Hargreaves CEO "we need to up our game!"

Interim results were 'meh'. But make no mistake, the (relatively new) CEO is implementing a big shakeup. The opportunity is there. This is all about execution.

This is not investment advice. Please read TheInvestors.blog disclaimer here.

Hargreaves Lansdown’s interim results for the six months to 31 Dec 23 (H1-24) were badly received by investors. The share price fell over 7% on the day of the release.

But I reckon too much of a focus on some disappointing metrics in the short term might be a mistake. The real meat of the release and the analyst presentation was in CEO Dan Olley’s changes to HL, and his plans for future. There was a refreshing honesty about HL’s weaknesses, a clear message that big changes are underway, and signs that the ‘old way of doing things’ is under some pressure.

I’ll tackle the results first, then dive into the updated strategy and execution.

Slow-ish growth, but not THAT bad

Net new business AUA for the six months was +£1.0bn. Markets were a tailwind which added £7.2bn, bringing total AUA to £142.2bn (up 6% over six months).

The new business number was probably the biggest disappointment for investors, which was down 38% year-on-year and Q2 (+£0.4bn) was down on Q1 (+£0.6bn).

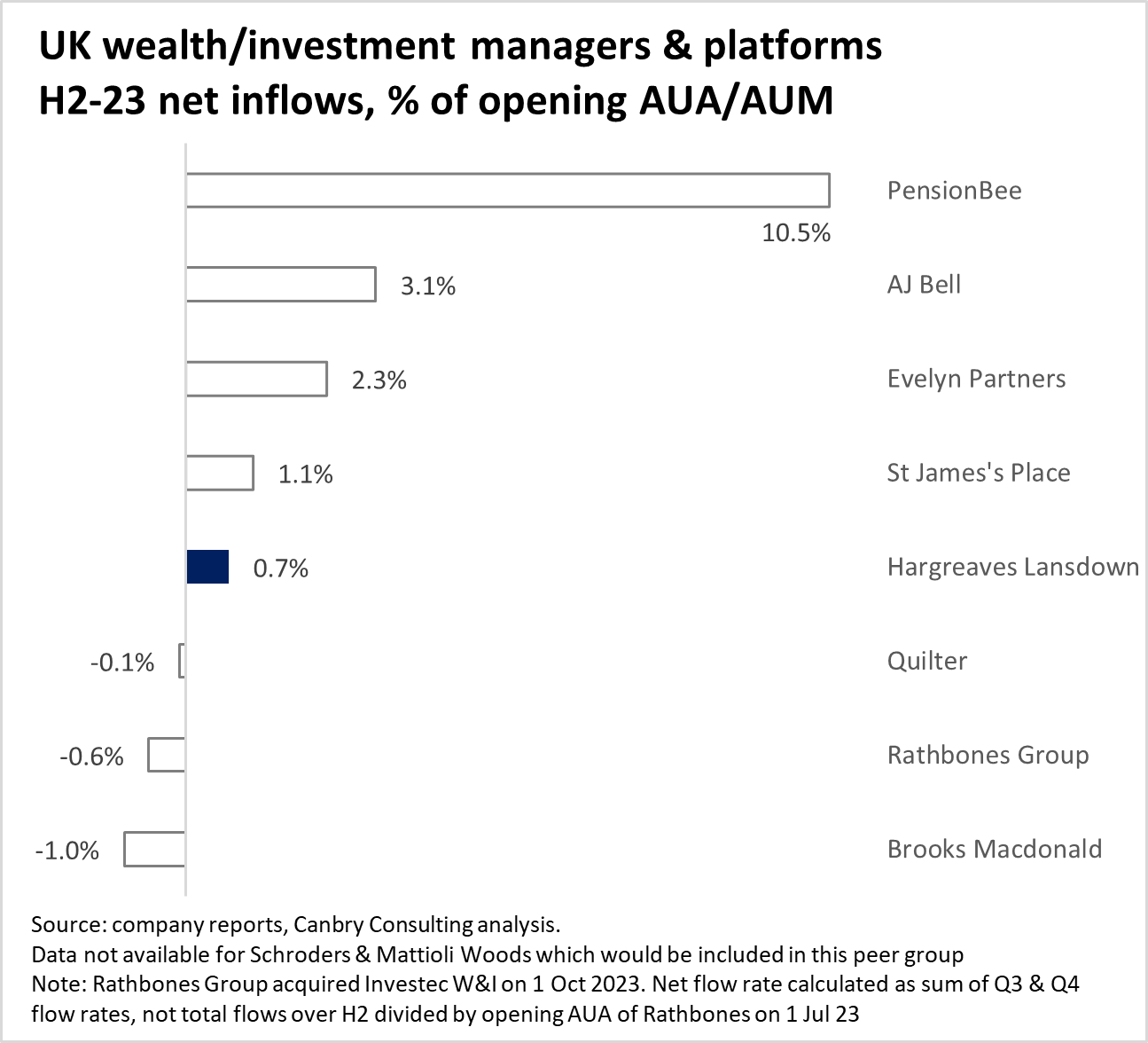

But in fairness, it was a period of tough trading conditions with a grim macro-economic environment, and nervous investors. For a large incumbent, the growth rates weren’t that bad compared to peers. (Note: H2-23 used in the charts below refers to calendar H2-23, and equates to FY H1-24 for HL).

Additionally, net new clients were substantially higher in Q2 (11.9k) versus Q1 (8.2k), although still well below the quarterly average of FY23 (16.8k). Over the half-year period HL attracted more net new customers (20k) than competitor AJ Bell (18k), although AJ Bell’s customer growth rate is far higher as it has a smaller customer base (484k vs the 1.8m of HL).

There is some nuance to HL’s net new business flows though. In its presentation to analysts, CEO Dan Olley said:

“We do not have an inflow problem but we do have an outflow problem.”

It reported that gross inflows were up year-on-year, with outflows up by even more.

HL has put this down to the market backdrop and product mix, saying that clients have been impacted by the cost-of-living squeeze.

“Outflows were highest in the products that our clients use for more transient saving and investing, such as our Fund and Share Account, driven by cash withdrawals to deal with cost-of-living issues and/or to pay down debts. The period also saw an increase in transfers to banks and building societies to take advantage of Cash ISA products.”

More on HL’s response to this later.

Mixed back of financial metrics

Turning to financial results, there weren’t really any metrics that jump out, other than an impairment charge and its impact on statutory profits, and the ongoing ‘strategic investment spend’, which are discussed below,

