PensionBee purring in the UK...

...but the share price seems stuck. It looks like all eyes are on its US buildout

TheInvestors.blog is not investment advice. Please read the disclaimer here.

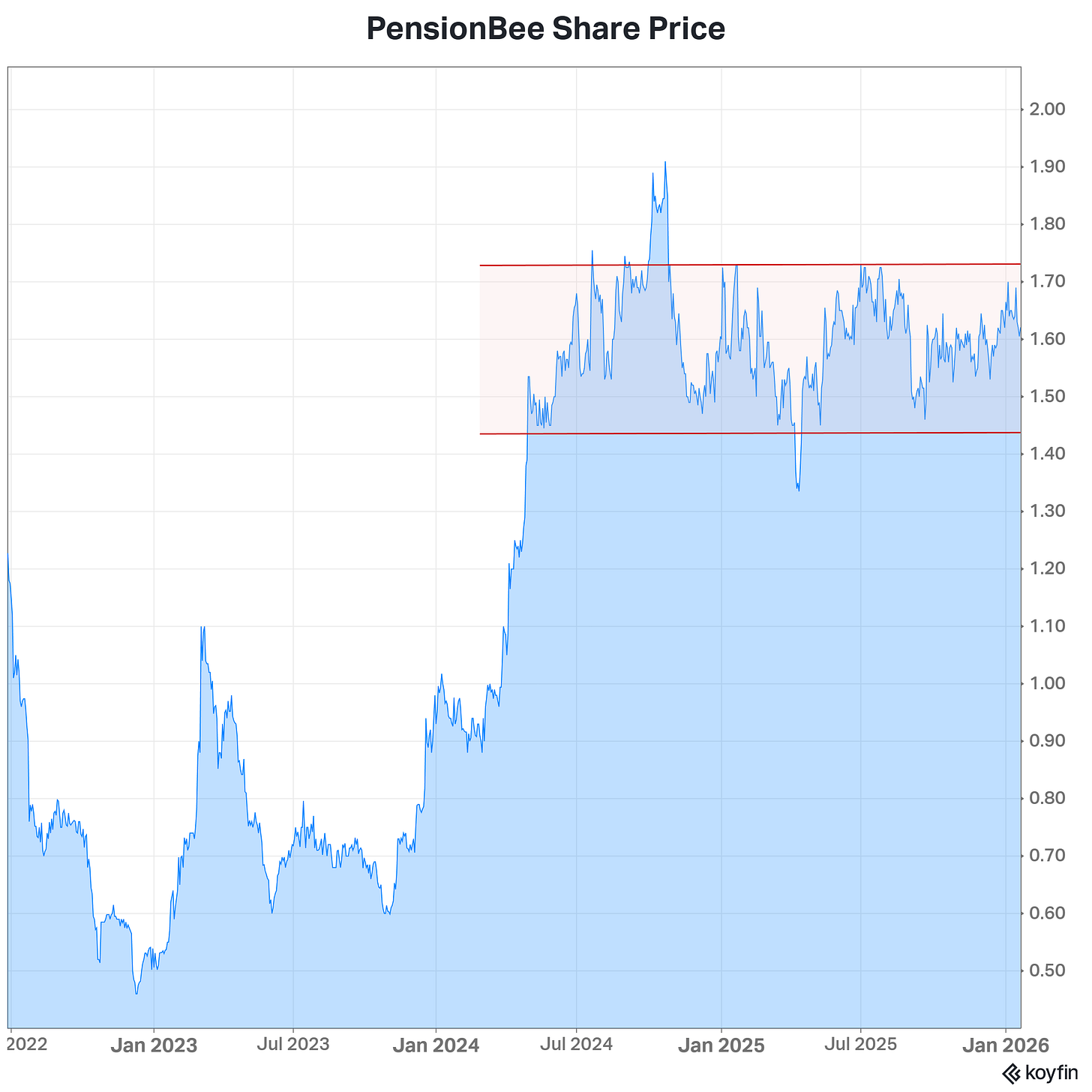

Since its strong rally in the first half of 2024, PensionBee’s share price looks stuck.

