PensionBee's pickle. The tyranny of guidance?

PensionBee & investors are grappling with a more complex growth v profitability story. They shouldn't be. This is a potential star of the London Stock Exchange. For now, it's about growth.

TheInvestors.blog is not investment advice. Please read the disclaimer here and do-your-own-research. Disclosure: I own PensionBee shares.

On 22 Jan 2025, PensionBee released a trading update covering Q4 of 2024.

It showed the business ticking along nicely, hitting or exceeding guidance provided at its Oct 2024 Capital Markets day and in its Q3-24 update:

Revenue was expected to exceed £30m in 2024. Actual revenue was £33m (up 39% from £24m in 2023).

Adjusted EBITDA was expected to be breakeven in 2024. Actual adj. EBITDA was a touch better than that at +£0.4m (up from -£8m in 2023), and +£2m in Q4-24.

That rounded off an impressive few years.

At the end of 2020 (just before its IPO in Apr 2021), invested customers stood at 69k with Assets Under Administration of £1.4bn. In Dec 2024, invested customers had grown to 265k (40% CAGR) and AUA to £5.8bn (44% CAGR). On 27 Jan 2025, PensionBee announced AUA had reached £6bn.

And it’s been a focused drive towards profitability too, as the business scaled. A key efficiency metric, invested customers per staff member, improved from 628 in Dec 2020 to 1,333 in Dec 2024. Adj. EBITDA improved from -£20m in 2022 to breakeven in 2024.

But the market didn’t react well to the 22 Jan 2025 update. The shares fell nearly 10% in the next two days from 173p to 158p, before recovering some ground to 163p on 5 Feb 2025.

That was the second wobble in recent months. In the weeks following the Q3-24 update on 23 Oct 2024, and, on the same day, an announcement of a capital raise (to fund a US expansion), PensionBee shares fell nearly 20% from 185p to 149p on 19 Nov 2024 (again, before recovering some of that ground). At the time of publication on 5 Feb 2025, the share price is 14% off the Oct 2024 high.

What’s going on with these downward moves following updates?

It looks to me like the Oct 24 move seems US-related, and the Jan 25 move UK-related. Investors seem broadly on board with the US expansion but were caught off guard by the capital raise. Then some investors seemed to hit a wobbly when looking at Q4-24 progress in PensionBee’s home UK market. I think I can see why, with financial guidance being partly to blame. I also think the wobbly is unjustified. But let’s look at the US and UK in turn.

US expansion welcomed by investors…

The story used to be so simple. PensionBee was an upstart disruptor of the UK pensions market, operating only in the UK. Its core offering was giving customers the opportunity to consolidate multiple pension pots into a single PensionBee pot. The consolidated pots are typically ‘legacy’ workplace pensions from jobs people leave. And people job-hop a lot, leaving behind many legacy pots!

Then, in Mar 2024, PensionBee announced it was expanding to the US. More details emerged over the next few months, and it looked like a well-thought-through plan. This was not a naive move by a UK business wanting to tackle the largest market in the world.

PensionBee was partnering with the large US financial State Street, which it had a longstanding relationship with. State Street had run investments for PensionBee since around 2016 and became a c5% shareholder in 2017, diluting to c4% post-IPO. State Street was to provide expertise and “Meaningful marketing support for US expansion over the next 5-7 years - at least $6 million until the end of 2025”.

PensionBee would run the new US operation (through a new wholly owned subsidiary, PensionBee Inc), and provide a financial contribution to the new US company “PensionBee Group will capitalise PensionBee Inc. with an injection from the existing resources of its Group balance sheet (approximately $4m over 36 months).

Shareholders clearly liked the ambition and the plan. [For more details refer to PensionBee’s Capital Markets Day presentation (the US expansion is presented at 55 minutes) and slides.] The share price kicked upwards in the months following the announcement and as more details emerged.

…but capital raise an unwelcome surprise

On 23 Oct 24, PensionBee announced a £20m capital raise (from institutional investors only), to accelerate the US expansion.

Following its Capital Markets Day … the Company has considered opportunities to accelerate the delivery of its medium and long term guidance.

