Jupiter jumping. Liontrust limping. Why?

After a rough few years for both stocks, Jupiter has bounced, Liontrust hasn't. What's behind recent moves? Can Jupiter run further? Can Liontrust bounce? [Part 1...]

TheInvestors.blog is not investment advice. Please read the disclaimer here.

The fortunes of Jupiter and Liontrust over the last few years make for a fascinating comparison in the UK-listed asset management space.

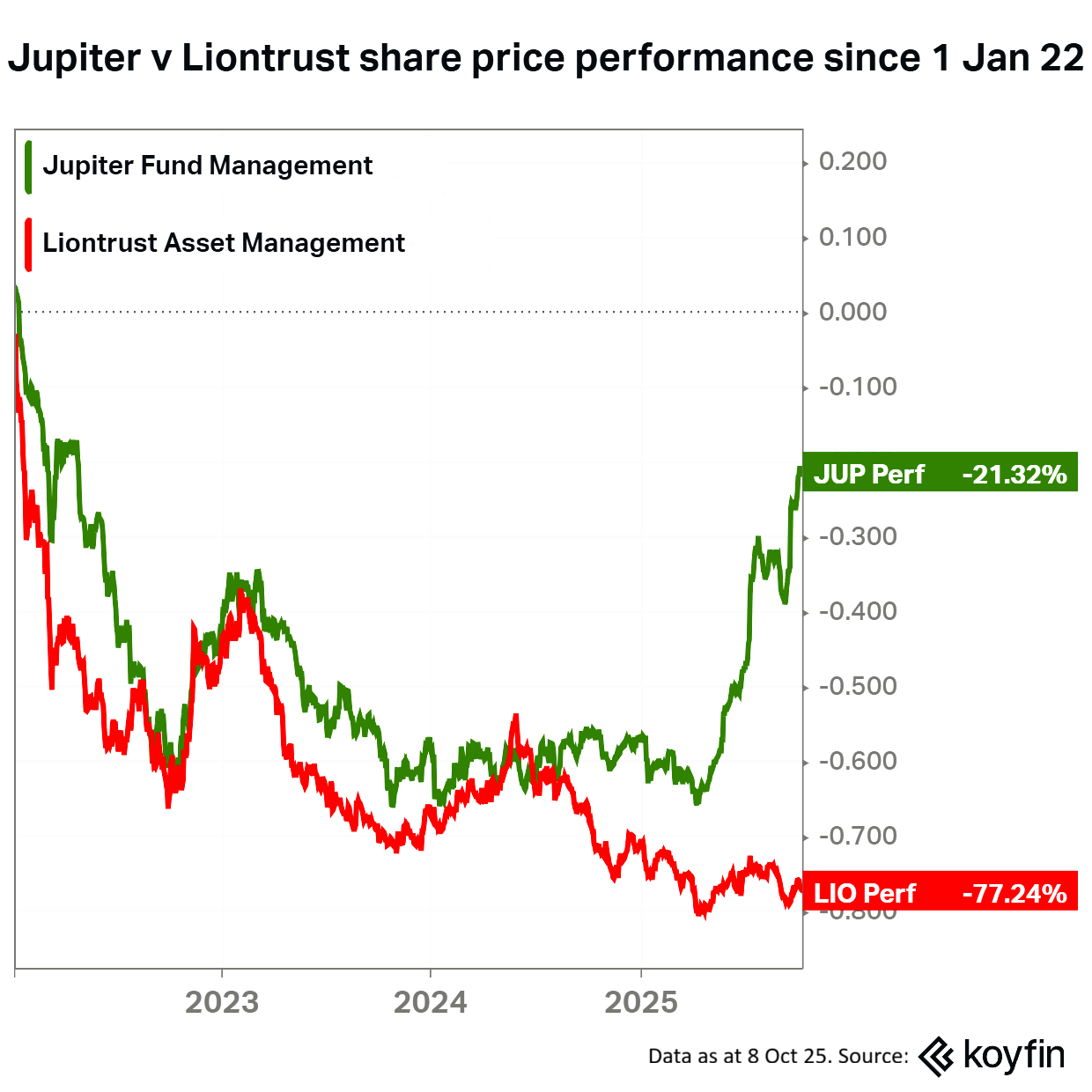

Both share prices were hard-hit in the market fall of early-mid-22 and mostly continued their decline over the next few years, with quite similar share price moves until the 2nd half of 2024, when they started to diverge.

