Mattioli Woods: Interims showcase the benefit of diverse income streams

Demand for advice ramps up, outstripping the negatives of investor nervousness and falling asset prices

This is not investment advice. Please read TheInvestors.blog disclaimer here.

This week I published my Equity Development research note covering the interim results of wealth manager Mattioli Woods. It’s not an understatement to say the wealth management environment during this period was ‘complicated’. And for these interims, I felt it warranted to do a fairly deep-dive into the company as a whole and its various business segments.

You can read the full research note and listen to a short audio summary here:

Here’s a teaser.

H1-24 revenue was up 8% y-o-y to £59.1m, with 4% organic revenue growth. H2 revenue is typically higher than H1 due to end of tax-year advice and H2 bias of client year-ends, and we maintain our FY24 revenue forecast of £123.6m (+11% y-o-y).

Adjusted EBITDA grew 10% from £15.0m to £16.5m with positive effects from organic growth (409 new clients, +13% over H1 23) and a changing revenue mix towards higher-yielding services.

But underlying those headline numbers is evidence that MW’s model of vertical integration and multiple, diverse income streams is a huge plus.

In an uncertain economic environment, and changing regulatory and tax environment, clients increasingly sought advice from MW which, with increased banking margin on cash balances, resulted in the core pensions business thriving with 21% revenue growth. The employee benefits and investment & asset management businesses also showed solid growth of 11% and 9% respectively.

However, the flipside of areas of economic weakness saw property segment revenue fall from £3.4m to £2.8m, and MW’s share of associate company Amati’s profits fall from £564k to £333k, with both businesses hit by falling asset prices (UK commercial property and UK small-cap equities).

MW has a strong net cash position of £32.7m, after paying £9.3m of dividends and £6.2m of acquisition-related payments (it has no debt). A confident outlook is maintained, with the interim dividend up from 8.8p to 9.0p.

Our fundamental valuation remains unchanged at 900p per share (53% above the current share price).

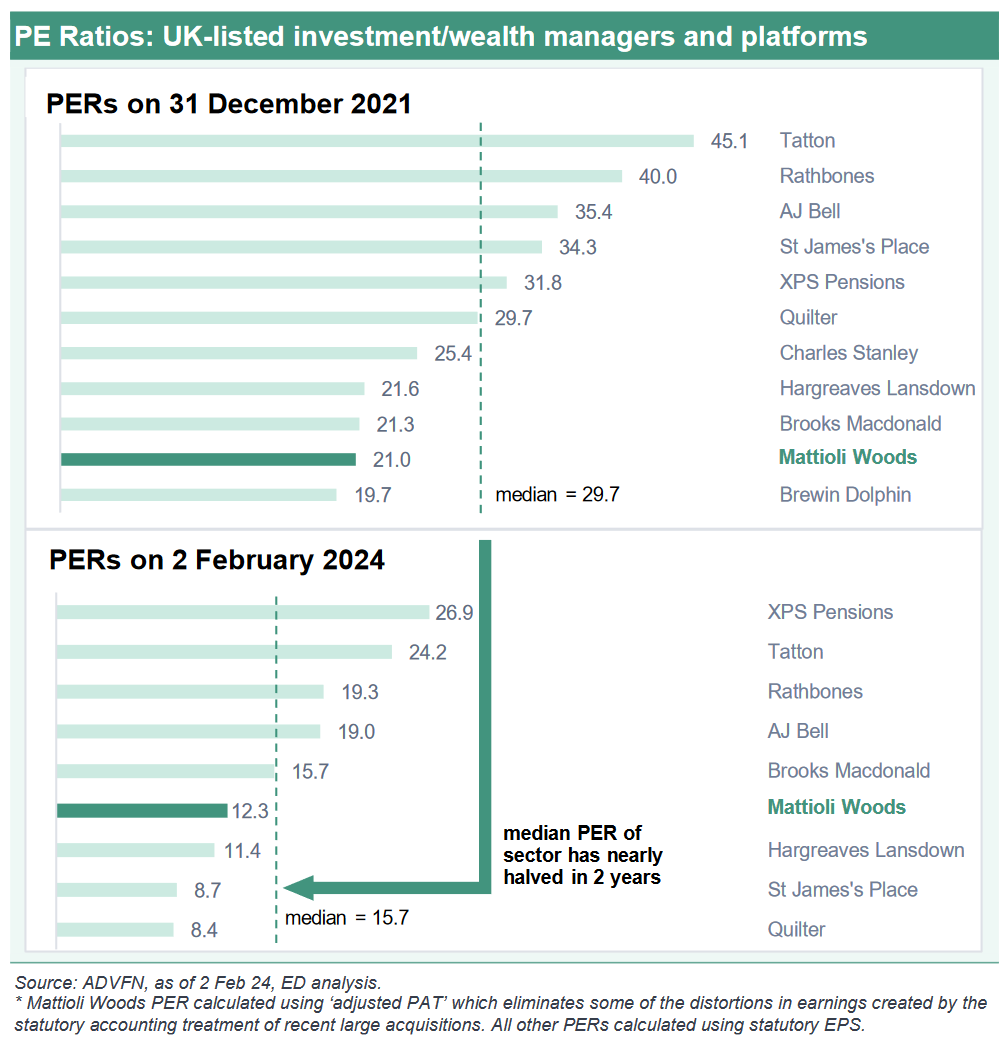

It is also worth noting that since the end of the bull market (end of 2021), the median PERs of UK-listed investment/wealth managers and platforms have declined 47% from 29.7 to 15.7. While valuations may well have ‘over-run’ to a degree at the end of the bull market, we certainly see the current median PER of 15.7 as being on the low side for a sector with such significant tailwinds and structural factors in its favour (detailed in the full note) and see potential for a sector rerating.

Moreover, with MW being so well positioned, we find it strange it’s PER of 12.3 is below this median.

Subscribe to TheInvestors.blog below to keep up to date with the UK wealth management sector. A key upcoming data point, which I’ll definitely be writing about, will be the results of the UK’s largest D2C platform, Hargreaves Lansdown, on 22nd February.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Please read TheInvestors.blog disclaimer here.

Disclosure: At the time of writing, Paul Bryant was a shareholder of Mattioli Woods, and covered Mattioli Woods as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Mattioli Woods here (Please read this link for the terms and conditions of reading Equity Development’s research).