Eye-catching insider holdings, buys & sells

The state of play of insiders' shareholdings at UK-listed asset managers, including one set of insiders who are buying like there's no tomorrow!

This is not investment advice. Please read TheInvestors.blog disclaimer here.

Investors obviously want directors and managers to have ‘skin in the game’, ideally by owning meaningful stakes of the companies they run or work in, to create an alignment of interests.

And investors also look for clues that point to positive or negative company prospects, or managements’ actual views on value, through their share purchases or sales.

So, what can be gleaned from the current state of play and goings-on in the UK-listed asset management sector over the last two years or so, when most asset managers’ share prices have been under huge pressure?

Let’s take a look through the lens of three data sets:

the percentage stake held by insiders;

the £-value stake held by insiders; and

insiders’ share purchases or sales over the last two years.

Note: The interpretation of the data presented in this post is a complicated subject covered by many academic and investment industry research papers, often aiming to highlight correlations between the level of insiders’ stakes or buy/sell actions, and investment returns. This post isn’t about regurgitating that research (it’s easy enough to find) or providing a detailed interpretation of insiders’ shareholding data – every investor will have their own interpretation of that.

What it hopefully is though, is a useful presentation of a few insightful data sets that can make investors’ own research more robust.

Founder-led businesses dominate high-shareholding percentages

There are huge variations in the percentage of insiders’ stakes. An obvious segmentation is that some UK asset managers are still founder-led, with some still retaining significant shareholding percentages. Foresight and Ashmore lead the way by some distance.

This ‘percentage view’ is a useful metric as a starting point when looking for alignment. And for those businesses where the insider percentage ownership is high, it’s hard to argue that insiders’ interests are not strongly aligned to other shareholders.

Another consideration for investors when looking at the founder-led businesses is that at some point founders with big stakes will be looking to retire/exit/realise value. And when the ownership stake is very high, it might not be so easy to realise that value in a gradual or smooth process, say by selling smaller chunks over a period of time.

Does that make founder-led businesses more likely to look for a suitor to acquire the whole business, with the potential for investors to realise an acquisition premium? Perhaps.

But looking at percentage shareholding doesn’t tell the whole alignment story, particularly for larger businesses and where ‘professional managers’ have taken over from founders.

