Headwinds, tailwinds, crosswinds: 2024 in review

2024 was a mixed bag of ups and downs for UK-listed asset managers. Could it be the tail-end of a bleak period which has seen the median share price fall 40% over 3 years?

TheInvestors.blog is not investment advice. Please read the disclaimer here.

This post covers 15 UK-listed asset managers with a mix of investment specialities including public and private equity, public and private debt, emerging markets, quant strategies, infrastructure, closed-ended funds, sector plays, and more.

There were many forces at work and a diversity in the quality of execution by these managers during the year. But there’s a common context affecting all of them. And that’s the seeming unrelenting march of passive investing. This has had a huge negative impact on the ability of many of these managers to attract and retain assets under management (AUM) in recent years.

However, in quite a few recent trading updates, I’ve picked up a more optimistic tone from management teams on this point, which seems to reflect more confidence in the future of active management. One of the arguments is that clients might increase active allocations due to concentration risks now associated with index investing. This is as a result of the increased share of many indexes of the ‘Mag-7’, driven in no small measure by passive investing.

There’s not that much evidence I have found of this in any numbers yet. But its certainly a point worth bearing in mind as you read the rest of this post, and think about the fortunes of these companies in the years ahead.

AUM growth

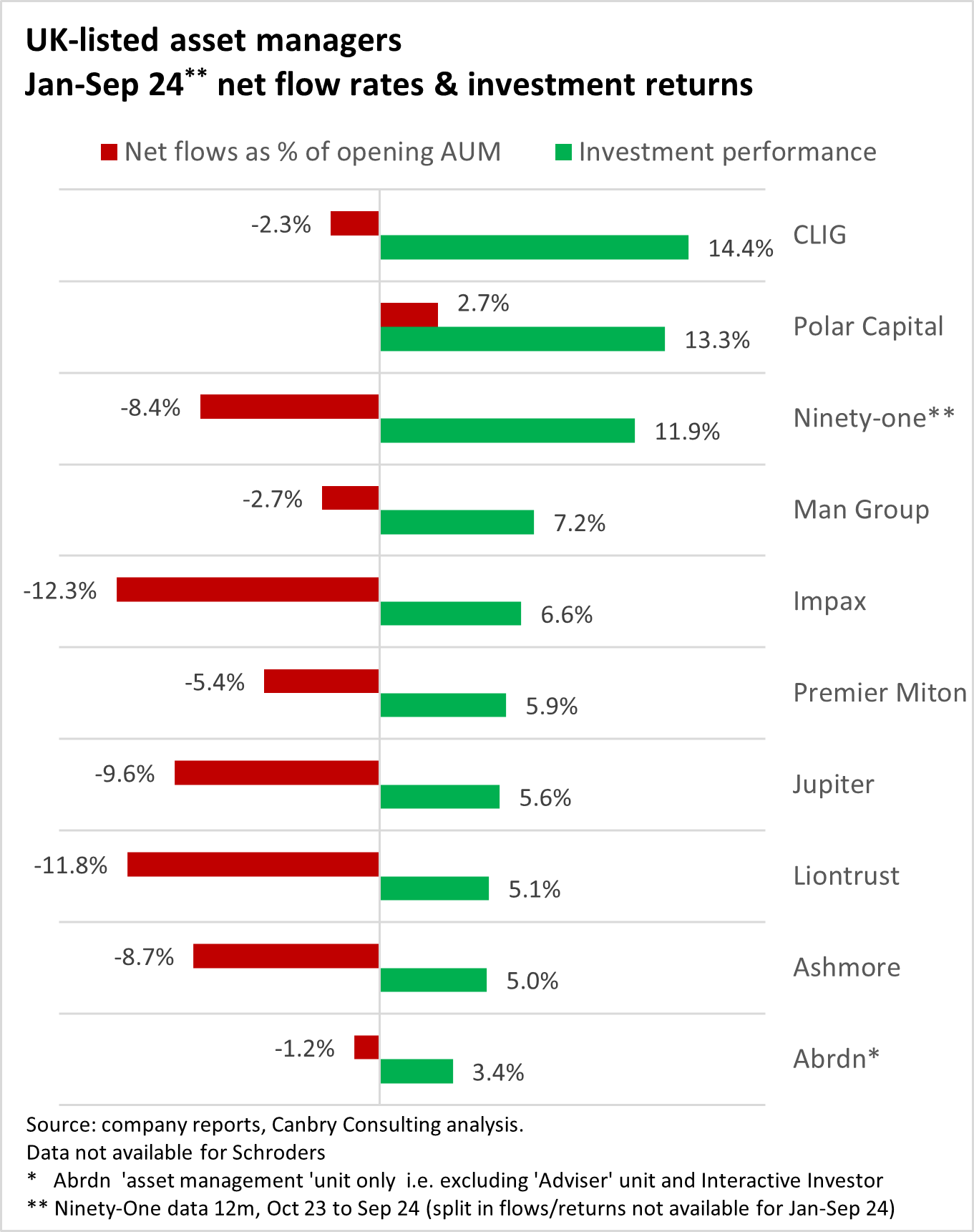

There was a huge disparity in the AUM movements of London-listed asset managers in the Jan-Sep 24 period.

[Note: The AUM growth rates below of CLIG, ICG, Ashmore, and Man Group are boosted relative to other managers by a currency effect. These four report AUM in US$, with the rest of the group reporting AUM in GBP. With the GBP strengthening by 6% versus the US$ (GBP/US$ moved from 1.27 to 1.34) between Jan 24 and Sep 24, the AUM growth of managers reporting in GBP suffered a currency headwind on those assets held in US$.

One of the obvious features of the chart above is the strong AUM growth of some managers in the private-assets space (marked on the chart) with Mercia, Pollen Street, and ICG all reporting significant fund raises during the period.