This is two businesses:

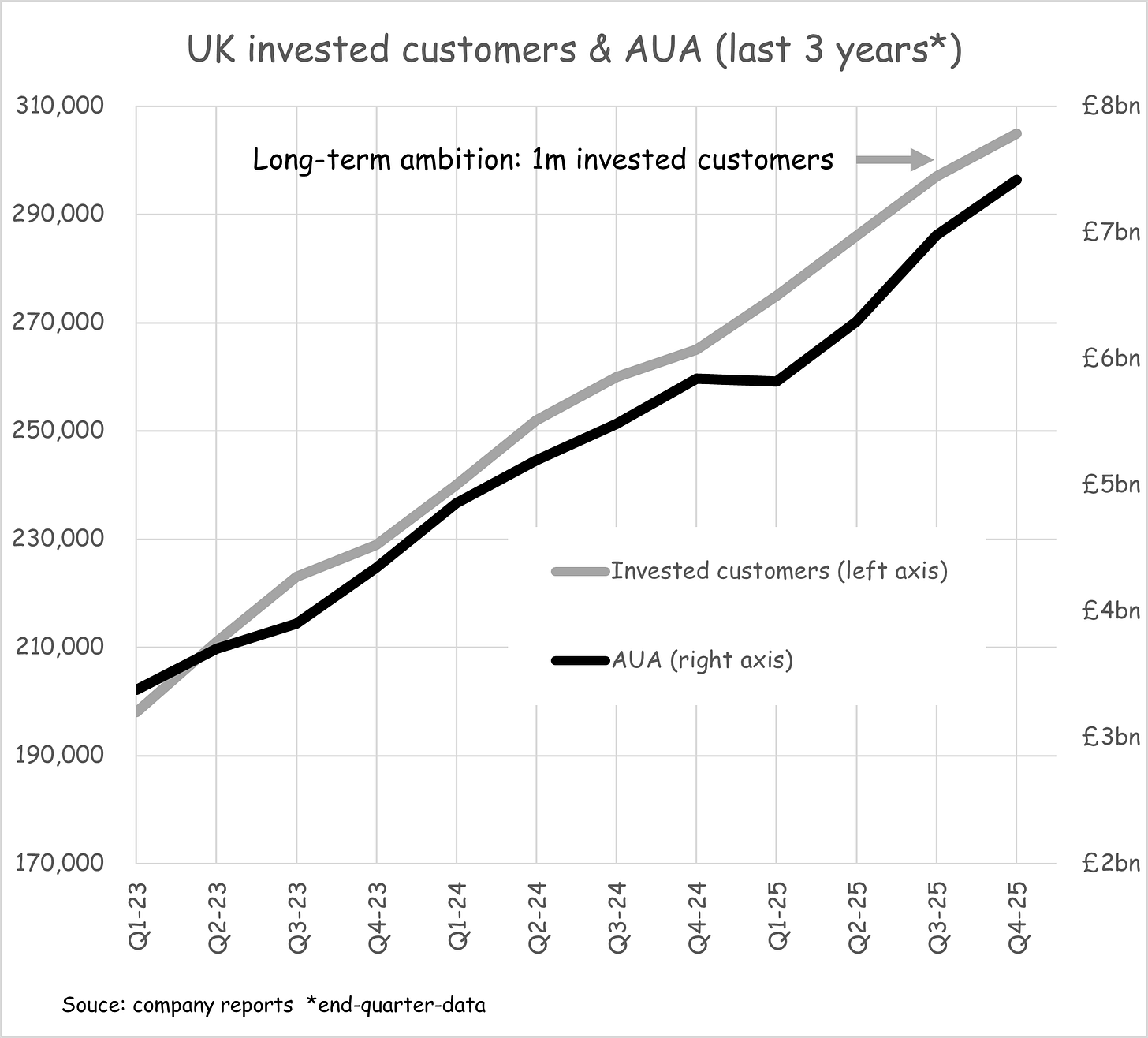

The original UK business, which is now well established but still scaling-up. It looks to have comfortably moved past breakeven, while maintaining solid reinvestment to maintain growth of its customer base and AUA.

Then there is the US business which has only just launched. Being so early stage, there are really only ‘project milestones’ to judge progress. More ‘hard metrics’ around customer numbers and AUA growth are expected during 2026. The potential in the US is enormous.

