Polar Capital: AUM jumps 12% in a quarter

Stellar investment returns by larger funds and a welcome return to positive net flows brighten outlook

This is not investment advice. Please read TheInvestors.blog disclaimer here.

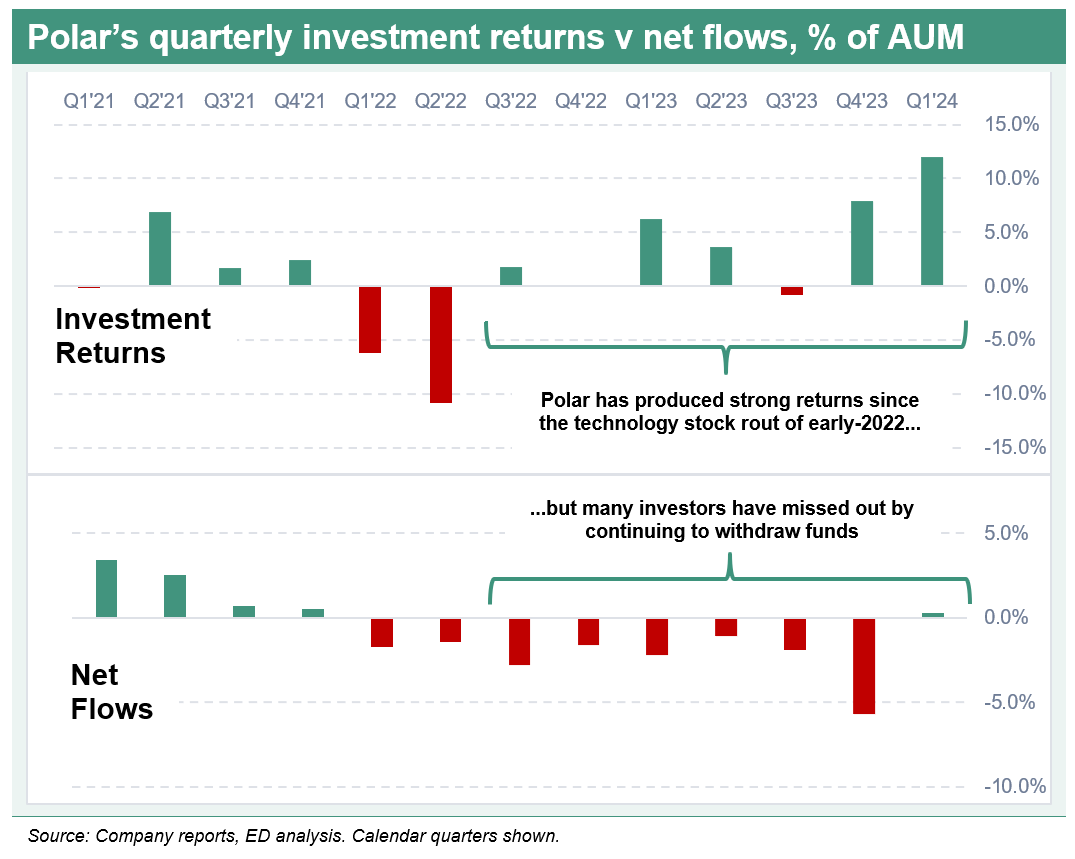

Polar Capital’s AUM jumped £2.3bn over Q4 of FY24 to £21.9bn on 31 Mar 24.

Investment performance was the AUM booster, with exceptional investment returns (mostly above benchmark) in Polar’s largest strategies of technology, healthcare and insurance.

Probably most pleasing though, was a return to positive, albeit modest, net flows in the quarter of +£56m.

Today, my Equity Development research note covering the AUM update was published. I drill into the drivers behind the strong quarter, the outlook for Polar Capital, and flag a few early signs of an improving outlook for UK and European equity and active management fund flows more generally. The full note is linked in the graphic below.

A key argument I make is that the improvement in Polar’s net flows shouldn’t be surprising, as it has been clear for some time that many investors’ decisions to keep reducing technology (and other equity) exposures following the valuation falls of 2022 have proved costly and resulted in them missing out on exceptional returns.

I hope you enjoy the full research note which can be read here.

Subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder of Polar Capital, and covered Polar Capital as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Polar Capital here. (Please read this link for the terms and conditions of reading Equity Development’s research).

Please read TheInvestors.blog disclaimer here.

https://citywire.com/wealth-manager/news/stock-talk-polar-capital-proves-its-strength/a2440380?re=119294&refea=1689446