PensionBee intends to use the £20 million of proceeds raised to accelerate investment in its US business by:

Increasing marketing expenditure on paid advertising channels… to accelerate new customer growth.

Accelerating the development of localised product features… to attract US customers and help them roll over their retirement accounts more easily and quickly.

Pursuing employer (sponsor) opportunities to bulk transfer former employees' account. Employer sponsors are seeking to relieve themselves of former employees' accounts and associated costs…

Overall, the proceeds will increase the Company's expenditure in its US business over 2025 and 2026 to accelerate the delivery of its medium and long-term guidance. The proceeds will also ensure maximum capital allocation to the UK business from organic cash generation in the UK.

The raise was at 185p per share, the closing price on 23 Oct 24, so no discount to the pre-raise share price. Existing shareholders were diluted around 4.8%. But this was nowhere near the share price fall over the next 3-4 weeks (c20%), so the raise clearly didn’t go down well. (The Q3 trading update on the same day looked OK so I cannot see that being the driver of such a sharp share price fall).

There’s really nothing more to say on this one at this stage. It’s now about execution in the US. Time will tell if the plan and the capital raise pay off. But the PensionBee share price, and its momentum, isn’t looking as rosy as it was before the capital raise.

(Misplaced?) UK customer growth worries

Three months later, on 22 Jan 2025, PensionBee released its Q4-24 update, which as I’ve shown, created another wobble.

