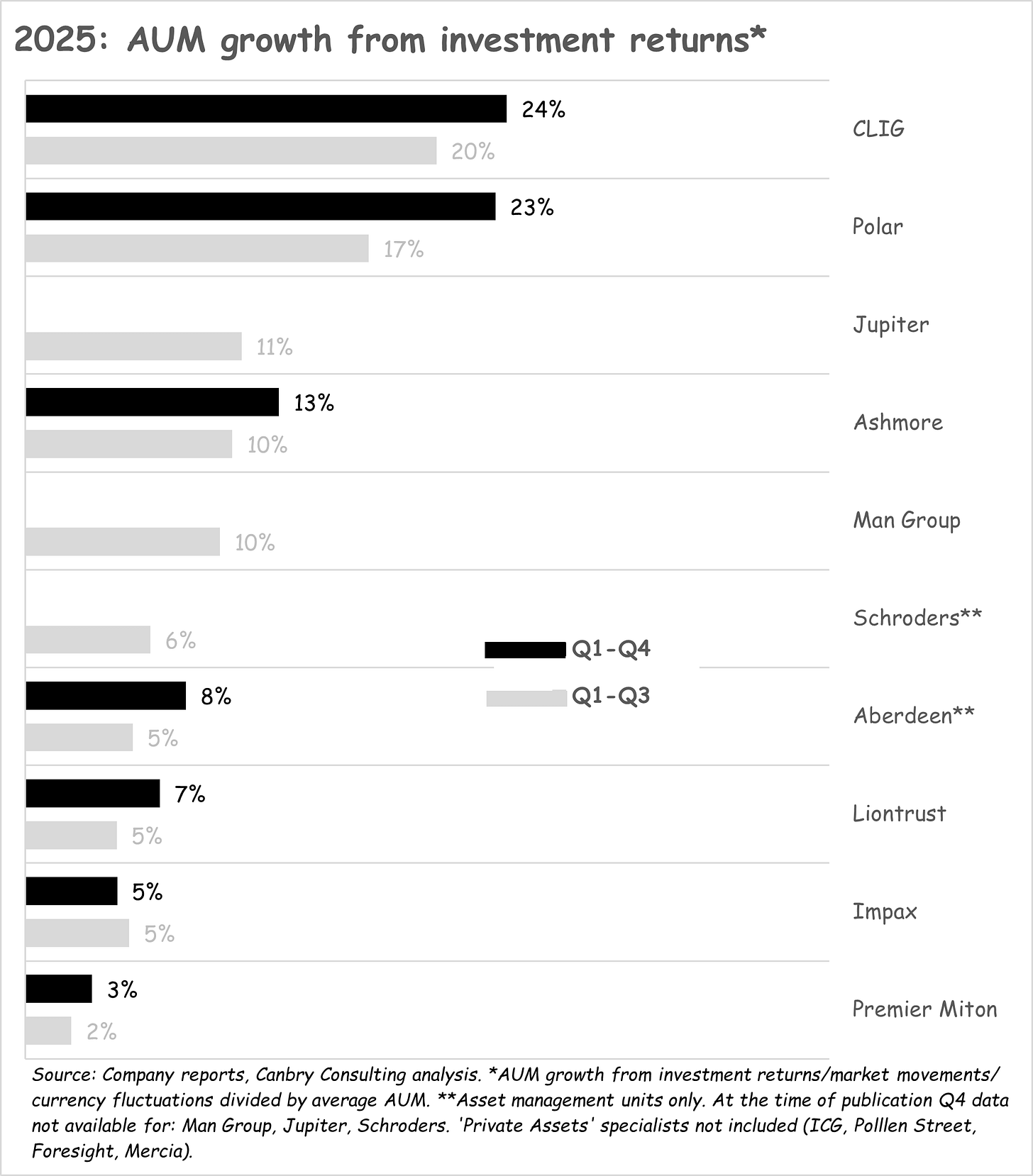

Investment returns the primary growth driver

Growth was primarily due to strong markets and solid investment returns, despite the sharp falls in Apr 25 related to the US’s ‘liberation day’ tariff announcements.

Standout returns were achieved by City of London Investment Group (CLIG), driven in particular by its emerging markets and international equities strategies, and by Polar Capital, driven in particular by its large exposure to technology equities strategies (this was despite a currency headwind as Polar reports AUM in GBP which strengthened significantly against the dollar in 2025 - see note in chart above).