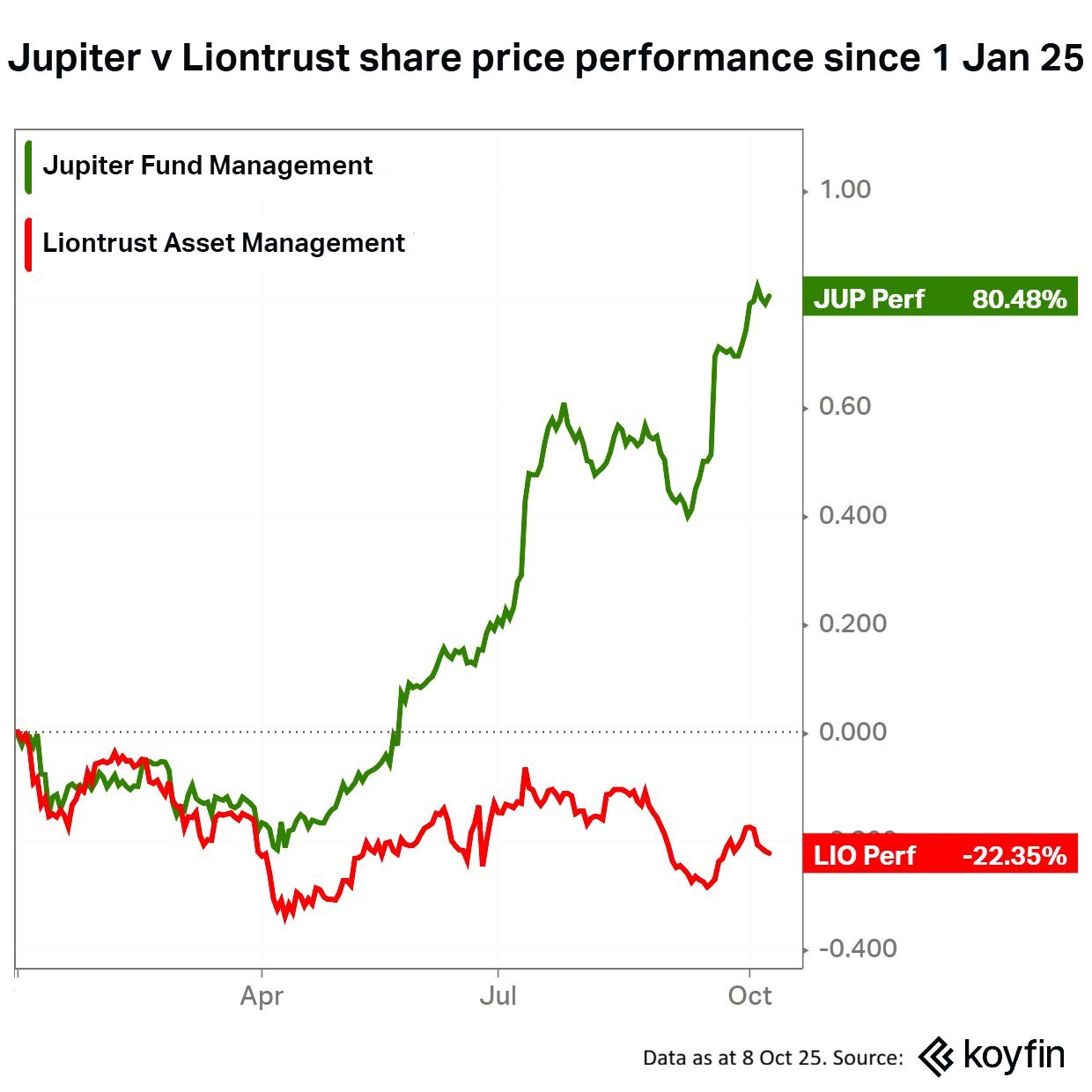

In Apr 25, that divergence accelerated as Jupiter started a pretty remarkable recovery (albeit off a very badly beaten-up valuation). Liontrust didn’t.

Before we dig into share price moves and possible reasons behind them, I’ll give a quick overview of the two businesses which should explain why they make for such an interesting comparison.

Business profiles

Both are UK-listed active asset managers. So, they’re both fighting the passive juggernaut.