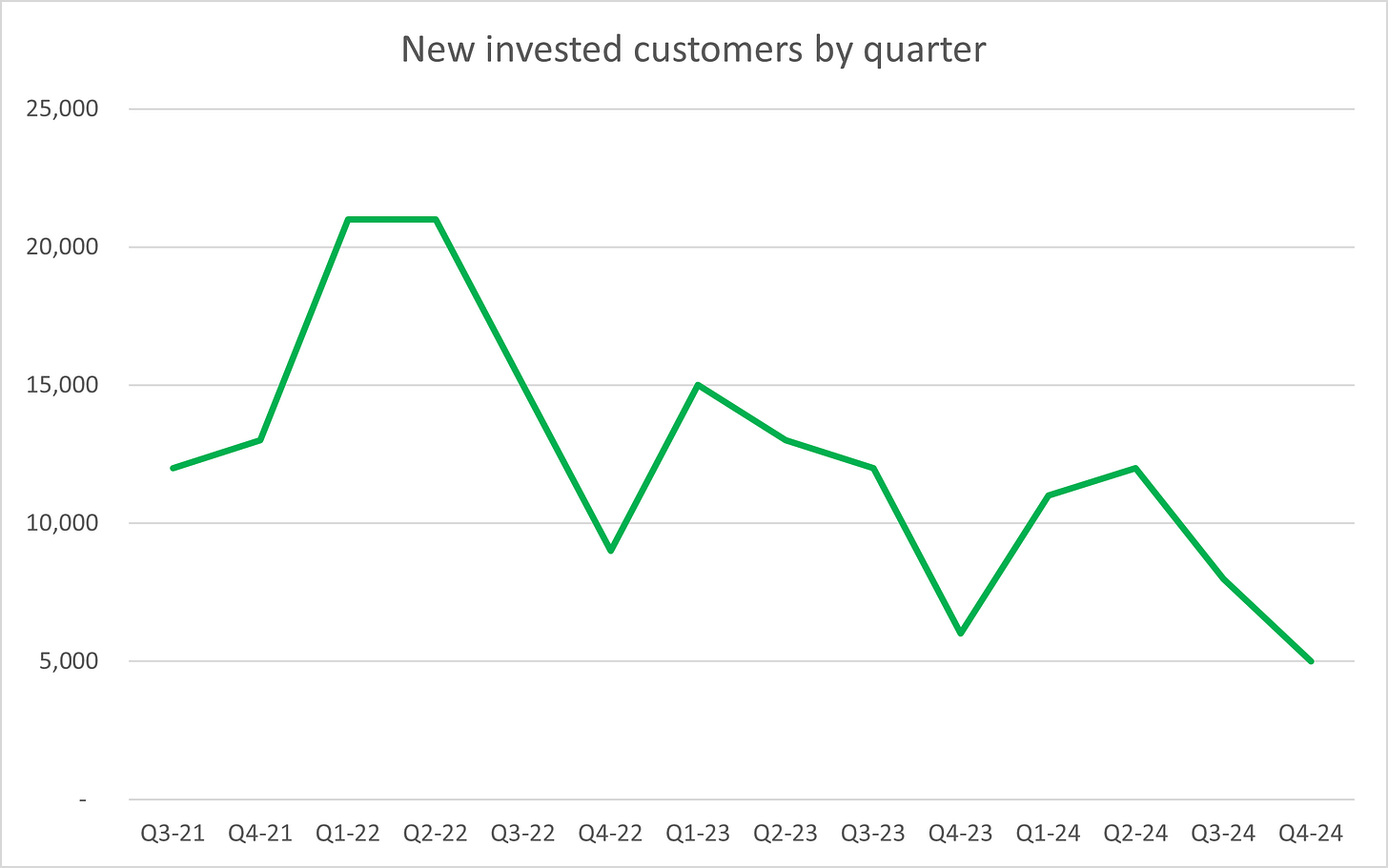

But the reasons behind this wobble are more complicated. You could probably forgive some investors for thinking PensionBee growth was rapidly slowing in the UK. Just look at the number of new invested customers added by quarter since the Apr 2021 IPO (Q3-21 is first full quarter post IPO). I’m pretty confident that the low new customer number in Q4-24 was primarily responsible for the negative share price reaction to the trading update.

But that chart is almost meaningless without looking at marketing spend. PensionBee runs a sophisticated digital (and other) marketing operation that can almost be thought of as a dial that can be turned up or down. So let’s overlay marketing spend on the previous chart.

Two points are worth highlighting:

The trend in spend is in line with what was communicated at the time of the IPO. The majority of the capital raised at IPO was to be used for marketing to scale the business, then spend would gradually taper off. So that ramp up in Q1-22 and Q2-22 was expected, as was the tapering off after that.

There is seasonality in spend (and customer growth) - notice the spikes in Q1 22, 23 and 24, and dips in Q4 22, 23, and 24 in the chart above. Q1 is a good time to acquire new customers, and Q4 not so good. PensionBee has communicated this on multiple occasions - people are just not that focused on making pension changes during the Christmas holiday season.

However, I think some investors are reading a bit more than they should into those Q4 dips (especially the latest Q4-24 dip), or not looking at what’s going on in enough detail. But I have no doubt the above dip in marketing spend - leading to a dip in customer growth in Q4-24 - led to the negative share price reaction on 23 and 24 Jan 25.

Is the tyranny of guidance to blame?

PensionBee has never shied away from providing financial guidance. And that guidance included reaching breakeven ‘run-rate’ adj. EBITDA by the end of 2023 and of reaching breakeven adj. EBITDA over 2024 as a whole. It met both of those goals. But meeting them was obviously helped by the lack of marketing spend in Q4 of both years.

Were the large dips in Q4 marketing spend just the usual seasonality, or a dial-back in spend to make sure those guidance targets were hit? There’s definitely an element of the former, but possibly a bit of the latter too, which opens the door for cynics to levy some criticism.

What would have been worse? Spending a bit more and missing guided EBITDA targets, or dialing back marketing spend slightly to hit them, during quarters when conditions for acquiring customers are not that ideal anyway? Who knows. It’s a point that could be debated ad nauseam.

What is much more important than the above anomaly, in my view, is to focus on a more complete set of metrics over a longer time horizon, including AUA net flows (more meaningful than customer numbers as it directly drives revenue), and what the prospects for continued AUA, revenue, and profitability growth in the UK are (without over-focusing on one quarter where there has clearly been a marketing spend anomaly).