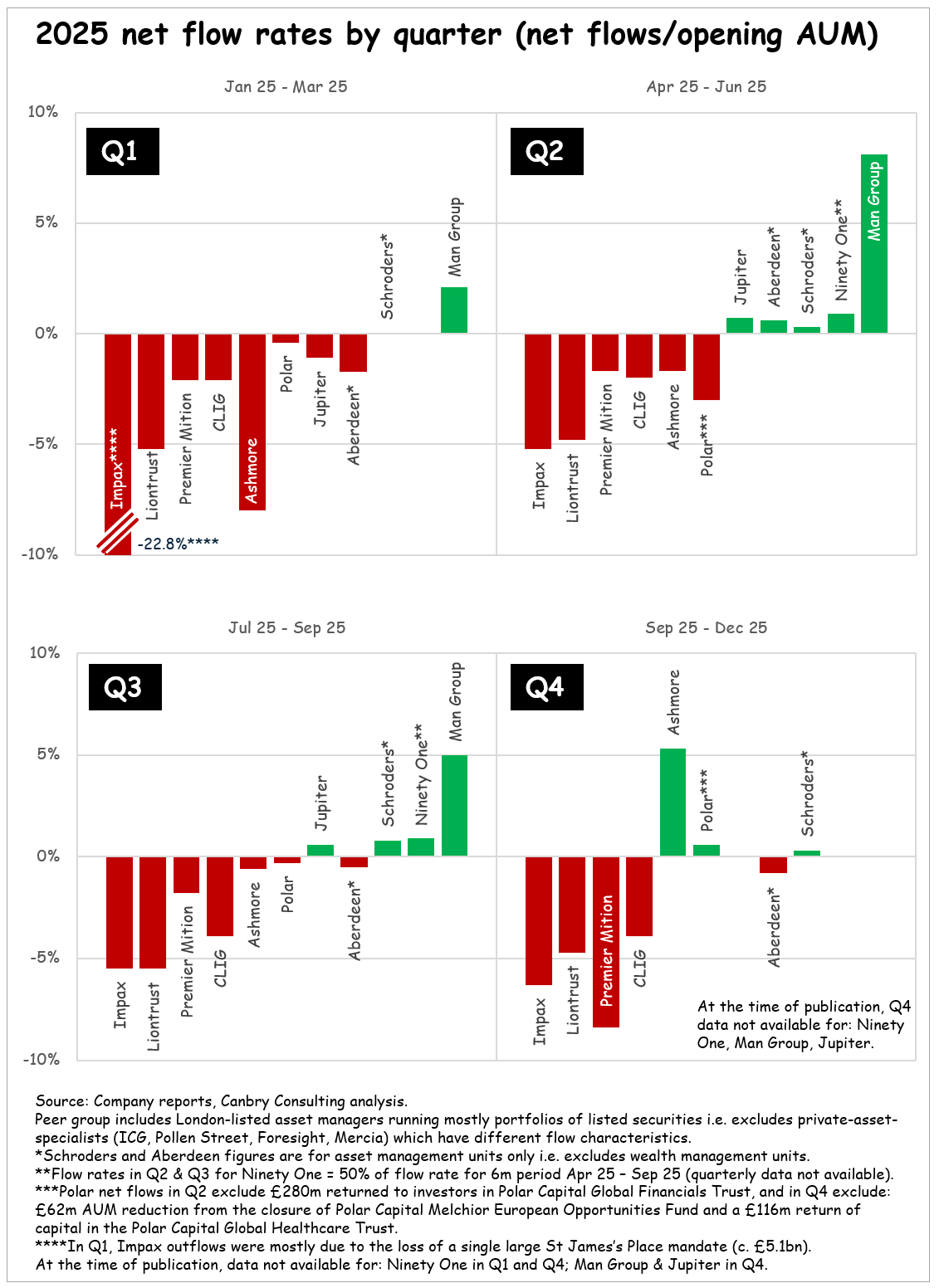

Volatile flows, mostly negative but improving

Net flows were volatile during 2025 with heavy outflows relatively common. With the exception of Man Group which attracted strong net inflows during Q1-Q3 and Ashmore in Q4, even when positive net flows were recorded by asset managers, these were not large.

But it was mostly an improving picture during the year, especially compared to a very weak Q1 (I would expect to see two more green bars added to Q4 in the chart below: Ninety One reported +5% AUM growth in Q4 - it did not split out the impact of flows and investment returns - but investment returns are unlikely to have been that high in the quarter so it probably achieved positive net flows; and given Man Group’s recent strong flow momentum, it’s reasonable to expect positive flows for Q4 - it hadn’t reported at the time of publication).

Share prices (often) follow flow fortunes

Now let’s revert back to share price movements and dive into some more detail on the link between share price and AUM flow. While share price divergence is linked to many factors, net flow fortunes are clearly playing a big role.