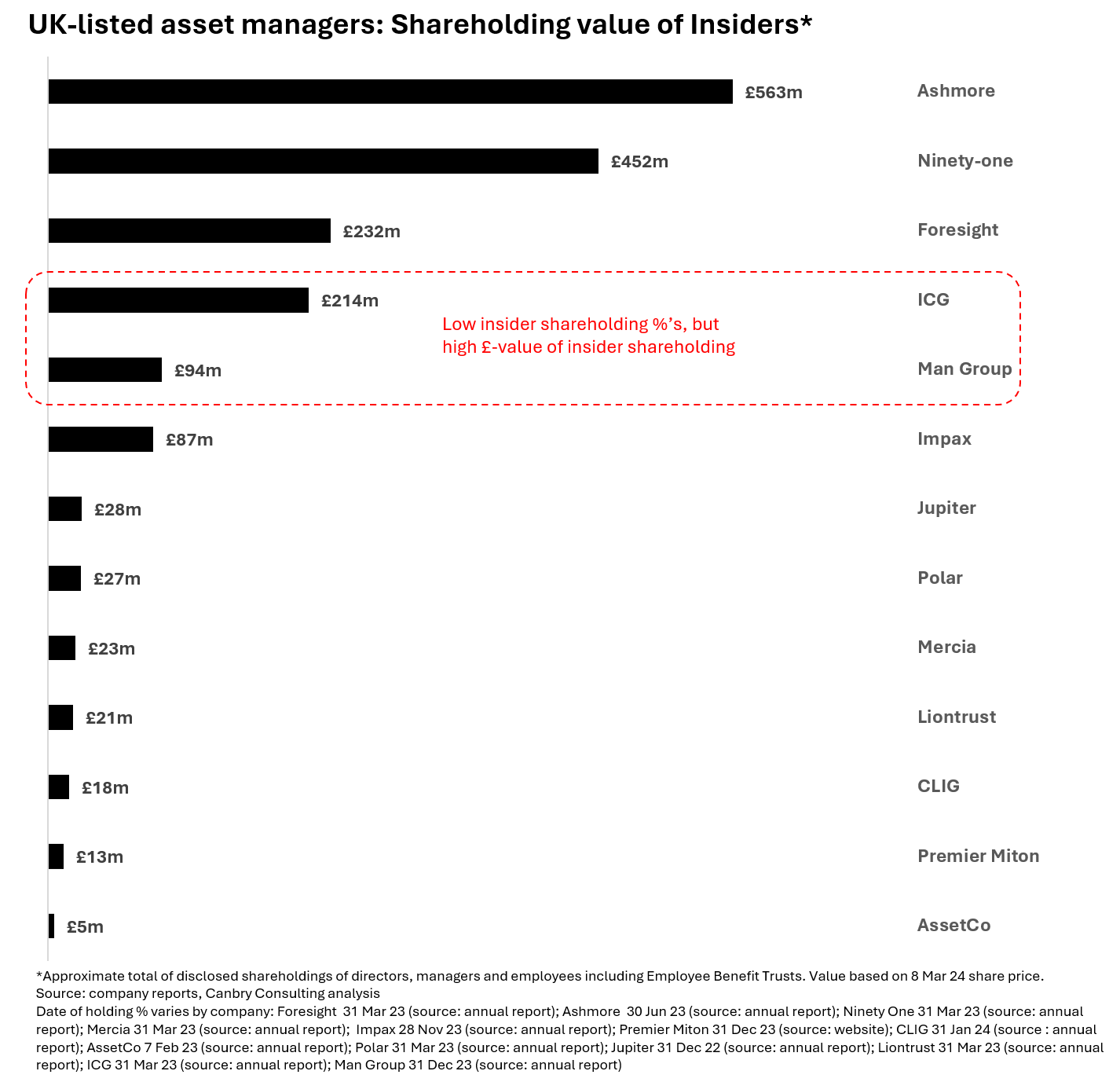

Alignment also driven by £-value of shareholding

While high-percentage founder stakes correlate with high-£-value stakes, there are other businesses (typically larger market-cap businesses) where insiders’ percentage stakes are low(ish), but these translate to huge £-value stakes, which clearly bumps up individual managers’ alignment with other shareholders.

The two obvious examples from the companies analysed in this post are Intermediate Capital Group (ICG) and Man Group which climb up from the bottom two places in the above percentage-view chart (4% and 3% insider percentage holdings) to 4th and 5th place in the £-value-view chart below.

It is probably fair to say that these large £-value stakes at ICG and Man are spread across quite a few employees.

ICG’s Employee Benefit Trust made up the bulk of insiders’ stakes at 3.2% on 31 Mar 23. But nonetheless, the value remains substantial. That 3.2% translates to a stake worth around £181m. And CEO Benoit Durteste’s 0.54% stake on 1 Jun 23 translates to a value of around £30m.The above two sections cover a ‘static’ view of alignment based on insiders’ holdings at a point in time.

Meanwhile Man Group’s Employee Trust also made up the bulk of insiders’ stakes at 2.9% on 31 Dec 23 (worth around £88m), with new CEO Robyn Grew’s 0.12% stake worth around £3.6m.

And even in those businesses with a substantially lower market cap than ICG or Man, and where successors have taken over from founders, stakes can be worth a substantial amount. For example, at Polar Capital, CEO Gavin Rochussen’s 1.6% stake is worth around £7m, a substantial amount to have invested in any one company in most people’s books.