HL recorded revenue growth of 5% to £368m, driven by higher average AUA and a higher net interest margin on cash in clients’ accounts. Underlying costs were up 10% (in line with guidance), and underlying PBT was up 5% to £222m.

Statutory PBT however was 8% lower year on year at £183m, with this metric including £22m of ‘strategic investment cost’ (in line with guidance), £14m of intangible impairments and £3m of restructuring cost.

HL is in a net cash position of +£536m, up 7% over the 6 month period.

But there’s more to the ‘strategic investment cost’ and ‘intangible impairments’ than the pure numbers. These are both closely related to the shakeup CEO Dan Olley is effecting on HL. He is six months into the job, has conducted a detailed review of the business, and is making some big changes.

Shakeup underway

Olley is certainly bullish about the longer-term prospects of HL, and what I wrote in a previous post still holds. He emphasises that the market opportunity in the UK is huge, with an addressable and growing market of over £3 trillion (which suggests HL has captured just 4-5% of this). He uses his experience of previously living in the US to make the point: “in the US, everyone I know invests, they’re engaged with it … what has amazed me since I first joined HL is how many people I know in the UK are the complete opposite, putting money into investments can be bottom of the list.”

He talks about HL having strong foundations: it has a good product range, is trusted by clients, often the first choice main provider among investors, and the business already has scale.

But Olley was also open about areas of weakness. He highlighted issues of concern being a deceleration in net new business growth (the business is still growing, with gross inflows strong but client retention levels decreasing), and decreasing operating leverage, with cost growth exceeding revenue growth.

So what’s he going to do about it? Olly has set four priorities:

Delight clients, drive growth – continue to evolve our value proposition to delight our clients and through that, drive our growth;

Save to invest – always strive to be a fitter and leaner business;

Increase execution pace – deliver for our clients everyday, improving our proposition on an ongoing basis;

Right people, right roles – make HL great for colleagues; the right culture, with the right people in the right roles, focused on the right priorities to deliver the strategy.

These are a bit jargon-ny and what nearly every CEO might say. But when you dig into what each priority really means, there appears to be some concrete plans being implemented. I’ve gone into some detail below.

Delight clients, drive growth

My take on this is that HL wants to stop the bleeding of outflows (potentially a relatively quick-win), while working to ratchet up the level of new investments among clients and UK consumers more generally (probably an opportunity that might ramp up more slowly).

Some context relevant to this is that HL’s Savings accounts have a very high withdrawal rate (especially to Banks and Building Societies), and that ISA outflows have been driven by clients moving to Cash ISAs, which means there is work to do on HL’s cash offerings.

