A not-so-quiet summer in UK wealth management

M&A, de-listings, strategy changes, international expansion, new CEOs, big share price falls and jumps, you name it. Catch up here.

We’re approaching Q3-24 trading updates for the UK wealth management sector. I’ll be writing about those in October, so be sure to subscribe to receive that update.

In preparation for that, it’s worth reflecting on what happened in H1-24, and especially, the flurry of corporate, strategic, and operational activity that happened over the summer holiday period.

TheInvestors.blog is not investment advice. Please read the disclaimer here.

Mostly solid AUM/AUA numbers in H1-24

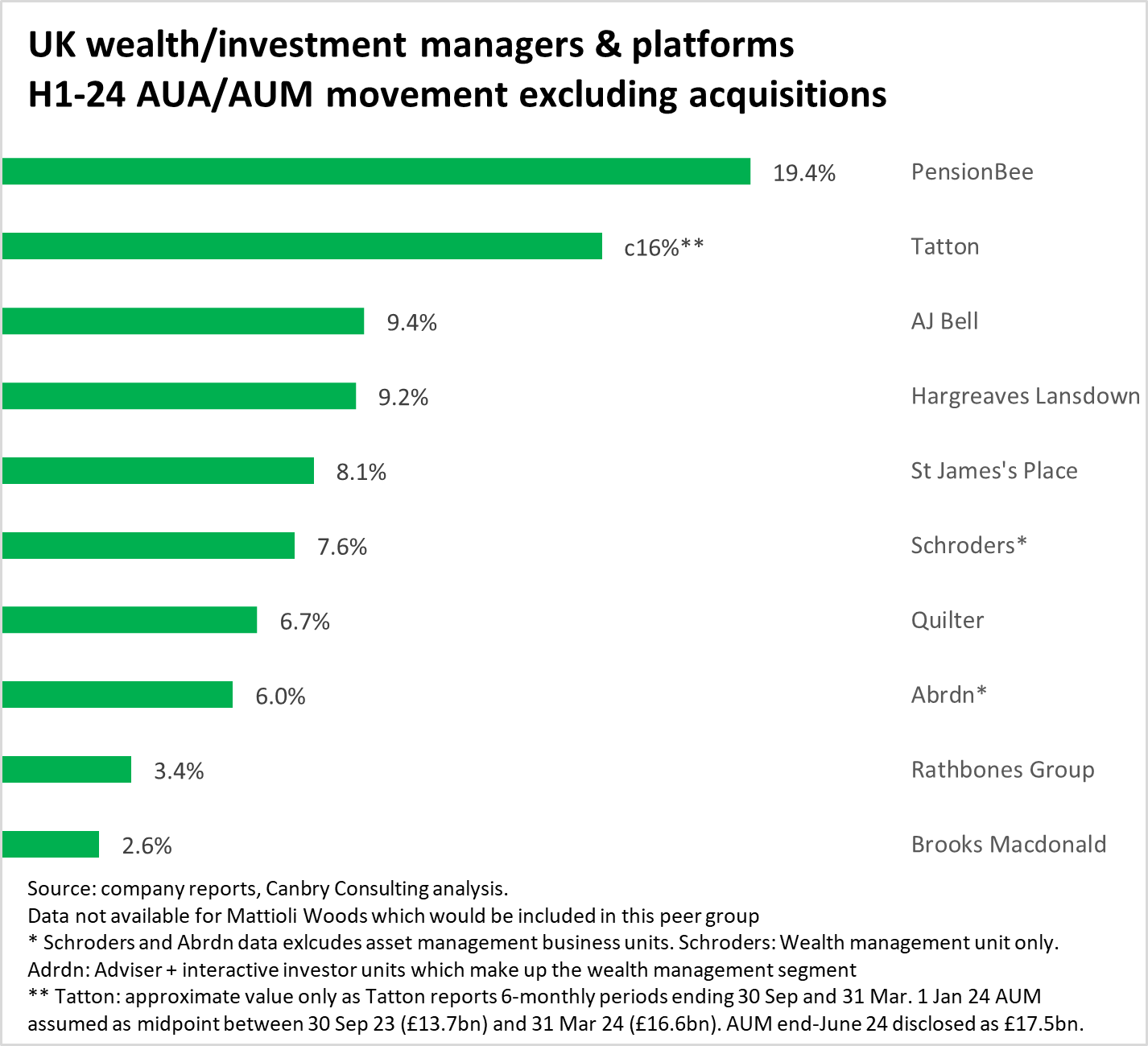

All companies in a UK wealth management peer group grew their AUM/AUA in the first half of 2024.