The strong growth of managers running private assets (driven mostly by capital raisings) contrasts with managers running portfolios of mostly listed assets, where the dominant, but opposing, forces at work were heavy outflows, coupled with strong investment returns. Only Polar Capital recorded positive net flows during the period.

Shares mostly negative in 2024, sharply down over 3Y

Turning to share price moves, over 2024 (to 13 Dec 24), there was a median fall of -9%. But that median doesn’t tell the whole story. Share price moves were a real mixed bag. Private markets specialists did relatively well, alongside City of London Investment Group (CLIG) and Polar Capital, which both recorded strong AUM growth during the period. Most other share prices were deeply negative, with Impax Asset Management particularly hard-hit on 13 Dec 24, following an announcement that it had been given notice of termination of a large mandate.

But the above YTD share price moves should be seen in the context of a longer time period. It’s been a horrific 3 years for asset managers’ share prices, with a median fall of -40%, and not a single share price in positive territory.

Company-by-company review

We’re clearly looking at a sector which has been badly beaten up. So, let’s run through the key developments by company in 2024 and what I think investors should be looking out for in Q4 updates (in Jan 25) and for the rest of 2025. The order of commentary is from highest to lowest AUM growth in 2024:

Mercia: Won a series of new mandates in the early-stage equity and SME debt space to significantly boost AUM. It also announced a pivot to sell down its significant on-balance sheet equity portfolio (estimated to take around 3 years) to concentrate on fee-earning third party fund management. The share price implies a huge discount to NAV of this portfolio, so if it starts realising sales at or above NAV (as it has historically been able to do), there is potential for a big re-rating. For more detail, you can read my latest Equity Development research note here: A rarity in the sector: Revenue +19%, EBITDA +34%.

Pollen Street: A strong period of capital raising for this private equity and private credit specialist. It looks to be in a sweet spot where demand for its investment strategies is strong. I’ve argued a few times though that the share price appears deeply discounted, taking its balance sheet into account (which includes a substantial on-balance sheet investment portfolio of assets, mostly in the credit space). Good growth, dividend yield 8%, conducting a share buy-back, and not exactly a micro-cap at a market cap of c£450m, I doubt this will remain under the radar for too long.

