Who’s who in UK-listed asset & wealth management

Runners and riders covered by this newsletter & what to expect

This is an update of a previous post which I keep pinned to the top of the website. It is an overview of the UK-listed asset and wealth management sector. There’s been quite a few changes since the original post!

TheInvestors.blog aims to provide nuggets of market and company analysis for shareholders of publicly-listed asset and wealth managers.

It should also be a useful read for directors, executives, and managers of these companies - offering insights into how investors are thinking about them and their peers.

TheInvestors.blog is not investment advice. Please read the disclaimer here.

Which companies are written about?

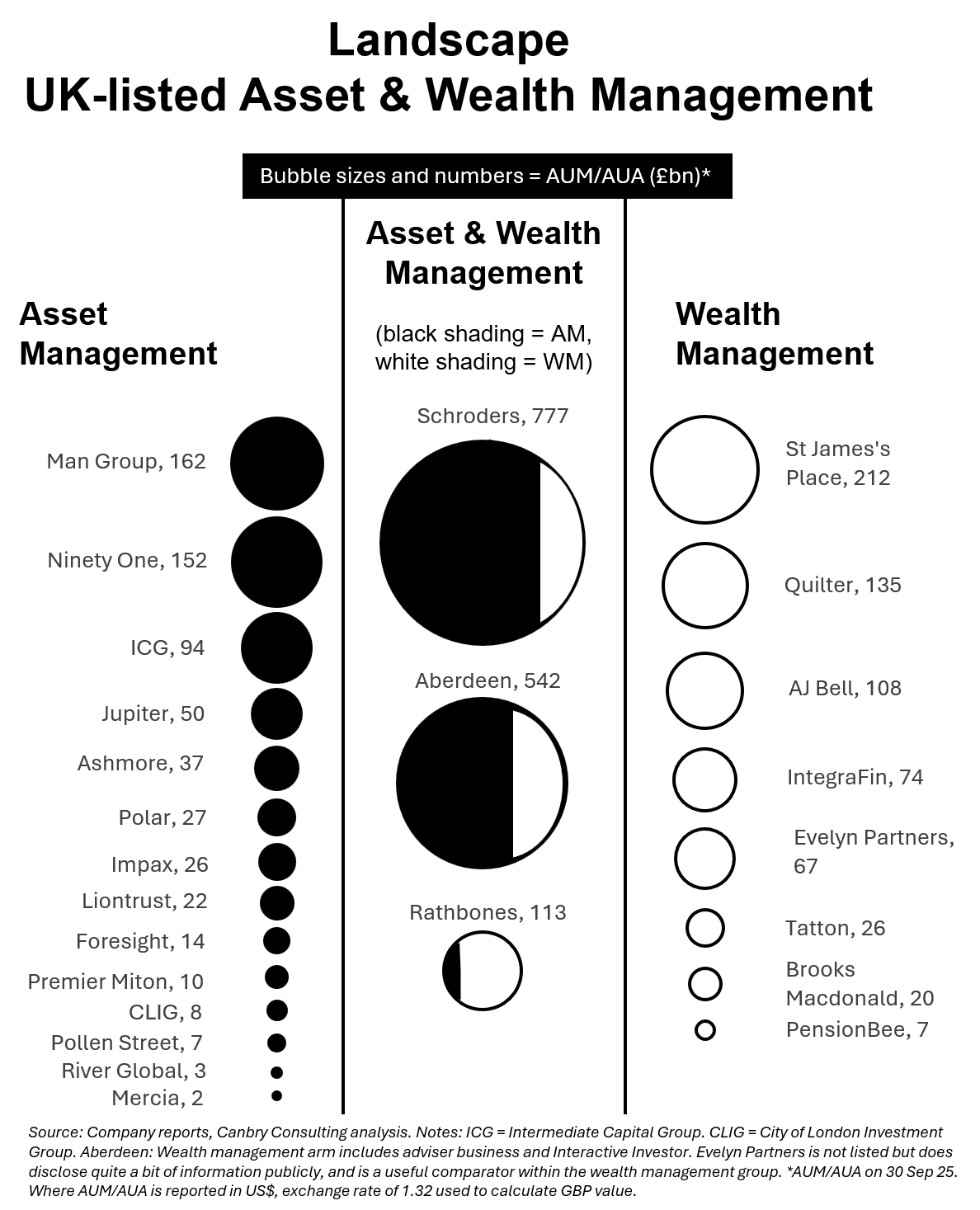

There are two main groups of companies covered in this newsletter:

Asset managers (left hand column in graphic below): These run investment funds which would typically make up only a part of an investor’s portfolio. Funds often have some sort of specialisation such as investing in a particular industry sector, asset class, or geography. Funds can certainly grow rapidly and benefit from ‘hot asset classes’ (think private assets over the last few years). But fund assets tend to be less sticky than those managed by wealth managers. Think about a scenario when an investor wants to exit an investment placed with an asset manager. They would be likely to move those assets to another asset manager or into cash.