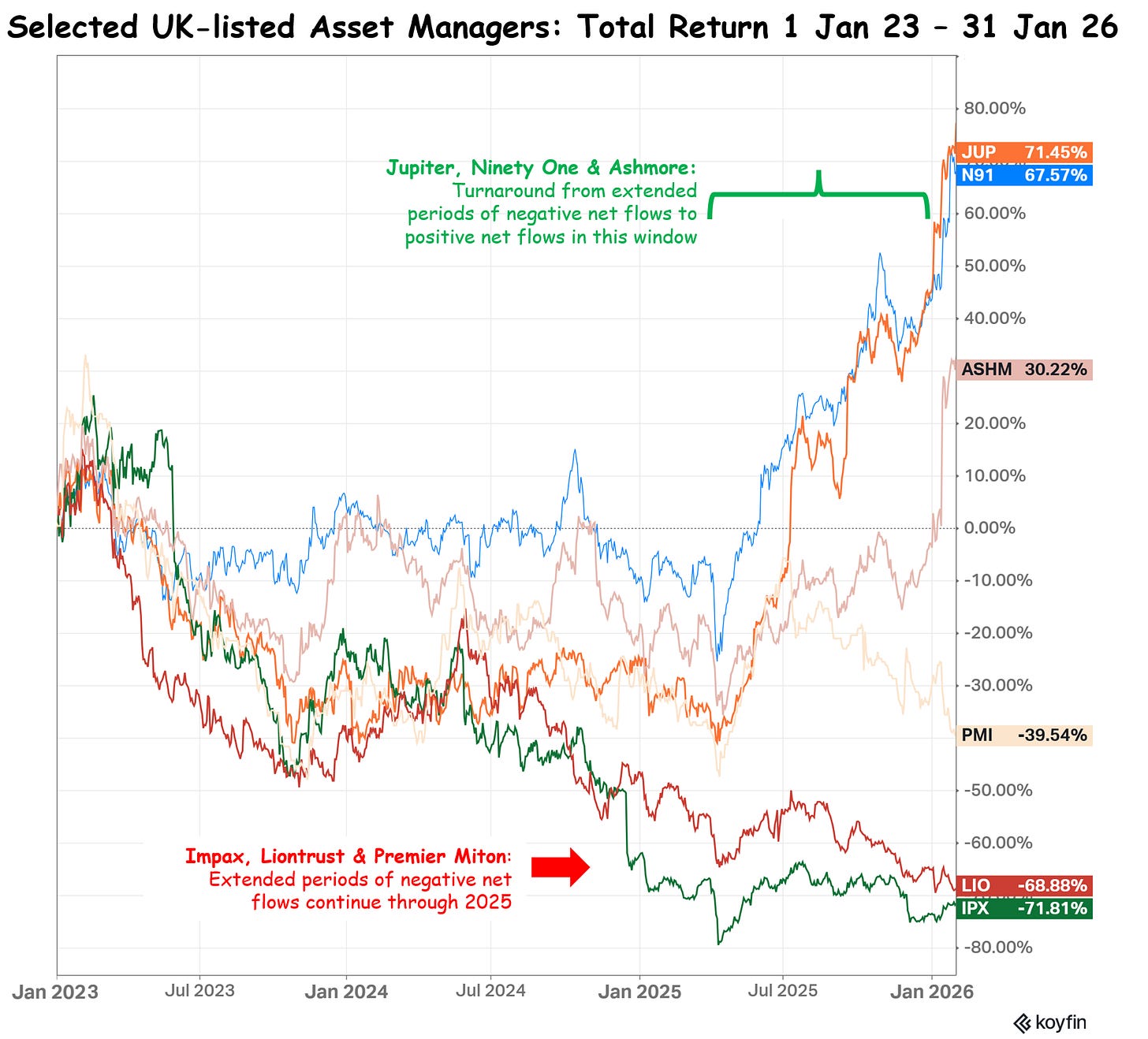

Just look at the differing share price fortunes (over a three-year period) of Jupiter, Ninety One and Ashmore; versus Impax, Liontrust and Premier Miton.

In 2023 and for most of 2024, all six of these asset managers experienced consistent and heavy net outflows.

But the net flow fortunes of Jupiter, Ninety One, and Ashmore started to turnaround in 2025 and move into positive net flows:

Jupiter: Net flows turned positive in Q2-25 after negative net flows in 8 out of 9 quarters between Jan 23 and Mar 25.

Ninety One: Net flows jumped substantially in the Apr-Sep 25 half-year after 5 consecutive half-years of heavy outflows and a small positive net flow in Oct 24 – Mar 25 half-year.

Ashmore: Outflows slowed substantially in Q2 & Q3 25, then turned positive in Q4-25 after 11 quarters of negative net flows (from Jan 23)

As can be seen from the chart above, the share prices of Jupiter, Ninety One and Ashmore kicked upwards very rapidly with this net flow turnaround.

Premier Miton, Liontrust, and Impax have not (yet?) turned this corner. These managers are still experiencing substantial outflows and their share prices keep getting hammered. But the share price reaction of other managers suggests that if and when net flows turnaround, the share price reaction could be substantial over a very short period. In part 2 of this post, I’ll look into the potential for that occurring.

What I’ll also be doing in parts two & three is laying out the current valuations of all fifteen UK-listed asset managers, and on a company-by-company basis, looking into what I think might be the most important triggers (beyond AUM moves) for future share price moves.

Subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication, and covered Impax Asset Management, Polar Capital, and Mercia Asset Management, as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on these companies by clicking on each. And please read this link for the terms and conditions of reading Equity Development’s research.