It’s impossible to untangle how much of the share price is being attributed to each business. But let’s dig into the latest update to see what might move the share price needle.

PensionBee UK

Growth is still strong.

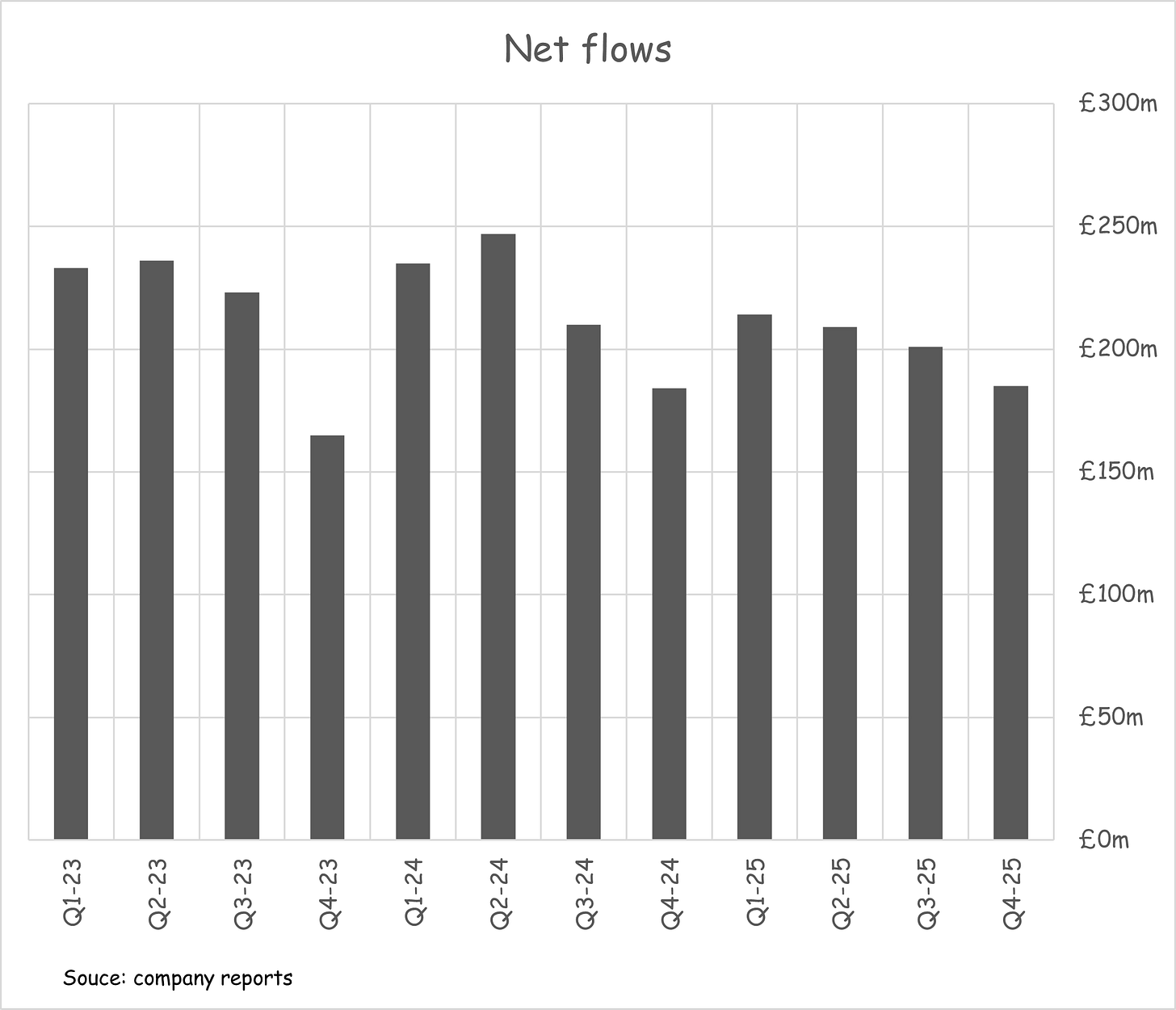

Net flows have been relatively consistent at around £200m per quarter, with some seasonality.