Wealth managers (right hand column in graphic below): These tend to house all or a large part of an investors’ portfolio (often spread across a range of investments such as individual equities or asset managers’ investment funds). The invested assets may or may not be coupled with investment advice. Assets tend to be stickier than those of asset managers. Think about a scenario when an investor wants to exit an investment or asset class, they will probably execute this switch without moving assets from their wealth manager. It is simply a case of switching from one financial product to another. This newsletter also includes platforms (such as AJ Bell and IntegraFin - Hargreaves Lansdown is no longer publicly-listed) and discretionary fund managers or DFMs (such as Tatton Asset Management, Brooks Macdonald) in the wealth management segment, as they tend to manage or administer portfolios for investors.

There are also companies which run both asset and wealth management operations (centre column in graphic below).

Who does what?

The big beasts (with asset and wealth management operations)

Schroders: Multinational asset manager with diverse offering serving a range of institutional and private investors. Public and private markets investment capabilities. It also has a significant advisory business (e.g. investment and advisory services to corporate pension schemes, insurance companies etc). Asset management AUM dominates (> 80% of AUM). It has a smaller but still significant wealth management arm (Cazenove Capital, Benchmark, Schroders Personal Wealth).

Aberdeen: Three segments: Investments - multinational asset management business with a range of funds, investment solutions and investment trusts (>70% of AUM); Adviser - UK’s 2nd largest adviser platform; Interactive Investor - the UK’s 2nd largest D2C investment platform.

Asset management segment

Man Group: Invests in equities, credit and multi-assets across public and private markets. Quant-focused (systematic) strategies as well as fundamental, research driven strategies. Roughly 40-45% of AUM sourced from EMEA, 40% Americas, 15-20% Asia Pacific.

Ninety One: Teams covering equities, fixed income, and multi-asset. Origins in South Africa, where it still has substantial operations and is listed on the Johannesburg Stock Exchange (in addition to its London-listing). Now a global operation with around 40% of AUM sourced from clients in Africa, 33% UK & Europe, 17% APAC and 10-12% Americas. ·

ICG [Intermediate Capital Group]: Private markets specialist with private equity (mid and upper-mid market), credit (direct lending, mezzanine, and structured credit solutions), real assets (infrastructure equity, real estate, and related private market strategies), and secondaries strategies (through ICG Strategic Equity, acquiring stakes in private equity funds). Operates across EMEA, America, APAC, UK & Ireland.

Jupiter: Active manager with equities, fixed income and multi-manager strategies. Primarily UK (c. 65% of AUM) and EMEA (c. 22%) client base. 82% of AUM from retail, wholesale and investment trust channels, 18% from institutional investors. A key strategy is to increase proportion of institutional AUM.

Ashmore: Specialist emerging markets active manager focused primarily on fixed income strategies (c. 85% of AUM) with equities making up c. 12% of AUM.

Impax: Specialist is sustainable investing. Mostly listed equities strategies but also offers fixed income, systematic, and private markets strategies. A key focus is to build fixed income AUM. Clients mainly institutional investors. 58% of AUM sourced from EMEA, 7% UK, 34% North America, 1% APAC.

Liontrust: Active manager with equities and especially UK-equities bias. UK retail investors dominate client base (83% of AUM in UK retail funds and MPS). Largest investment strategies are Sustainable Investment (35% of AUM) and Multi-Asset (18%).

Polar Capital: ‘Multi-boutique’ with 14 investment teams managing specialist portfolios with a thematic, sector, geographic, or financial instrument focus. Technology (51% of AUM), healthcare (14%) and Emerging Markets & Asia (14%) are the largest strategies. Targets mostly institutional investors with client base primarily in UK (c. 61%) and across Europe ex-UK (c. 26%).

