A wild Q4 = a fascinating 2025

Headwinds, tailwinds, crosswinds part 2: an update on UK-listed asset managers

TheInvestors.blog is not investment advice. Please read the disclaimer here.

In December 2024 I took a detailed look at UK-listed asset managers’ fortunes in the first three quarters of 2024 (link below).

With a decent sample of Q4 data now in, it’s certainly worth an update.

A wild Q4-24

Let’s look at net flows first. But before diving into company-level data, some fascinating context is provided by Calastone’s Dec 24 and Jan 25 fund flow index updates (flows from UK-based investors into funds domiciled in the UK).

Check out the wild swings in equity fund flows around the UK budget (the last two bars are Oct 24 and Nov 24).

Source: Calastone Fund Flow Index Dec 24

Calastone commented:

UK investors flocked back into equity funds in record size in November, according to the latest Fund Flow Index from Calastone, the largest global funds network. After October’s record outflows, prompted by fears, subsequently justified, that the Chancellor would hike capital gains tax, November in turn saw equity-fund inflows at all-time highs, breaching the £3bn mark for the first time. The two months mirrored each other closely. October’s net selling was £2.71bn as investors took profits, while November’s net buying was £3.06bn as investors reinvested all the funds they had withdrawn the month before.

Calastone’s Jan 25 update showed Dec 24 was another strong month, with investors adding a net £2.91bn into equity funds (add another bar on the end of the above chart for Dec just below the level of that large Nov bar).

Passive flows dominate (by a lot!)

However, looking at total equity fund flows misses a key trend for asset managers - the growth of passive. Just look at the jump in passive flows in 2024 (the chart below is annual data, versus monthly data of active + passive combined in the chart above).

Source: Calastone Fund Flow Index Jan 25

Calastone commented:

2024 was a big year for passive equity funds. Investors committed £29.65bn to the index-trackers, more than in the previous four years combined, and withdrew £2.43bn from their actively managed counterparts. The difference in investor appetite for the two strategies was easily the largest on Calastone’s record.

Can the strength of momentum into passive persist? I suspect it will remain strong, but I wouldn’t be surprised to see a bit more strength in the active space. As I wrote in part 1 of this post in Dec 24:

… in quite a few recent trading updates, I’ve picked up a more optimistic tone from management teams on this point, which seems to reflect more confidence in the future of active management. One of the arguments is that clients might increase active allocations due to concentration risks now associated with index investing. This is as a result of the increased share of many indexes of the ‘Mag-7’, driven in no small measure by passive investing.

Widespread outflows for active managers, but not in private markets

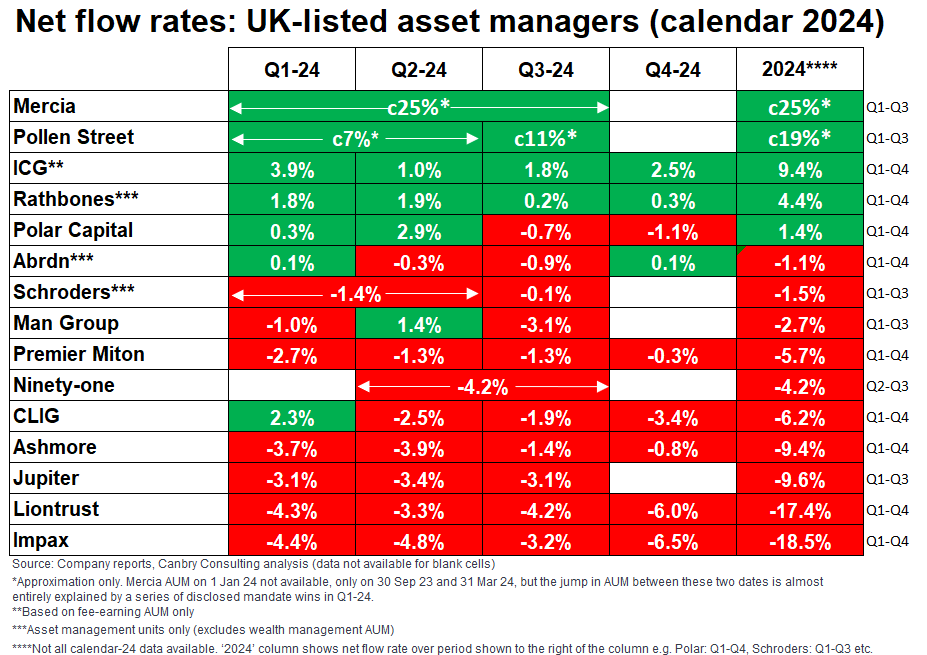

That move to passive was obviously bad news for most UK-listed AMs, which are predominantly in the active space. Company net flow rates are shown in the table below by quarter and for the full 2024 year (where available). It’s mostly a sea of red.