Polar Capital: A very strong 2024 with positive net flows (hen’s teeth for active managers in the period) and big investment returns, particularly in Q1 which saw Polar’s largest strategies of technology (c38% of AUM), healthcare (c20%) and insurance (c11%) beat benchmarks and boost AUM. In my recent research note covering its interim results, I argue that prospects remain strong, despite current headwinds for active managers. It has a range of specialist investment strategies

(which it continues to expand e.g. a new International Small Company Strategy), and an enviable longer- and shorter-term investment track record, all of which should generate ongoing demand. With strong margins, balance sheet, and

dividend yield I argue it should trade at a higher PER than its current 12x.

CLIG (City of London Investment Group): This specialist in closed-ended funds recorded a very strong investment performance in 2024, which contributed over 14% to AUM growth. CLIG’s emerging markets portfolio in particular produced very strong returns. And while its net flows were slightly negative, they were among the strongest in the peer group. CLIG describes its secret sauce (in its Nov 24 shareholder presentation) as its ability to capture volatility and generate differentiated alpha from closed-ended-fund discounts (to NAV). Shareholders will be looking for delivery on that metric and if that translates to net flows returning, and a scale-up of AUM.

ICG: A consistent strong performer in recent years, with its interim results (to 30 Sep 24) claiming to have achieved an 18% growth in AUM over the last five years. 2024 was also strong with fundraising of $10bn in the six months to Sep 24, ICG's second highest ever six month fundraise. It’s 2024 annual report shows a 5Y fee income CAGR of 22% and a 5Y PBT CAGR of 21% in the fund management company (group PBT is more volatile because of movements in ICG’s on-balance sheet investment portfolio). It’s no wonder that this is the strongest performing share price over 2024 and over three years among this group. Shareholders will want more of the same.

Ashmore: This emerging markets fixed income specialist has produced solid-enough investment returns for investors but it just can’t seem to stem the tide of outflows - EM Debt seems to be stubbornly out-of-favour with investors. It’s Oct 24 trading statement struck an upbeat tone saying: “Net flows improved from previous quarters, driven by an increase in gross subscriptions from institutional investors across a range of investment themes and reduced redemptions. This pickup in activity is consistent with an increase in investor risk appetite following improvements in the broader macroeconomic environment and building on the positive returns delivered by Emerging Markets over the past two years.” But that was pre-US-election which has ramped up uncertainty in the EM space. We’ll have to wait and see.

Man Group: Highly differentiated manager with a quant focus across equity, credit, alternatives, and real estate, with significant long-only and absolute return strategies. One of the stronger-performing share prices over the last three years. Great fundamental progress until 30 Jun 24 with positive net flows and strong returns, but hit a speedbump in Q3 with a single client withdrawing c$7bn (4% of AUM), switching from Systematic Long Only strategies to a passive portfolio. Those types of withdrawals are going to happen to all asset managers from time to time. The bigger picture for Man is continuing progress under relatively-new CEO Robyn Grew, and how the focus on strategic priorities progresses (more focus on credit, wealth channel, and the US).

Ninety-one: Origins in South Africa, where it still has substantial operations and is listed on the Johannesburg Stock Exchange (in addition to its London-listing), with teams covering equities, fixed income, and multi-asset around the world. Sources 41% of AUM from clients in Africa, 31% in UK & Europe. AUM hard hit by outflows since 2022. Higher exposure to emerging market equities and debt than most other asset managers (60% of AUM in EM strategies). Recently announced a deal with one of the largest South African financial groups, Sanlam, which will see £17bn of AUM transferred from Sanlam to Ninety-One (a 13% boost) and Ninety One gaining preferred access to Sanlam’s substantial distribution network, which should help a return to growth. Investors will be watching deal execution and progress in returning to net inflows.

abrdn: Still leaking assets in its asset management arm (abrdn-owned investment platform Interactive Investor attracting assets making group flows look a lot better). Since Sep 24 under the leadership of Jason Windsor (previously CFO). He has continued the inherited transformation programme which included significant cost savings. Investors will be looking to see what changes under the new CEO, and what financial impact he can deliver.