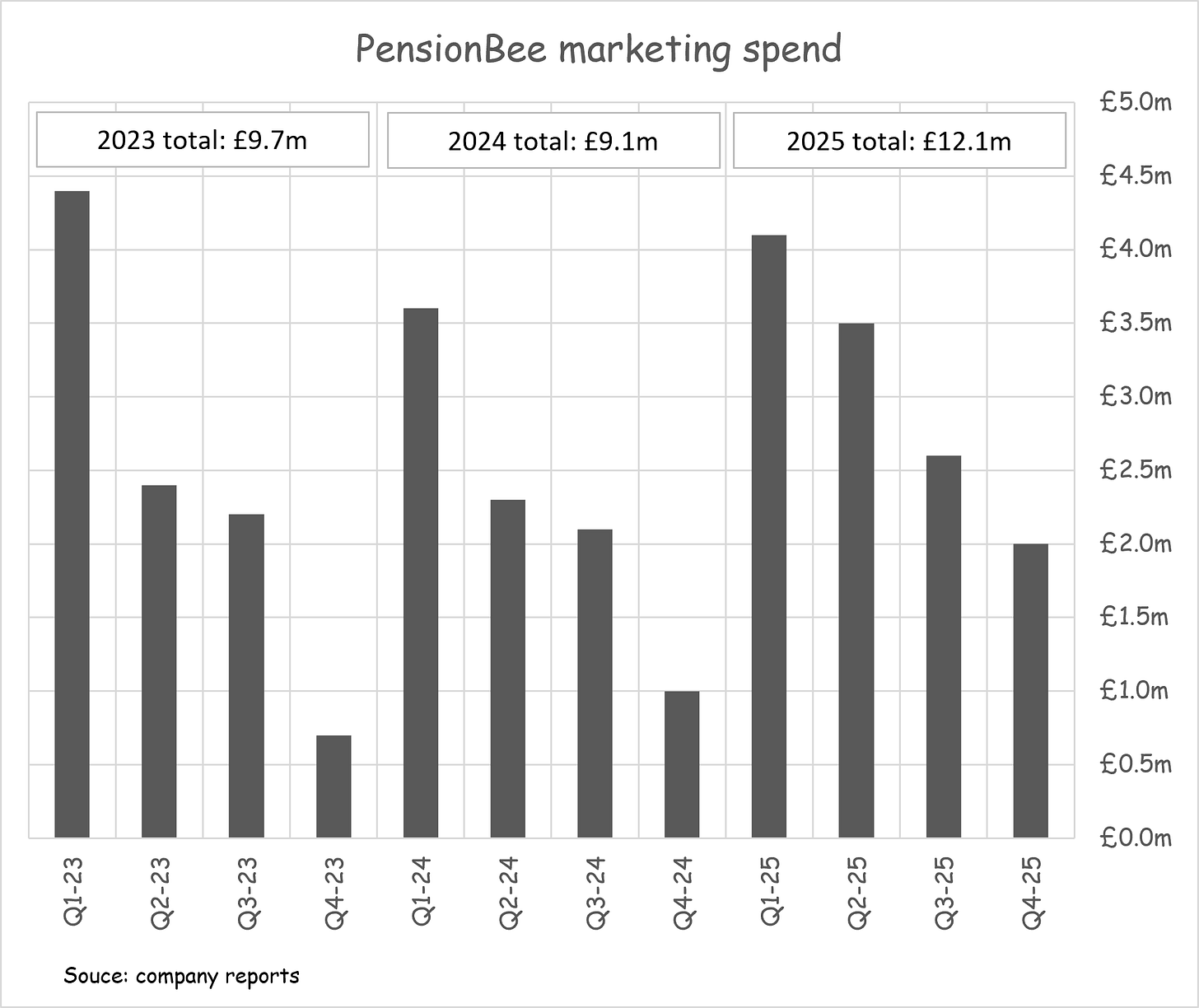

The seasonality of the business is more obvious in marketing spend deployment, with Q1 typically conducive to ramping up spending, and Q4 less so. The run up to Christmas is not that conducive for encouraging consumers to invest in their pensions.