But although it was a year clearly characterised by outflows, there were some significant exceptions:

Most notably, the table is topped by three AMs in the private markets space, Mercia, Pollen Street, and ICG, which all attracted significant assets in relation to their size during the year.

Also, Rathbones’ asset management unit (around 14% of total group AUM, the balance is in the wealth management space) bucked the negative net flow trend, as did Polar Capital, although it did see small outflows in Q3 and Q4 of 2024.

Those experiencing the heaviest outflows were:

Impax, the sustainable investing specialist, which was hit by more investors shunning that style of investing, and some of its major distribution partners (BNP Paribas and St James’s Place) de-risking portfolios away from Impax’s (mostly) small and mid-cap equities bias.

Liontrust, which was hurt by investors moving out of its UK smaller-cap equities bias, and also by the downturn in sustainable investing.

Jupiter, with outflows exaggerated by clients ‘following’ high-profile individual managers leaving the business.

Ashmore, hurt by investors shunning its specialist emerging market debt space, but notably, outflows slowed significantly in Q3 and Q4.

Investment returns provide relief

But investment returns were a totally different story, with nearly all AMs recording positive returns, and Polar Capital the standout leader, with returns of over 20%, double that of the next highest return.

Polar’s superior investment return was certainly helped by its large exposure to technology stocks, with tech strategies making up 42% of AUM. But its performance is still impressive. Its technology strategies returned 33% (gross of fees) over 2024 with the Nasdaq composite returning 29% and the S&P 500 25%.

At the other end of the spectrum was private markets specialist ICG, but it looks like the negative returns on its fee-earning AUM were driven mostly by currency moves. It holds around 55% of its fee-earning AUM in EUR, 34% in US$, and 10% in GBP, but reports AUM in US$. So the 6.7% decline in the EUR versus the US$ over 2024, and the 2.5% decline in Sterling versus the US$ would have negatively impacted US$-based AUM levels.

The impact of currency moves also needs to be flagged for other comparisons between AMs, particularly in Q3 and Q4. In the above table, CLIG, Man Group, Ashmore, and ICG report AUM in US$, with the rest reporting in GBP. In Q1 and Q2, currency impacts were small. But in Q3, Sterling was up 3.7% against the dollar, making the returns of GBP-reporting managers weaker versus those reporting in US$ (on those assets held in US$). While in Q4, Sterling was down 5.3% versus the dollar, making the returns of GBP-reporting managers stronger versus those reporting in US$ - note the much weaker returns of CLIG, Ashmore and ICG in Q4.