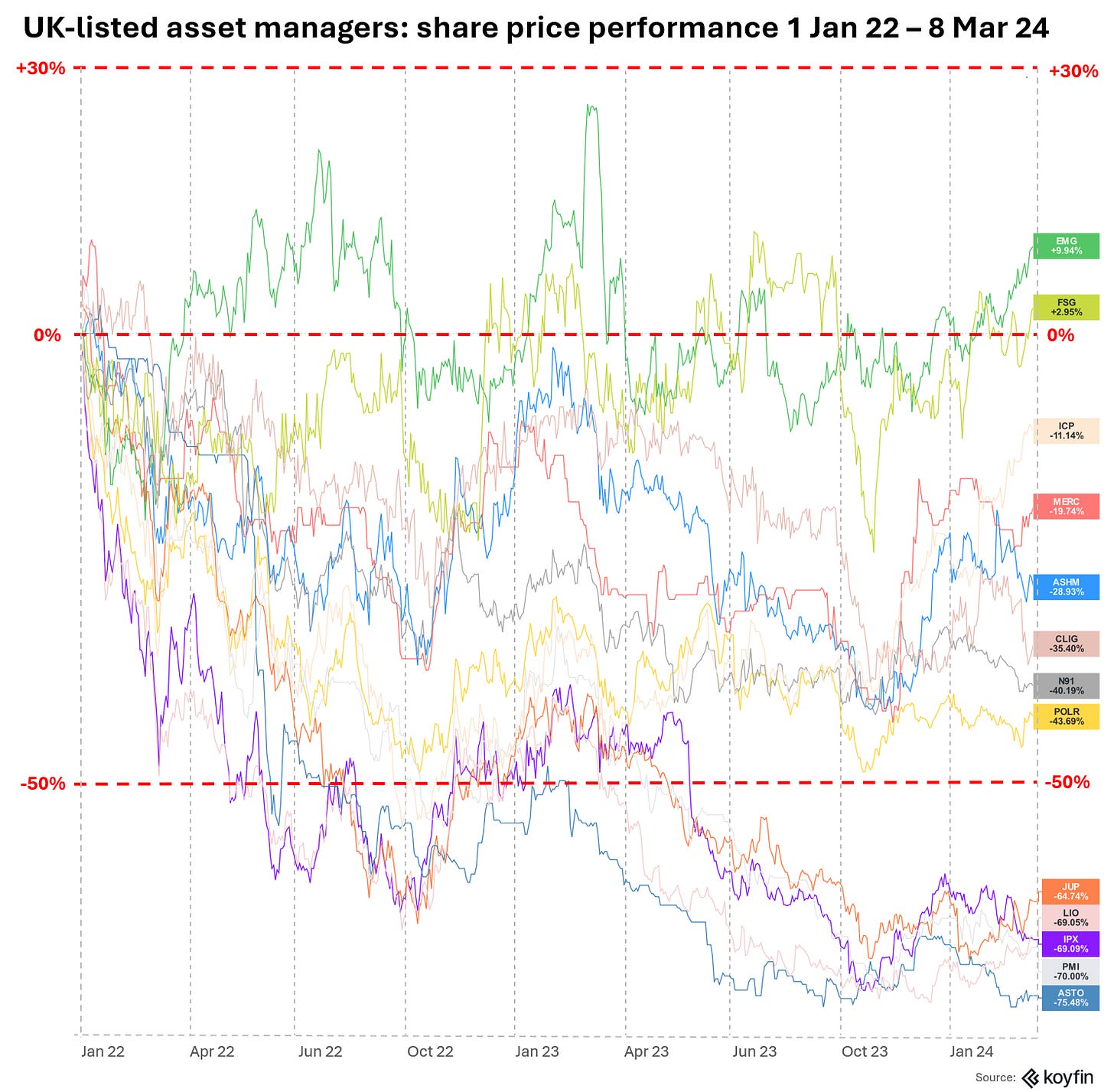

Have insiders been ‘buying-low’? Not so much, with one exception

The above two data sets cover a ‘static’ view of alignment based on insiders’ holdings at a point in time.

But a third data set could offer clues as to whether insiders think the widespread share price sell-off of the last two years or so is justified. Four out of 13 asset managers’ share prices fell more than 60% between Jan 22 and Mar 24, five between 19% and 50%, and only two recorded share price gains.

Now, to be fair, it probably wouldn’t be reasonable to expect those founders with huge amounts already invested in their businesses to be topping up even further (Ashmore, Foresight and Impax for example).

But we would surely have expected insiders to be buying shares over this period if they felt there was a discrepancy between price and value? But mostly, that hasn’t been the case, with one glaring exception. Ninety One.

It looks to me though that the nearly £78m of insider share purchases at Ninety One in around 26 months is not just a case of opportunistic purchases to take advantage of a depressed share price.

These purchases have been structured almost entirely though an investment vehicle called Forty Two Point Two which has been set up to raise substantial amounts of capital and acquire shares in Ninety One over a period of time (starting well before the share price falls of 2022). The structure is explained in the Ninety One annual report and in a debt-raising note from the Stock Exchange of Mauritius:

Forty Two Point Two is a company wholly-owned by the Marathon Trust, both of which are associates/connected persons of Hendrik du Toit (Ninety One co-founder and CEO) and Kim McFarland (CFO). The Marathon Trust is a long-term share ownership vehicle which was established to enable key employees of Ninety One, including Hendrik du Toit and Kim McFarland, to collectively participate in an indirect equity shareholding in Ninety One. Participatory interests in the Marathon Trust are not interests in an employee share scheme. Forty Two Point Two’s acquisition of its shareholding in Ninety One has been, and future share acquisitions are expected to be, funded by personal capital provided by the participants in the Marathon Trust and/or third-party debt-funding assumed by Forty Two Point Two.

The Marathon Trust owns 100% of the share capital of the Issuer (Forty Two Point Two) … Participation in the Marathon Trust is offered to senior leaders and other key employees of Ninety One on an invitation-only basis. Participation and participation levels is highly sensitive employment-related information, which is therefore treated as confidential within Ninety One. Further, participation may be funded from personal wealth, personal borrowings and/or after-tax remuneration. There may therefore be a strong link between participation levels and current and/or historic remuneration levels at Ninety One. For these reasons, the information relating to the Directors’ individual participation levels is not disclosed above.

Indeed, Forty Two Point Two has raised a number of tranches of debt finance on the Stock Exchange of Mauritius to fund share purchases. For example, in Aug 2021 it embarked on a programme to raise the equivalent of up to around £85m for the purpose of paying down debt and acquiring shares in Ninety One, according to the debt issuing note.

It also looks like the share acquisitions are spread among quite a few key employees, because on 31 Mar 23, the equity exposures to Ninety One of the CEO and CFO were 2.5% and 1.6% respectively (source: Ninety One FY23 annual report), compared to the c30% shareholding of Forty Two Point Two in Ninety One plc.

There is clearly an ongoing play for insiders at Ninety One to substantially bump up their shareholding, although the end game isn’t entirely clear yet. Definitely one to watch.

Subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Please read TheInvestors.blog disclaimer here.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication, and covered Impax Asset Management and Polar Capital as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Impax Asset Management here, and on Polar Capital here. (Please read this link for the terms and conditions of reading Equity Development’s research).

A previous summary of Ninety One (a bit dated but maybe a useful high level introduction) https://www.theinvestors.blog/p/ninety-one-asset-management-tough