Also worth noting is that in the second half of 2025, the UK budget was certainly a drag on pension investments - an issue highlighted by PensionBee and others in the UK wealth management space.

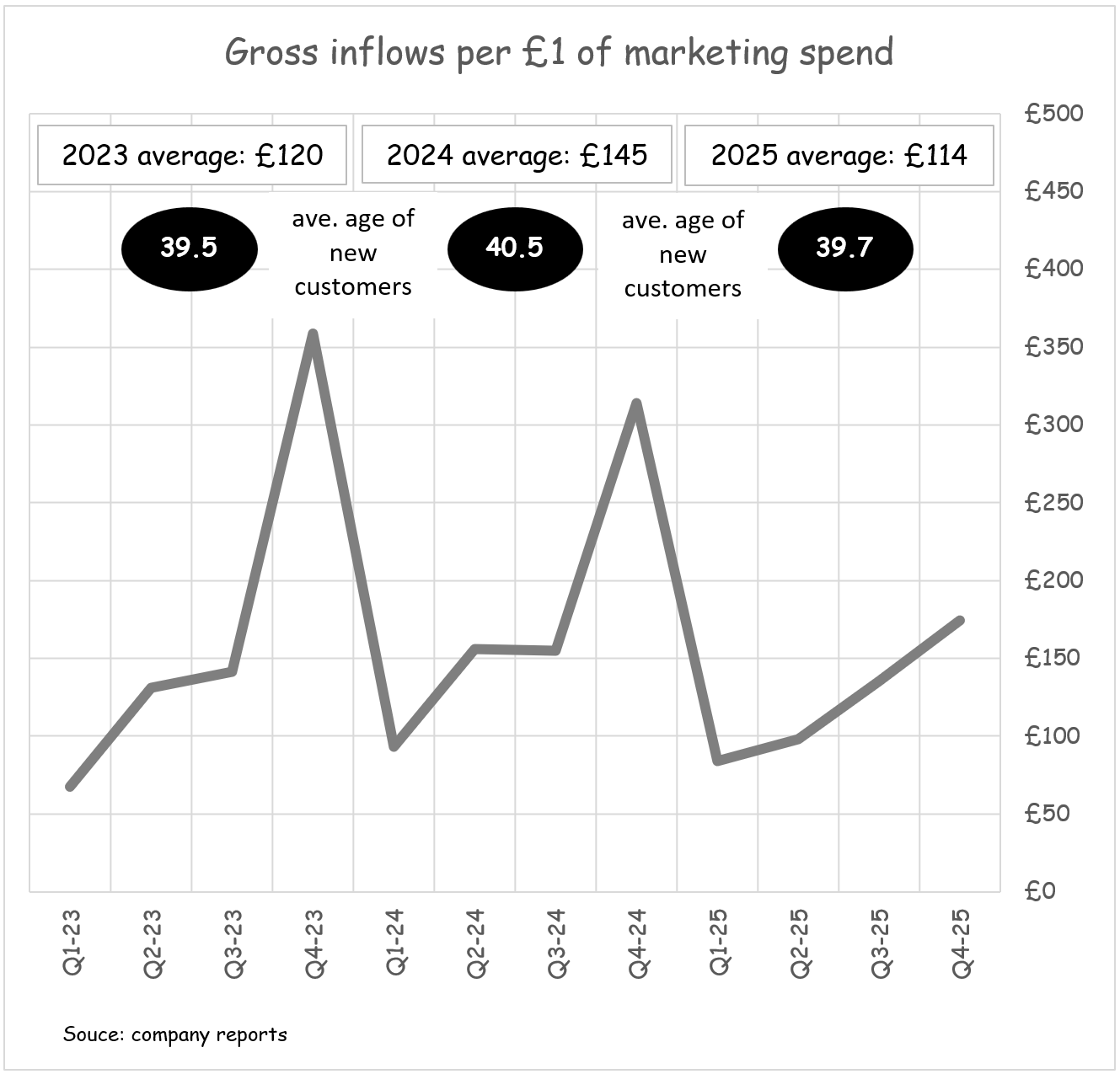

This can be seen in marketing spend efficiency. In 2025, PensionBee generated lower gross inflows per £ of marketing spend compared to prior years. In the chart below it is clear that the usual Q4 spike in gross inflows per £ of marketing spend was largely absent in 2025 (this metric usually spikes in Q4 as marketing spend in Q4 falls while gross inflows should still have some momentum from marketing spend in Q2 & Q3).