Schroders: Like abrdn, Schroders has recently had a change of leadership with the previous CFO (Richard Oldfield) taking over the CEO role in Sep 24. The asset management arm hasn’t been a fantastic performer, hurt by the public markets business suffering outflows, along with its solutions business (hit by an £8bn withdrawal from a Scottish Widows mandate). Within asset management, private markets is attracting net new flows. Wealth Management (c17% of AUM) also attracting net new business. But all eyes are on what changes the new CEO will bring.

Premier Miton: AUM growth positive in 2024 (just), on strong investment performance but still-weak flows. Flows however have improved significantly. Fixed income funds have largely maintained positive flows over the last few years, multi-asset fund flows have been only slightly negative, with equity funds suffering from heavy outflows over 2022, 2023 and early-2024. Equity fund flows are much improved over the last two quarters, although still slightly negative. In its FY24 results (to 30 Sep 24), Premier Miton struck a positive tone, saying it had also seen inflows for its International Equity funds with UK equity funds very much out of favour. Premier Miton is sometimes perceived as being more UK-heavy than it actually is - UK equity funds make up only 18% of its AUM. A consistent return to positive flows and a recovery in profit margins could see a big re-rating of a battered share price.

Foresight: This investor in infrastructure assets (81% of AUM, primarily energy and transport) and private equity (13% of AUM) has had a quiet-ish 18 months with AUM only up around 2% in that period (following very rapid scaling up in the 4-5 years prior to that). Fantastic (and consistent) “core” EBITDA margins of c40%. Investors will be looking to see growth accelerate.

Jupiter: Another AM coming off the back of a really tough few years, made even worse by the departure of some key individual fund managers, which resulted in big outflows. But CEO Matthew Beesley, now just over two years into his tenure is certainly reshaping the business. He’s looking to build its institutional client base, has culled sub-scale and underperforming funds, and it looks like he’s eyeing up the active ETF space too. I’ll be looking for the net flow bleeding to stop in 2025 and for some positive progress on that front. Jupiter has a substantial balance sheet, which makes its fund management business look extremely lowly-rated (see my commentary on its valuation towards the end of this post). There’s also a detailed and interesting recent interview with Beesley by Citiwire here.

Impax: An annus horribilis for Impax. Most significantly, two key clients, BNP Paribas and St James’s Place pulled substantial funds (the largest chunk of the SJP withdrawal, £5.2bn or 14% of AUM was announced in Dec 24 so is not reflected in the first two charts of this post, but the above share price charts do include the immediate reaction to the announcement: a 23% one-day fall on 13 Dec 24). I’ve covered Impax as an analyst since 2019, so know it well. And I can’t help but believe the pessimism on Impax’s future is overdone. This is a quality outfit with a highly differentiated and specialist offering (in key growth sectors), operating around the world. Despite the fall in AUM, it still has substantial profit margins and a strong balance sheet. You can read my recent Equity Development research on Impax here, to read my analysis in more detail.

Liontrust: Another manager emerging(?) from an awful few years of huge outflows, a heavy tilt towards unloved UK equities, and also the reputational damage from its failed acquisition attempt of GAM. It’s share price has bounced a little recently, following an enormous 3-year fall, on the announcement of cost cutting measures, a target of maintaining the dividend (current yield nearly 15%!) a share buyback, and some encouraging directors’ share purchases (£450k by CEO & wife; £227k by CFO). It’s still profitable, has a decent balance sheet, but ultimately, Liontrust will need to get back to positive inflows and get profit margins increasing again to convince investors it’s truly back on track.

It feels like there’s an air of ‘the worst of the storm is over’ for active managers. The facts don’t yet back that up. It’s going to be a fascinating 2025!

Subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication, and covered Impax Asset Management, Polar Capital, and Mercia Asset Management, as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on these companies by clicking on each. And please read this link for the terms and conditions of reading Equity Development’s research.