The large disparity in AUM/AUA movement was mostly driven by huge differences in net flow performance. Notably, PensionBee and Tatton continued their strong trajectories of attracting assets at a significantly higher rate than others.

Meanwhile, Rathbones and Brooks Macdonald were the only two recording negative net flows. For both groups though, Q2 net outflows were far smaller than Q1. The other weaker performers, Abrdn and St James’s Place, also recorded much stronger net flows in Q2 over Q1, so things might be looking up. I’ll be watching net flow trends carefully.

Rising markets resulted in investment performance having a positive impact on AUM/AUA growth in H1, but as is usually the case in wealth management, this had less of an impact on differences in AUM/AUA movements.

More bad news for London-listings

Mattioli Woods departs LSE

The 4th of September saw Mattioli Woods depart AIM with the finalisation of its acquisition by Tiger Bidco Limited (Pollen Street Capital). Pollen is a listed entity so we might get some insights into how MW progresses under its new owners from Pollen’s future reports.

The deal was worth approximately £432m, a premium of around 34% to the pre-deal MW share price. No point debating now if it was enough, the deal is done.

Hargreaves Lansdown - one foot out of the public-markets door

Bigger news on the de-listing front was from the UK’s largest D2C platform, Hargreaves Lansdown. A Private Equity consortium’s offer to acquire the business for around £5.4bn and take it private was made firm on 9th August, and HL’s board confirmed it intended to “unanimously recommend the cash offer to shareholders”.

Shareholder and regulatory approvals are still to come but it’s looking more and more like a rather meek exit from the London Stock Exchange for HL.

On 23rd Feb 24, when the share price was around 750p (the offer is 52% above that), I wrote a commentary on HL's interim results. Some extracts from that included...

"Hargreaves CEO: ‘we need to up our game!’”

”Interim results were 'meh'. But make no mistake, the (relatively new) CEO is implementing a big shakeup. The opportunity is there. This is all about execution."

"if Olly (CEO) can implement his plan successfully, there’s a chance HL could re-rate.”

"I reckon HL is a stock to keep an eye on. It currently carries a fairly low PE ratio compared to peers."

Based on FY24 results, the PE was c12x at the time I wrote that post, with the subsequent offer pricing the business at c18x.

So is 52% (1140p per share) enough of a re-rating for shareholders? We’ll know soon enough. A nagging question for me is: What makes the original offer of 985p per share one that substantially undervalues HL and its future prospects (HL Board, 22 May 24), while 1140p (16% higher) is an offer than can be unanimously recommended?