The company also attributes the fall in marketing spend efficiency to its strategy of targeting a slightly younger age cohort in 2025. The size of incoming pension pots are highly correlated to age (older cohorts bring larger pension pots).

In PensionBee’s results presentation on 21 Jan 26, CFO Christoph Martin said they are targeting a slightly older demographic in 2026, with a subsequent increase in incoming pot size expected, which should also drive an increase in gross inflows per £ of marketing spend. With the UK budget out of the way, a less nervous consumer should also contribute to increased gross inflows.

This is a metric I’ll be watching out for in the first two quarters of 2026 to see if there is any ‘bounce back’ in marketing spend efficiency.

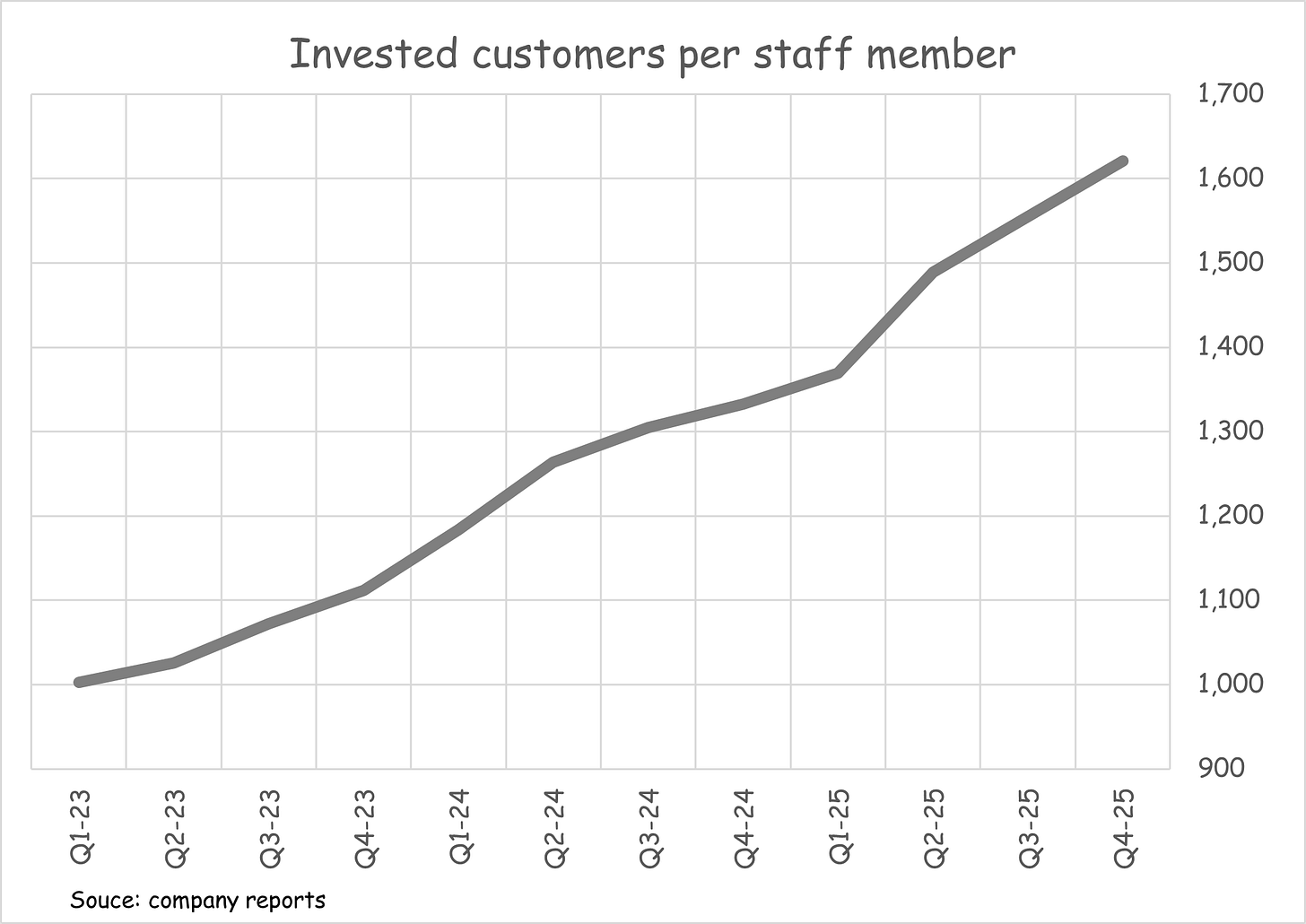

Offsetting the above headwind though has been a continuing increase in operating leverage. One of the cleaner measures of this is the number of invested customers per staff member - and this remains on a solid upwards trajectory as PensionBee scales.

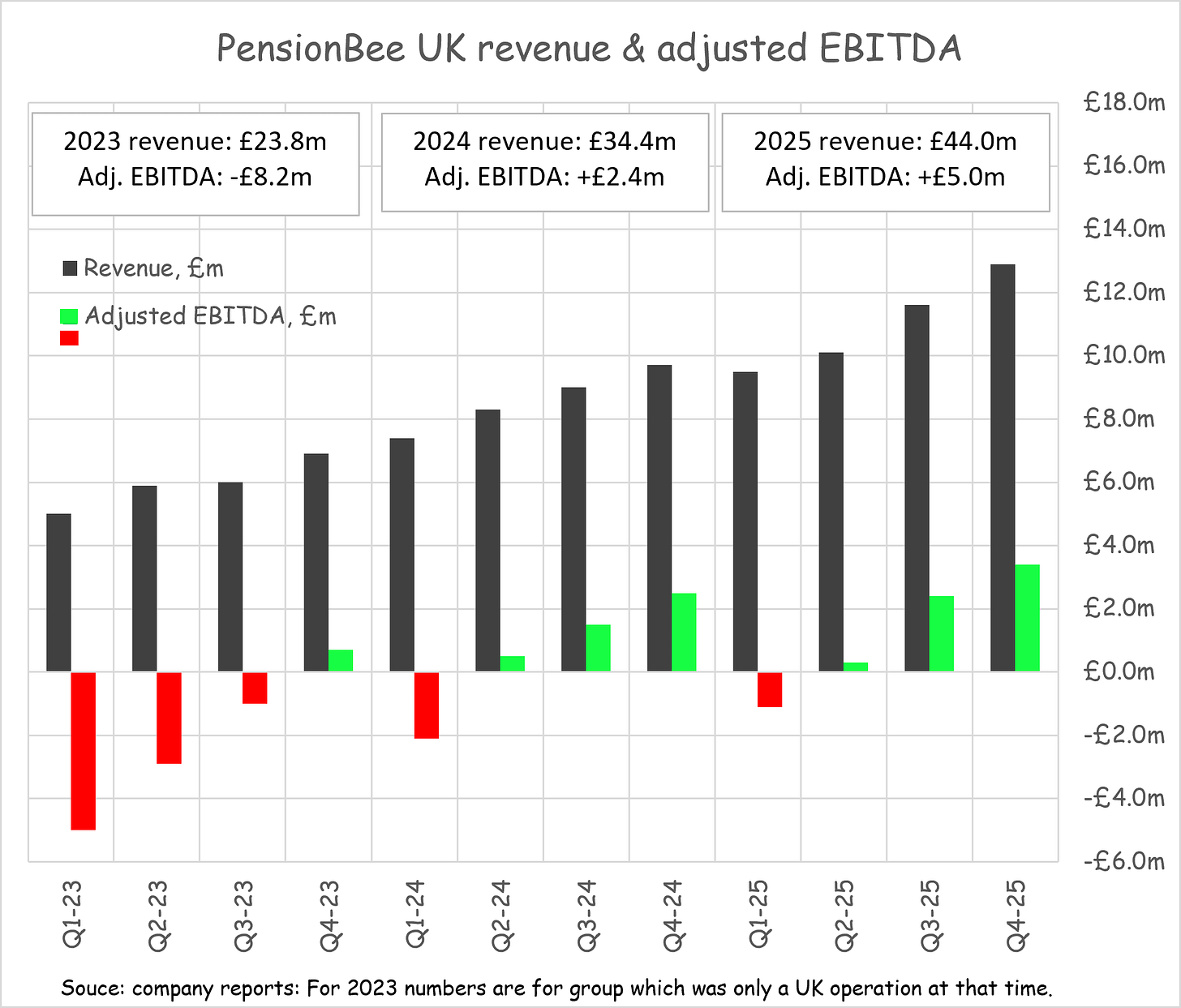

AUA growth and operating leverage has translated to improving financials for PensionBee’s UK business.