Looking to 2025…

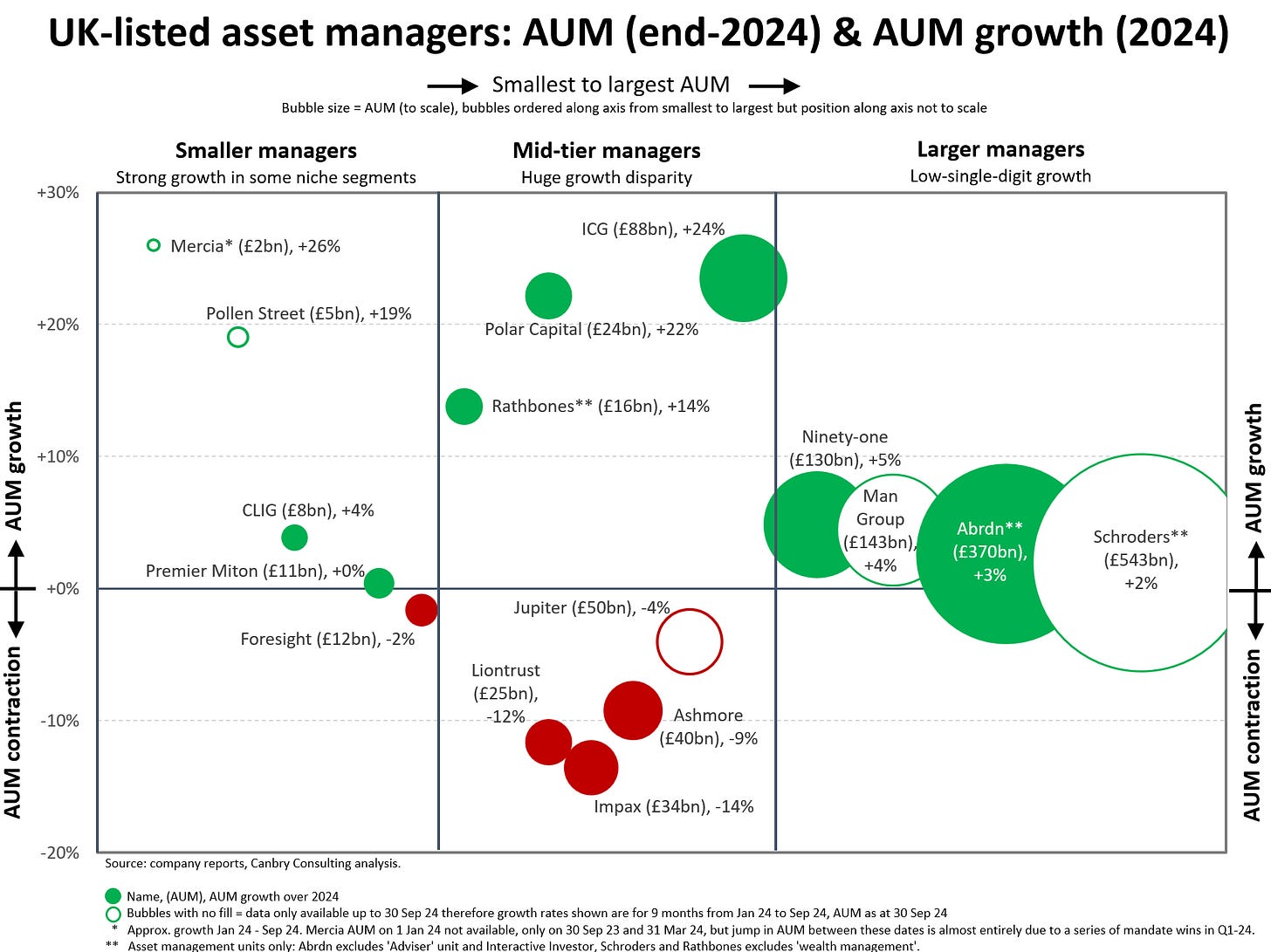

If we zoom out and summarize total AUM movements over 2024, and also consider movements in relation to size, an interesting picture emerges.

On the right of the chart, all of the larger AMs recorded low-single-digit AUM growth in 2024, with no clear differentiation from an AUM growth perspective. Could any of these managers pull away in 2025?

Schroders and Abrdn have fairly diverse investment ranges, so it’s hard to see a big growth gap opening up between these two, but Abrdn does have a fairly large EM and APAC AUM base, so is more exposed to flow and return trends in those asset classes.

Man Group is unique in this group with substantial AUM in alternatives such as absolute return, total return and quantitative strategies, so it could certainly experience a different AUM growth trajectory.

And Ninety-One has around 60% of its AUM in EM investment strategies, so will follow the fortunes of those asset classes to a greater degree.

In the middle of the chart, the mid-tier managers showed a huge disparity in growth rates over 2024.

When it comes to winners, Polar Capital benefited from its tech exposure and even though it is diversifying, its growth fortunes will still be impacted by the fortunes of the tech sector. And ICG is certainly well positioned in the popular private markets space, where momentum in terms of attracting assets still looks very strong.

Those AMs which saw AUM contractions in 2024 will be attracting sharp investor scrutiny in 2025, most notably:

Will Impax return to net inflows following its loss of business from BNP Paribas and St James’s Place? It will be a tough start to 2025 but a key trend which could help it turn the corner is a re-balancing of investor interest away from the mag-7 and into mid and smaller cap equities. If this tailwind emerges, it could also be exaggerated by a ‘reversion to the mean’ of mid and small cap valuations, which have been very depressed in relation to mega cap tech stocks.

Will Liontrust stem the bleeding from its large UK retail investor base? There’s a lot of credibility to be re-gained on that front.

Will emerging market fixed income return to favour and help Ashmore return to growth? Or is further suffering on the way during a Trump presidency?

Will Jupiter start showing some growth once the outflows associated with the loss of star fund managers are flushed out of the system?

Then on the left of the chart, we have the smaller managers which have also shown a growth disparity:

Pollen Street and Mercia have taken advantage of their respective niches in the private markets space, and have grown quickly. Can this continue? And why has the other private markets specialist, Foresight, not been able to achieve strong growth too?

Premier Miton, with its fairly diverse range of specialist funds, is starting to look like it has weathered the worst of the outflows storm and could be close to a return to growth. In its January 2025 trading update, it stated: ”it was pleasing to note that flows turned slightly positive in both November and December. This was largely driven by positive flow into our US equity, Diversified multi-asset, fixed income and absolute return strategies alongside continued outflows from our UK equity strategies. The net result for the quarter was an outflow of £33 million which is a noticeable improvement on recent quarters.”

And CLIG doesn’t give us much of an insight into its outlook in its recent trading update covering the Jul-Dec 24 period: “Strong market returns over the six months led to client rebalancing, asset allocation changes, and included a large client drawing down cash management capital for acquisitions. Net investment outflows were $564 million for the Group over the period, led by EM, International Equity and KIM strategies, while OV and alternatives had net inflows of $63 million.”

Subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication, and covered Impax Asset Management, Polar Capital, and Mercia Asset Management, as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on these companies by clicking on each. And please read this link for the terms and conditions of reading Equity Development’s research.