Big Strategic Moves

St James’s Place cuts fees and costs

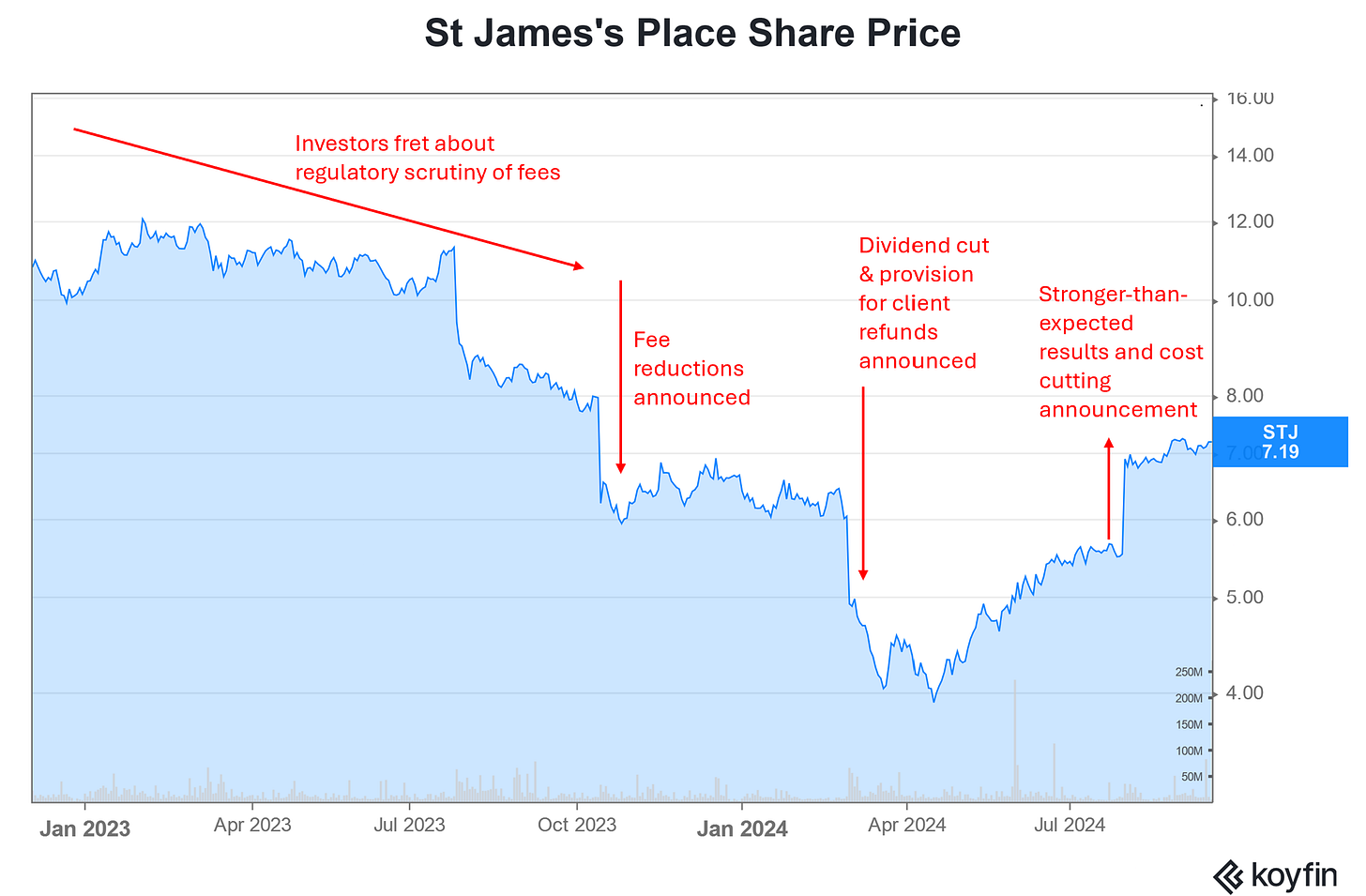

The shakeup continues at one of the largest wealth managers in the UK, St James’s Place. As a reminder, its fees were subject to heavy scrutiny from regulators during 2023 around their compliance with ‘consumer duty’. Shareholders were clearly fretting over this and the potential impact on future profitability. Between Jan and Sep 23, the share price fell more than 30%.

In Oct 23 SJP duly announced a fee cut, which triggered another fall in the share price, taking the fall between Jan and Oct 23 to around 50%. In Feb 24, the dividend was cut and a £426m provision made for potential client refunds. Further share price falls. In total, the share price fell around 75% between early 2023 and an Apr 24 low.

The share price started a recovery off the April lows and jumped 25% in one day on 30 July 24, when stronger-than-expected interim results and an aggressive cost cutting strategy were announced, with the aim of reducing the cost base by £100m per year by 2027.

At the time of writing, SJP’s share price was up around 75% off April 24 lows (but still down around 40% from early-23 levels). The execution of its turnaround strategy is going to be crucial and will be closely watched by investors. There’s no doubt SJP will be a major source of news in the wealth management sector for some time. Stay tuned!

Brooks Macdonald - changing of the guard, change in strategy

Meanwhile, Brooks Macdonald’s previous CFO and current CEO-designate, Andrea Montague (to formally take over as CEO on 1 Oct 24) has been ringing the changes.

In the results presentation of 12 Sep 24 she announced the sale of international operations to Canaccord Genuity. The unit had been under ‘strategic review’ since Mar 24. If the deal goes ahead (it is still subject to regulatory approval), it will bring in £28m upfront and potentially as much as £51m over two years.