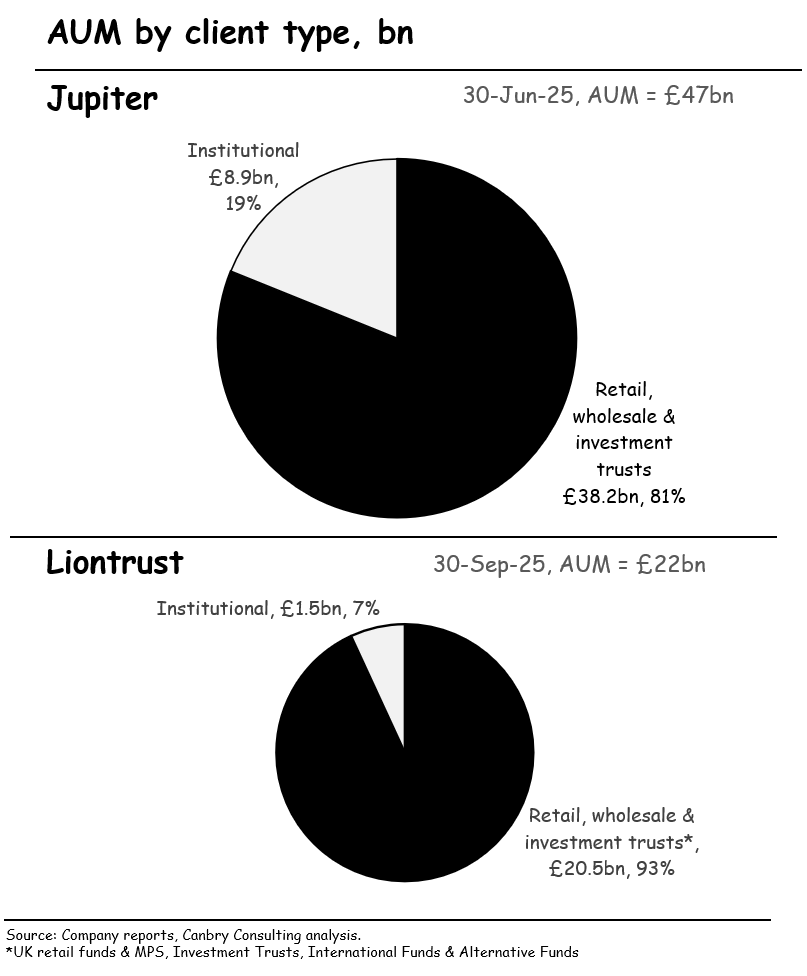

Both service predominantly retail-investors (mainly through adviser, wealth manager or platform channels) and have a smaller proportion of institutional clients.

Jupiter is bigger, with £47bn of assets under management (AUM), Liontrust manages £22bn.

Those client profiles mean they have similar-ish revenue margins. Jupiter averages 0.65% per annum of management fees on AUM, Liontrust 0.60%.

‘Underlying’ profit margins are a little higher at Liontrust, but not dramatically so. Liontrust reports an ‘adjusted operating margin’, which was just over 29% in the year to 31 Mar 25. Jupiter’s ‘underlying PBT’ as a percentage of net management fees (not an identical measure, but not far off) was around 24% in the year to 31 Dec 24. More on profits and margins later.