Prospects still strong for UK growth

Now, while adding new customers is important (PensionBee reckons it can get to 1 million UK customers in 5-10 years, from the current 265k), AUA growth is not ONLY about the absolute volume of NEW customers:

Existing customers are sticky (retention rate >95%), and continue to feed their pension pots over time. At its capital markets day in Oct 24, PensionBee disclosed that average annual contributions per customer had grown from £507 in 2020 to £849 in 2024. So the AUA base compounds over time, even without new customers (it is also affected by market movements of course).

And the type of new customer matters a lot too. Over 2024, PensionBee said it concentrated its customer acquisition strategy on customers with larger account balances (which mostly means older customers): “resulting in growth of 16% in the average UK account balance to c.£22,000 (Q4 2023: c.£19,000)”.

Also, PensionBee’s marketing spend can, and is, channeled to acquire new customers (brand awareness campaigns, digital marketing etc) and to encourage existing customers to maintain or increase contributions (”right-message-right-time” approach through email, in-app messages etc).

All of the above means that AUA inflows have been far more stable than new customer additions as marketing spend has declined from its ‘scaling up’ peak in 2022. This can be clearly seen when we contrast net AUA flows to marketing spend (chart below), to the highly correlated relationship of new customers to marketing spend in the previous chart above.

To illustrate this point further consider that over 2024, Invested Customers grew by 16%, AUA by 34%, and revenue by 39%.

The other change that is occurring is that marketing spend is becoming much more efficient with increased brand awareness and as PensionBee hones its techniques over time as experience and data builds. This means it does not have to spend as much on marketing to continue to grow strongly. The metric PensionBee uses to track this is net flows per pound of marketing spend. And look how this has improved over the last three years - from around £30 three years ago to around £100 today.

Looking forward, now that the UK looks to have moved into a cash generating position, PensionBee intends to use ‘surplus’ cash generated by UK operations to deploy to marketing and drive further growth.

Indeed, in its Q4-24 results presentation, CEO Romi Savova said PensionBee intends to “re-accelerate” the deployment of marketing capital in the UK and invest more in marketing in 2025 compared to 2024. That would mean more than £9m deployed to marketing, and if PensionBee can meet or beat £100 of net flows per £ of marketing spend, total 2025 net flows of around or over £1bn (2024: £876m).

A growth story, not an EBITDA story (for a while yet)

OK, I don’t mean that to be taken too literally, but the point I’m trying to stress is that too much obsessing with breakeven or positive EBITDA is not that productive at this stage of PensionBee’s life cycle. And especially if it clouds the growth story, as I think it has following the Q4-24 trading update.

In the UK, while at a more advanced stage than in the US, PensionBee is still quite small. Priority 1 is to beef up that £6bn of AUA, by a lot.

As a shareholder, I’m not focused on PensionBee being EBITDA-breakeven at a £6bn AUA level (although it’s obviously a good thing). I’m really not that fussed right now if EBITDA is a few hundred thousand in the green or the red. The reason I invested is because PensionBee has the potential to add a zero to that AUA level in time. And without doubt, the level of EBITDA at that kind of scale will be very very attractive.

Of course, the business needs to manage its cash carefully, but I don’t want to see the business held back by a previous commitment to positive EBITDA. I want to see a focus on growth, not paring back marketing spend and new customer acquisition, even if it is for a short while, to make sure EBITDA is the right side of the breakeven line.

In the US, things are actually simpler. PensionBee is a true start-up business. It will either be successful and become one of the roaring success stories of the London Stock Exchange, or it will fail in the US. Investors understand that. That’s the risk they take.

And another point worth being brutally frank about, is that PensionBee is unashamedly ‘leaning west’, trying to attract more interest from US shareholders. And US investors are far more enthusiastic about a growth story than UK investors. PensionBee has had significant US shareholders for quite a few years now. But as its presence as a business builds there, so too should its profile as a business to invest in. (There was a reason that in 2024 it moved its results announcements from the usual UK early-morning slot to late-afternoon UK-time!).

I think this business has the potential to make a step-change in scale and be one of the shining lights of the UK market. It shouldn’t be letting tiny nuances of financial guidance get in the way of that.

Subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in PensionBee.