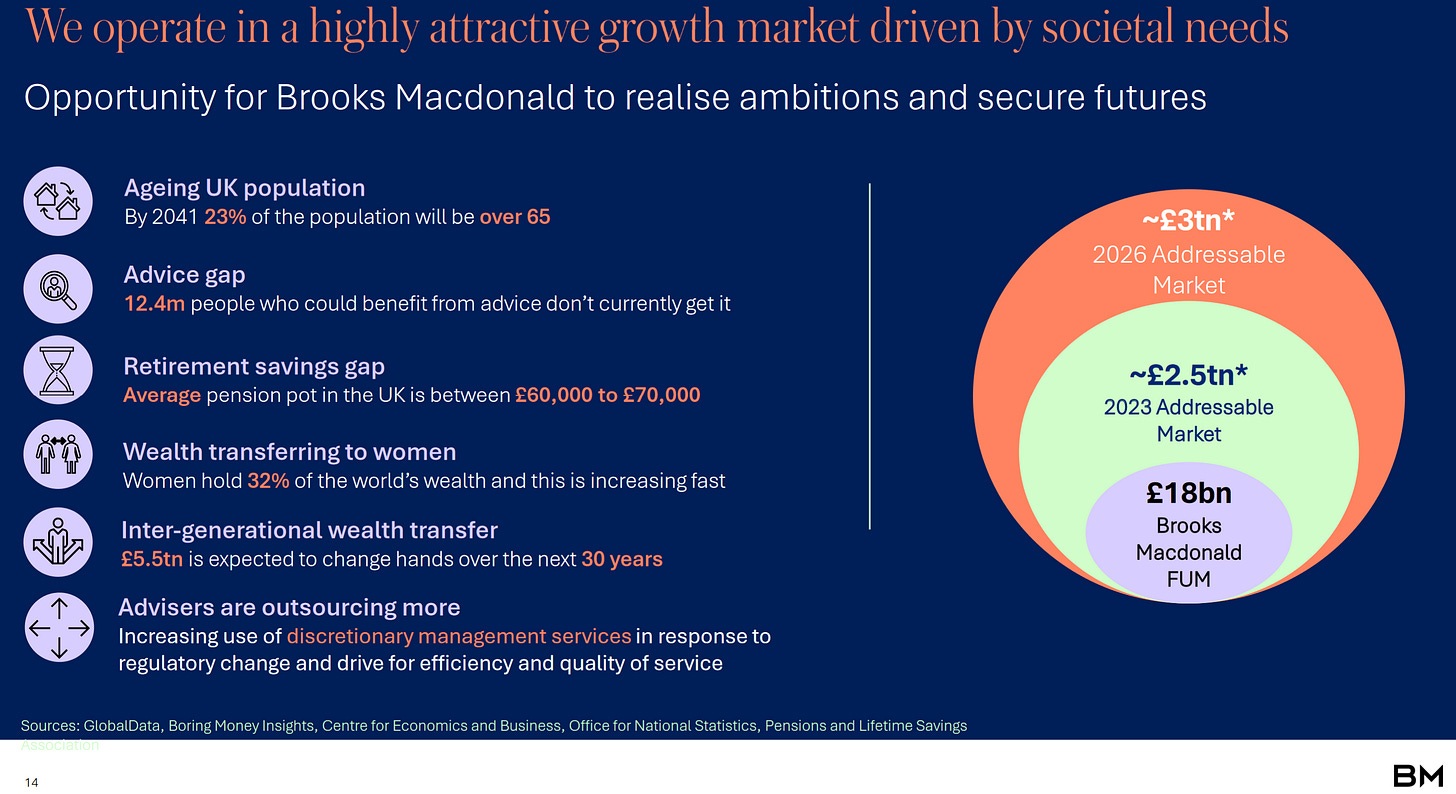

This will focus BM, making it entirely dedicated to the UK wealth management sector with no distractions from international operations (Channel Islands and Isle of Man). It spelled out some of the key attractions of focussing on the UK (source: Brooks Macdonald analyst presentation 12 Sep 24).

The sale will also leave the group in an extremely strong cash position with a big war chest (for its size) to pursue acquisitions (which is part of the strategy). BM had £75m of cash and a £46m surplus above regulatory capital requirements on 30 Jun 24. That’s before the sale of international operations. Indeed, on 17 Sep 24 it announced the acquisition of Lucas Fettes Financial Planning, further beefing up its direct business. I’d be surprised if the acquisition strategy doesn’t ramp up even more.