It’s worth highlighting that:

Revenue is recurring and is compounded as positive net flows (from new customers transferring their pension pots to PensionBee and from existing customers topping up their pension pots) add to an existing AUA base from which fees are generated.

The average age of a PensionBee customer is around 40, and the customer retention rate is c. 96%, so flows from existing customers should grow rapidly over time. This is not just about winning new customers.

EBITDA is volatile on a quarterly basis, mostly because of the volatility in marketing spend.

EBITDA has clearly moved into positive territory for the UK, with the business now able to reinvest profits. PensionBee UK doubled its EBITDA in 2025, despite a substantial ramp up in marketing spend from £9m to £12m.

While there are certainly some market headwinds in the form of UK customers being more reluctant to invest in their pensions because of economic and policy uncertainty, it’s pretty clear to me that PensionBee UK is a business with an engine that is purring along smoothly. I expect growth to continue and profits to ramp quite quickly over the next few years.

PensionBee US

It’s very early days for the US business. It has only just launched and AUA is just US$3m. 2025 was really about building the foundations and building brand awareness. But the ball is rolling and the opportunity is enormous. It’s just hard to judge how big this business could be.

As I’ve said before, PensionBee’s US strategy this looks well-thought-through. It is not a moon-shot move by a UK business wanting to tackle the largest market in the world. PensionBee is partnering with the large US financial State Street, which it has a longstanding relationship with. State Street has run investments for PensionBee since around 2016 and became a shareholder in 2017. I’d refer you to pages 13-16 of its 2024 results presentation for a good summary of what PensionBee is doing in the US and pages 9-12 of its 2025 interim results presentation for an update..

Another point worth highlighting is that PensionBee is unashamedly ‘leaning west’, trying to attract more interest from US shareholders. This makes sense. I think it’s fair to say US investors are far more enthusiastic about a growth story than UK investors. PensionBee has had significant US shareholders for quite a few years now. But as its presence as a business builds there, so too should its profile as a business to invest in. (There was a reason that in 2024 it moved its results announcements from the usual UK early-morning slot to late-afternoon UK-time!).

To further grease the wheels of this ‘westward lean’, PensionBee announced in Dec 25 it has qualified to trade on the OTCQX Best Market (’OTCQX’) - .

PensionBee will continue to trade primarily on the London Stock Exchange (LON: PBEE). The OTCQX trading facility will operate alongside this primary listing to enhance international investor access and support improved, cost-effective trading convenience.

‘Unsticking’ the share price

The first chart of this post shows that PensionBee’s share price appears stuck in a range. What might move the share price (to the upside)?

Success in the UK should move it upwards, but probably gradually. Success would mean continuing to build customer numbers, AUA, and a rapid ramp up in cash generation and profitability. As investors start to see profits move from promise to reality and become larger and larger, they will likely assign a larger value to the UK business (it also becomes far easier to value when it’s profitable!). But I reckon this is likely to be a gradual process, building value over a few years.

Strong traction in the US could provide a sudden kick upwards. The US might be a different story. If PensionBee starts to show tangible and rapid progress in the US (initially measured by customer numbers, AUA, and revenue), investors might assign a much higher value to this business as PensionBee US moves from ‘buildout’ to ‘initial growth’ to ‘scale-up’. But what do those numbers need to be and by when, to trigger a share price move?

What do you think? Feel free to post thoughts in the comments section of this post.

Be sure to subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in PensionBee.

Thanks Paul. Another solid post. I agree with your analysis. I think it is an attractive stock.

Your cross reference / comparison to the commentary of the other wealth managers was very helpful.