Also, SIPPs have a much lower churn rate than other products, HL has grown its SIPP business more slowly than some competitors, so growing the pensions business is now a big focus.

It’s working on a few levers to address these issues:

Expanding/enhancing products. New products include a multi-bank cash ISA (fixed-term, easy-access and limited access) and ready-made pension plans (which are HL-managed portfolios gradually de-risked as retirement approaches).

Increasing/improving content to drive flows. This is well underway. The programme to offer and make people aware of the opportunity in gilts (in a high interest rate environment) has attracted £1.8bn of AUA. The new ‘Five to watch’ campaign attracted £100m in the first month. And HL has introduced a six-week free course on how to invest with confidence.

Making the process of investing easier. The Easy bank transfer functionality has facilitated £1bn of investments since launch. The improved regular savings functionality in the HL app, launched in Jan 24, has resulted in nearly £500k (per month) of new savings.

Improving service levels. HL has beefed up its helpdesk staff numbers and reduced the answering times of calls.

Improving the digital experience. It has re-designed site navigation and web-journeys with a 21% uplift in the conversion rate of transfers-in, and the new search page in the mobile app has resulted in a 51% increase in purchases of HL’s ready-made-investments.

If these actions continue to be successful, they should translate to higher net new customers added, higher AUA growth, and higher retention rates. Those will be the acid tests of success.

Save to invest

In blunt terms, this is about cutting costs and fat.

HL claims to be taking the knife to third party spend, such as IT licenses, recruitment agencies and contractor spend.

It’s automating processes that currently require a significant amount of manual work.

And Olly talks about ‘sharpening accountabilities’. Maybe I’m over-interpreting, but that sounds like implementing a more ruthless approach to individual performance management.

The ‘invest’ part of this priority is then about using savings to reinvest in the platform.

Increase execution pace

The way projects are being assessed and implemented is also changing.

Olly has binned two projects - software that was developed to support a client financial health check tool, and the development of a tool to improve efficiency for Financial Advisors. HL had capitalised £14m of spend on these projects, creating an intangible asset. That gets written off with a corresponding impairment charge (contributing to the drop in statutory PBT mentioned earlier).

And he has re-jigged how project teams are set up and managed. For example, ring-fenced project teams have been set up to implement projects without the distraction of the day-to-day running of the business. Again, performance management looks like a focus in this area with a new Objectives and key results approach, to ‘drive alignment and performance’.

HL is already claiming some big wins from these changes, such the rollout Amazon Connect being accelerated and delivered in half the time originally estimated, decommissioning the legacy telephony system ahead of plan to save on dual running costs, and implementing Salesforce within the Complaints and Client Service team within four months (a key advantage being that this is in place over the busy tax year-end period).

The acid tests of success for the Save to invest and Increase execution pace priorities will be higher operating margins, and increased operating leverage.

Right people, right roles

The last priority is about getting the right people in place. And Olly has not been shy in making sweeping changes to the executive team, including:

Richard Hebdon as Chief Digital and Technology Officer – joined HL from RELX, the global information services provider, where he was Chief Technology Officer for a division of LexisNexis.

Afonso Nascimento as Chief Strategy Officer – who has been with HL as interim CSO for the last three months driving the strategic agenda and digital transformation (he has strategy and financial services experience from Boston Consulting Group).

Lucy Thomas as Corporate Affairs Director (from March 2024) – currently Director of Corporate and Regulatory Affairs at TalkTalk, and prior to this in senior roles at Edelman and at the BBC where she was a producer on programmes such as Newsnight and the World at One.

There is also a strengthened technology leadership team and new appointments in the client-facing solution development teams and the digital automation and transformation teams.

Most of those appointments feel to me like they are there to implement a big change programme.

***

I reckon HL is a stock to keep an eye on. It currently carries a fairly low PE ratio compared to peers.

And while there may be some short-term pain as some of these changes are implemented (they are not all low-risk), if Olly can implement his plan successfully, there’s a chance HL could re-rate. Encouragingly, he’s prepared to measure his success on some some hard metrics, not soft and woolly achievements:

Looking further forward, we will measure our success in the delivery of our strategy through seeing a step up in AUA growth, increasing our client satisfaction and retention, driving operating leverage through a different cost trajectory for the business and enabling sustainable operating margins over the medium term.

As he said in the analyst call: “We need to up our game”.

Subscribe to TheInvestors.blog below to keep up to date with the UK wealth management sector.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Please read TheInvestors.blog disclaimer here.

Disclosure: At the time of writing, Paul Bryant was a shareholder of Hargreaves Lansdown.