Montague also announced a re-jigged strategy for ongoing UK operations called Reigniting Growth which has three priorities, and encouragingly, each has KPI’s which have been spelled out:

Delivering excellent client service. KPI’s: Client retention rate; Top 3 DFM provider

Broadening and deepening client reach. KPI’s: No. of Advisers & Clients; % of Advisers with >1 product

Driving scale and efficiencies. KPI’s: Cost : Income management; FUM per employee

These are not dramatically new moves, but more about improving existing operations and ruthless execution. The recent Chair’s statement said:

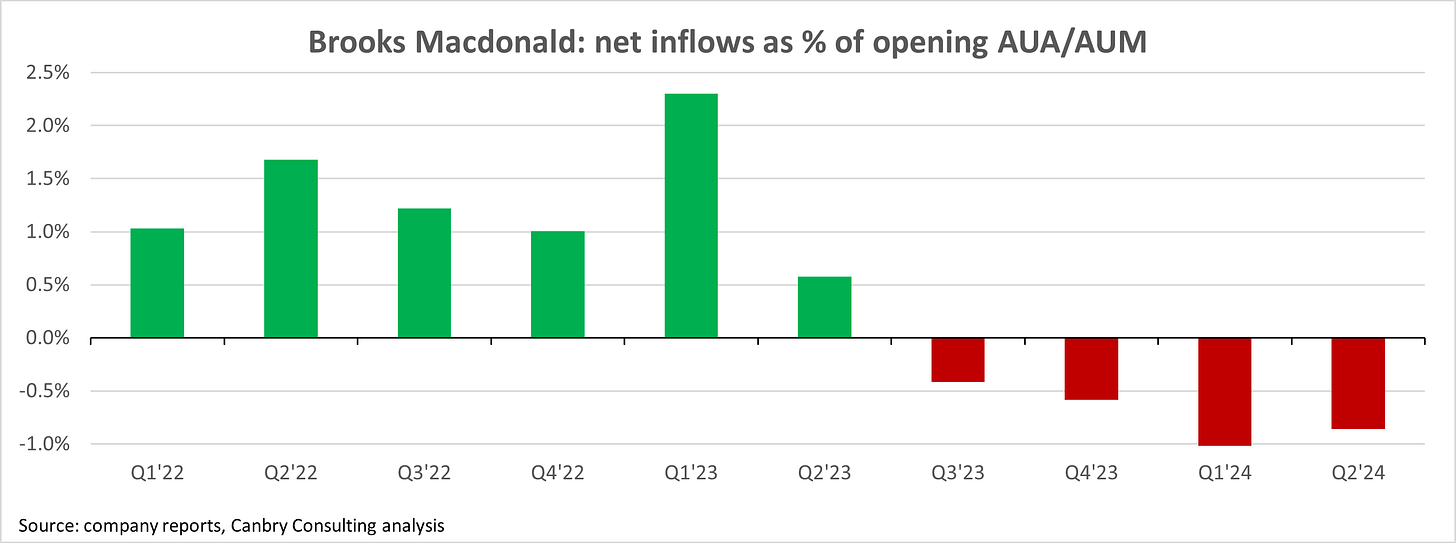

“We recognise that we need to improve our flows, to attract new clients and to retain existing clients, and are committing to a medium-term target of 5% net inflows per annum. However, we also recognise the importance of doing this efficiently and will limit underlying cost growth to less than 5% per annum.”

Flows will be key and a turnaround in the trend is essential:

PensionBee launches in the USA

August saw interim results from PensionBee and a bit more detail on its launch into the USA.

Its UK business continues to purr along nicely with AUA reaching £5.2bn (up 20% over 6 months), invested customers reaching 252k (up 10%), and H1-24 revenue reaching £15.4m (up 41% y-o-y). Marketing efficiencies continue to be captured as the business scales with each £1 of marketing spend generating £82 of net flows in H1-24, 20% up on H1-23 (£69).

PensionBee is targeting adjusted EBITDA profitability for the whole of FY24 (-£8.4m in FY23) and it’s worth pointing out that while I’m not a big fan of ‘adjusted’ metrics, adjusted EBITDA for PensionBee is not a bad proxy for ‘cash profits/losses’, as share-based payments (while absolutely still an expense to shareholders) make up the bulk of the difference between adjusted EBITDA and operating profit. PensionBee does not have amortisation of capitalised technology development in its accounts (as is common in technology companies).

Cash burn has reduced dramatically with cash and equivalents of £10.9m on 30 Jun 24, down £1.3m over H1-24. That compares to a reduction of £9.1m over FY23 from £21.3m to £12.2m.