Recent AUM moves

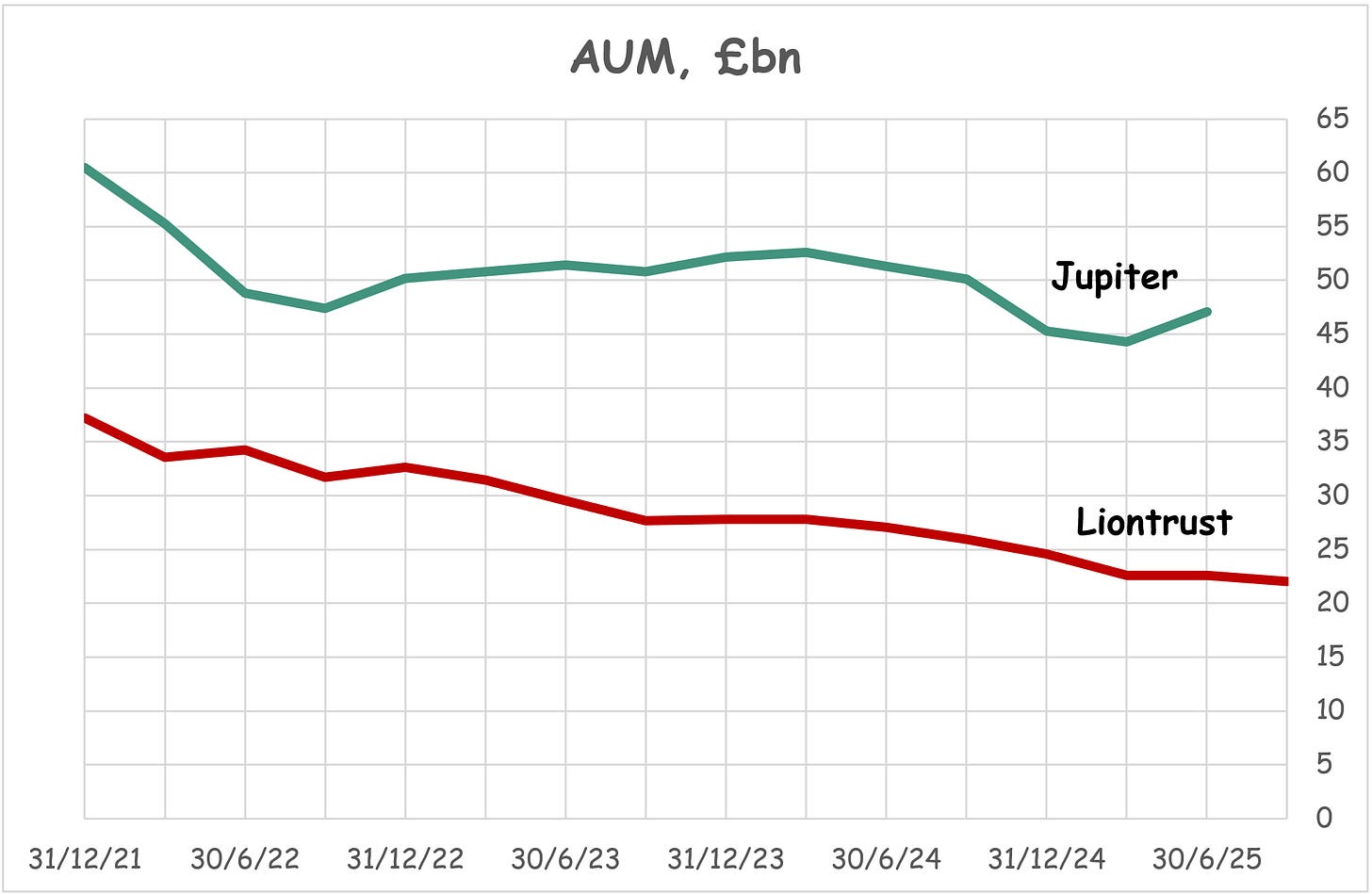

Both have suffered AUM declines over the last few years.