Foresight: Specialist investor in infrastructure/real assets (80% of AUM), private equity (12% of AUM) and listed securities (8% of AUM), mostly with a sustainability theme e.g. energy transition.

Premier Miton: Manages a range of equity strategies (45% of AUM: 16% of total AUM in UK equities, 29% in non-UK), multi-asset (26%), fixed income (21%), and absolute return (8%) strategies. Most of its AUM is in funds but it does have some AUM sourced via segregated mandates (11%) and investment trusts (3%).

CLIG: City of London Investment Group invests primarily in closed-end funds (equity, fixed income and alternatives). It’s London-based business has an institutional investor focus and a significant emerging markets investment focus (34% of AUM). It also has a US business (37% of AUM) which primarily has a HNW individual client base.

Pollen Street: Private markets specialist (equity: 62% of AUM; credit: 38% of AUM). AUM mainly sourced from investors in Europe ex-UK (34%), USA (31%), UK (19%), and Middle East and Asia (16%). It’s £6.1bn of AUM includes c. £0.5bn of on-balance-sheet investments. Sector focus in payments, wealth, insurance, tech-enabled services, and lending.

River Global: Focussed on acquiring asset and wealth management businesses. Asset management businesses held in separate A-shares. Stake in wealth management platform Parmenion is held in B-shares.

Mercia: Venture capital, development finance (mostly SME loans) and property finance to mostly regional (ex-London) UK businesses, investing between £100k and £20m. It manages c£1.8bn of funds for third parties and invests alongside them with c. £130m of on balance sheet investments. It intends to increase focus on third party fund management and divest from most of its on-balance-sheet investments.

Wealth management segment:

St James’s Place: Advice-led wealth manager with ‘partner’ adviser model (tied to SJP). It has around 4,900 advisers. AUM primarily in mass-affluent space (78% of AUM in £100k-£2m assets-per-client range). Ambitions to push further into HNW segment (£2m-£10m) which currently makes up around 15% of AUM and ultra-HNW (>£10m), which makes up around 7% of AUM.

Quilter: Advice-led wealth manager in 1) Affluent segment with £50k-£250k to invest (c. 73% of AUM: sourced via restricted/tied advisers and third-party IFAs using Quilter platform) and 2) HNW segment with >£250k to invest (c. 26% of AUM: sourced via restricted/tied advisers and IFAs). Also runs investment solutions (discretionary fund management and portfolio services).

AJ Bell: Adviser platform and D2C platform (61% and 32% of AUA respectively). Adviser platform is 4th largest in UK after Quilter, Aberdeen, and Transact. D2C platform also 4th largest after HL, Interactive Investor and Fidelity. Also has non-platform AJ Bell Investments business making up 6% of AUA.

IntegraFin: Holding company of adviser platform Transact (technology and investment platform), which is the 3rd largest adviser platform in the UK (after Quilter and Aberdeen).

Tatton: Serves smaller, UK-based Independent Financial Advisers via two business units: Tatton Investment Management - discretionary fund management (c87% of group revenue), and Paradigm - regulatory and compliance consulting and outsourcing, plus mortgage and protection insurance aggregation (c13% of group revenue).

Brooks Macdonald: Provides investment management services for financial advisers and private clients in the UK and financial advice services directly to private clients.

PensionBee: High-growth, earlier-stage business, IPO’d in 2021. D2C model giving customers the ability to switch and consolidate ‘legacy’ pension pots (typically from previous jobs). Focus on UK market to date but recently launched in US also.

What to expect from this newsletter

Future posts will include commentary on the most important issues for shareholders:

individual company financial results;

quarterly, half-yearly, and annual comparisons of assets-under-management movements to tease out who’s winning and who’s losing;

macro-trends of where capital is moving from and to, and which asset managers benefit or lose from these trends;

strategic sector analysis; and

thoughts on opportunities and threats.

Lastly, I’m always open to suggestions and feedback - what you liked, what you didn’t like, what you’d like to see in future posts.

Subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication, and covered Impax Asset Management, Polar Capital, Mercia Asset Management, and Tatton Asset Management, as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on these companies by clicking on each. And please read this link for the terms and conditions of reading Equity Development’s research.

Great article. FYI, SPW was a joint venture between Schroders and Lloyds. Lloyds has now taken back full control, and SPW will now fall under Lloyds.