But the really ‘big swing for the fences’ for PensionBee is surely its foray into the US. It has partnered with State Street Global Advisors. It has a long-standing relationship with State Street which provides investment management services for some of PensionBee’s investment portfolios in the UK and owns c4% of PensionBee’s shares (as at 31 Dec 23).

The US is the world’s largest defined contribution pension market, with PensionBee summarising the venture as follows:

PensionBee will deploy its award-winning online retirement proposition and proprietary technology, enabling US consumers to easily consolidate and roll over their 401(k) plans and Individual Retirement Accounts ('IRAs') into one new PensionBee IRA.

PensionBee has selected a range of investment portfolios to be offered to customers that use SSGA's model portfolios, exclusively consisting of SSGA managed Exchange Traded Funds ('ETFs').

SSGA will provide meaningful marketing support to PensionBee as the Company uses its data-led, multi-channel customer acquisition approach to attract new customers.

This is definitely one to watch. If PensionBee gets this right, it could be a massive game-changer for the business. And as its profile builds in the US, this move might even attract interest from US investors in PensionBee shares?

If you’re interested in this one, it might be worth attending the upcoming Capital Markets Day on 1 Oct 24.

New CEOs at Schroders and abrdn

The summer also saw changes in the C-suite.

In early-September, Schroders announced that CFO Richard Oldfield will take over the CEO position from Peter Harrison in November, following: “an orderly and comprehensive succession process, which began in April and involved a global search, including internal and external candidates”, according to the announcement. The FT has a detailed write-up here.

Bear in mind that Schroders is predominantly an asset management business (over 80% of AUM/AUA), but its wealth management arm is still significant (around £135bn AUA, making it one of the larger wealth managers in the UK). And as the FT says: “Led by its ultra-high-net-worth brand Cazenove, the wealth business is performing strongly, with £3.7bn of net new business in the first half, and benefits from long-term structural tailwinds.”

A remarkably similar story has unfolded at abrdn. This is also mostly an asset management business (c70% of AUM/AUA) but a very large wealth management business nonetheless (c£148bn of AUA in its Adviser and Interactive Investor units). Abrdn says it has undergone a “strategic repositioning of the company to a specialist asset manager, and a digitally-focused wealth manager”.

Jason Windsor was formally appointed CEO on 10 Sep. He was previously CFO and has been interim CEO since May 24, when Stephen Bird left. “A formal succession process was initiated at that time, supported by an external search firm, which resulted in the Board considering a number of candidates for the role, both internal and external, in line with the Group's long term succession planning.” The Chairman wrote: “I am delighted that Jason emerged from what was a very thorough process as the unanimous choice of the Board to lead abrdn in its next phase.”

I’ll be looking out for any major changes under these new CEOs.

Positives in Rathbones and Quilter interim results

Rathbones, in its half-year results to 30 Jun 24, a period where it continued to digest the large Investec Wealth & Investment acquisition (which makes up around 40% of AUA/AUM), reported good progress on achieving acquisition synergies.

We have achieved synergy realisation ahead of target, with run-rate synergies of £20 million delivered to the end of June 2024, well ahead of our year one post-combination objective of £15 million. These synergies have delivered a benefit to underlying operating profit for the six-month period of £8 million and we remain confident in the guidance set out at the time of the combination.

But perhaps even more important are some encouraging signs for net flows. Net outflows reduced from £0.6 bn in Q1-24 to flat in Q2. And net flows in the Investec business improved significantly. It had been leaking assets since its acquisition but had positive net flows of £0.2bn in Q2 compared to negative flows of £0.6bn in Q1.

Meanwhile, Quilter’s net flows and profits showed a robust improvement in its half-year results to 30 Jun 24.

Core net inflows totalled £1.7 billion, an increase of 164% (H1 2023: £0.7 billion). This reflected continued good performance from the Quilter channel in both High Net Worth and Affluent segments and significantly improved IFA channel flows onto the Quilter Platform.

Adjusted profit before tax increased by 28% to £97 million (H1 2023: £76 million), delivering an operating margin of 29%, an increase of five percentage points (H1 2023: 24%).

I’ll be writing about the wealth management sector again in October when Q3 trading updates are in.

Be sure to subscribe to TheInvestors.blog below to keep up to date.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication and covered Tatton Asset Management as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Tatton here. And please read this link for the terms and conditions of reading Equity Development’s research.