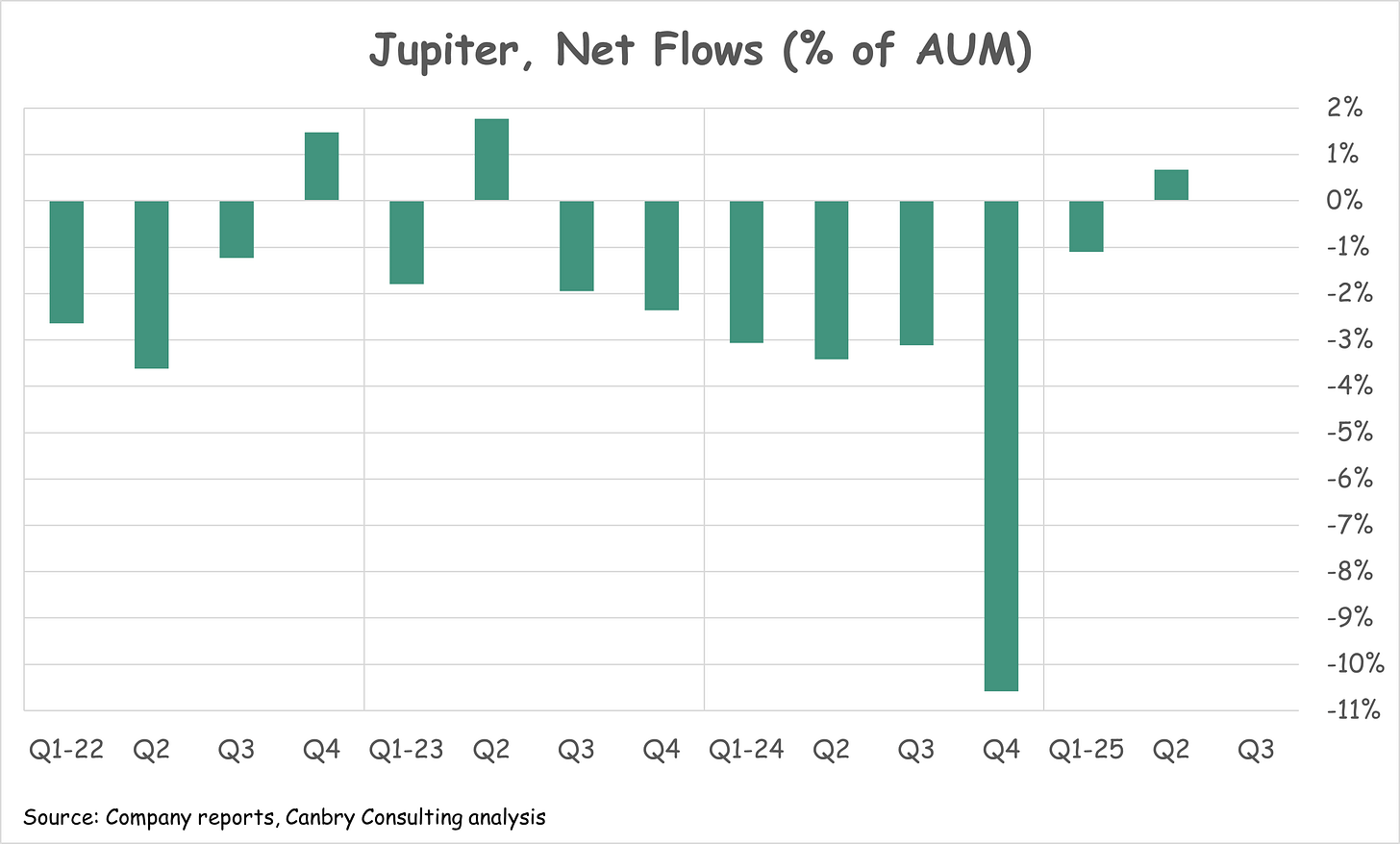

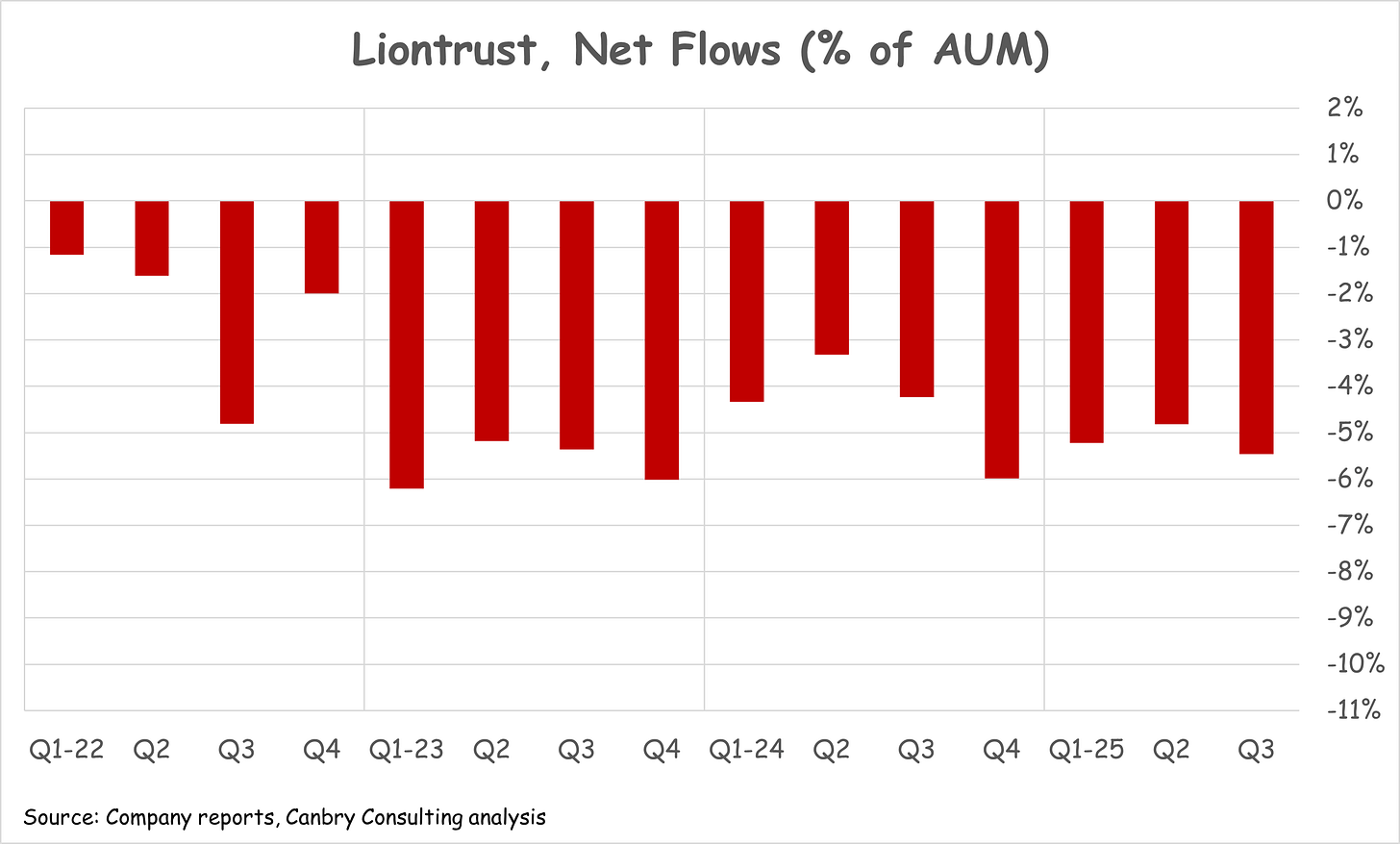

And worryingly, those declines have mostly been a result of net outflows. Clients have been withdrawing more capital than they have been putting in.

There’s no doubt that these outflows spooked investors in both companies and were almost certainly the main reason for prolonged share price declines. Economies of scale were being lost so profit margins were declining, and investors were (are still?) questioning the future of these types of active asset managers (often in the context of the rise of passive).

Why the divergence? Why now?

So why the sudden jump in Jupiter shares, but not Liontrust? Primarily, Jupiter has seen a flow of tangible good news recently:

The first good sign might have been observed from the chart above. Jupiter’s Q1-25 AUM update (on 24 Apr 25) showed a marked improvement in net flows, even though they were still negative. Management also struck a positive tone for future flows in that statement, despite the ‘liberation day’ turmoil taking place around that time.

A May 25 announcement stated it had identified more cost savings than originally flagged.

In Jul 25, the announcement of the acquisition of CCLA Investment Management (which specialises in the charity sector) was very well received. The acquisition should add £15bn to AUM. The price tag of £100m (funded entirely from cash) for £13m of ‘underlying operating earnings’, looks like a sensible price. And the announcement also put a number to the cost synergies thought to be achievable: £16m per annum by 2027.

Flows actually did turn positive in Q2, reinforcing that positive sentiment and share price momentum.

And then in Sep 25 Peel Hunt released a bumper upgrade titled: “Upgrades don’t come much bigger”.

[Q3 AUM numbers were not yet released at the time of publication …]

All of the above built on a very depressed valuation and contributed to the rally seen year-to-date.

Meanwhile, at Liontrust, management have certainly been striking a positive tone for a little while now. But to date, it’s really only been about tone. That positivity has not yet flowed through to the numbers. The Q3 trading update said:

“Over the past few quarters, we have written about our belief that the market environment going forward will be more favourable for active managers. We are now seeing clients seeking to diversify away from the US and towards active management, and this is shown in an acceleration of interest in Liontrust strategies. We are having success among institutional investors and wealth managers, notably internationally. This includes new mandates as yet unfunded and being added to clients’ buy lists. This progress has been slower than as we had hoped, however…”

What next?

So can Jupiter’s price continue to rise? And will Liontrust start to recover too?

Over the next couple of weeks I’ll be digging into the current fundamentals and the prospects of these two businesses, what that means in terms of fundamental valuation, and how that stacks up against current share prices.

Be sure to subscribe to TheInvestors.blog below to get notified when the next post of this comparison drops and to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication.