Strong growth at Tatton: profit +24%, dividend +19%

Another exceptionally strong year. Financial advisers continue to outsource investment management to this market leader. Their confidence in Tatton looks well justified.

TheInvestors.blog is not investment advice. Please read the disclaimer here.

Today, my Equity Development research note was published covering Tatton Asset Management’s FY25 results.

Here’s the video summary.

And here’s the executive summary:

FY25 (to 31 Mar 25) was an exceptionally strong year which exceeded Equity Development’s previous forecasts. Revenue grew 23% to £45.3m (previous forecast £44.3m), adjusted operating profit 24% to £22.9m (£22.1m) and PBT 29% to £21.6m (£21.3m). Net cash was £32.1m at year-end with no debt. Full year dividend is 19.0p (yield 3.2%), +19% year-on-year.

Growth underpins financial performance

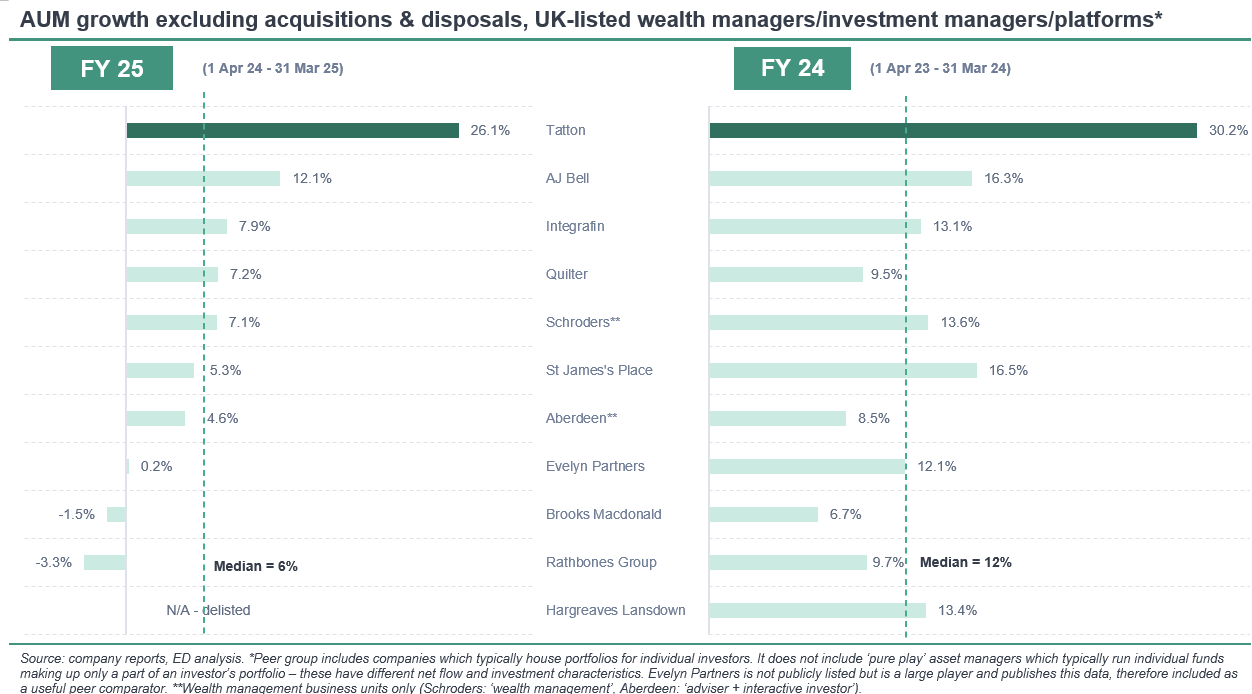

Underpinning performance was sector-leading AUM growth, up 26% to £20.9bn.

This was in turn mostly a result of record organic net flows of £3.7bn (FY24: £2.3bn). Tatton’s net flow rate has been far higher than peers for some years now.

Good prospects for continued growth

There are multiple market and Tatton-specific drivers which underpin prospects:

savers and investors keep contributing to their investment and retirement pots;

an ageing UK population demands more financial advice with more ‘adviser-led’ investments (Tatton’s channel);

and advisers continue to outsource investment management to focus on financial planning and advice.

Indeed, on-platform discretionary fund management FUM (Tatton’s immediate market) increased 40% last year (longer term CAGR: 28%), reaching 21% of the total platform market (up from 6% in 2017), reaching £183bn (total on-platform: £872bn).

On the analyst call this morning I asked CEO Paul Hogarth about the outlook for growth of the on-platform DFM market. He reckons £200bn will be reached in the next couple of years, and longer term, possibly reach as much as 40% of the overall on-platform market. That puts Tatton in a massive market with ample growth headroom.

Tatton leads the on-platform DFM market (12% share), focusing on consistent investment performance (built over 12 years), exceptional service, and low fees.

Advisers’ confidence looks well justified. In its core MPS suite, every strategy outperformed or matched peers over 3, 5, and 10 years. Tatton has built this low-fee model while maintaining the highest operating margin in the sector at 50.6%.

Ahead of target trajectory

Just over a year ago, Tatton set a new medium-term (5-year) growth target of reaching £30bn AUM/I by March ‘29. That meant adding c. £2.5bn per year on average. One-year in, it has added £4.2bn, well ahead of the trajectory needed to reach this target. It has also had a strong start to FY26, with AUM/I rising a further 5% to £22.9bn in the 10 weeks to early-June.

Read the full research note here.

Be sure to subscribe to TheInvestors.blog below to keep up to date.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant covered Tatton Asset Management as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Tatton here. And please read this link for the terms and conditions of reading Equity Development’s research.