Asset Managers' AUM continues recovery in Q1

Good investment returns offset weak flows (again). But the picture is nuanced, with a huge divergence in fortunes. Have fundamentals, and sector-sentiment, turned?

This is not investment advice. Please read TheInvestors.blog disclaimer here.

Most asset managers showed AUM growth in Q1-24.

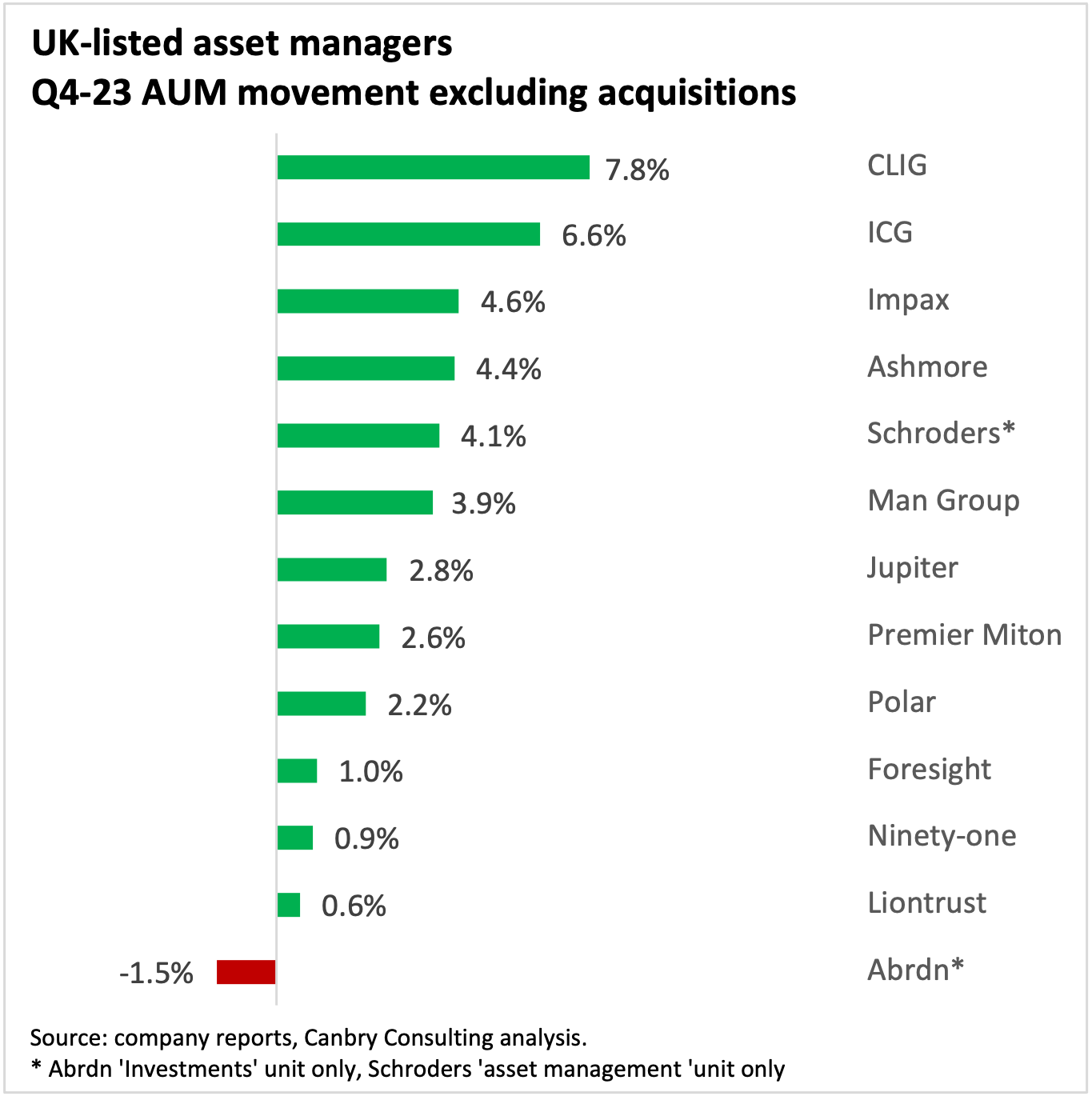

As they did in Q4-23 (see previous post below).

Three stood head and shoulders above the pack in Q1-24: Polar Capital, City of London Investment Group, and Man Group.

Strong returns concentrated in select sectors/assets

In the case of Polar (especially) and Man, investment returns were the dominant driver, with Impax and Liontrust also producing strong returns in the period.

For Polar, all three of its largest equity sector exposures (Technology, Healthcare, and Insurance) had a stellar quarter, with its largest funds in these areas outperforming benchmarks, which themselves were very strong. This was detailed in my recent Equity Development research note AUM and forecasts up, stellar returns, positive flows, and summarised in the chart below.

For Man Group, returns were especially strong in its long-only strategies (as they were in 2023), but also good in its Absolute Return Strategies (designed to produce returns in rising or falling markets). Impax’s growth-oriented bias in the sustainable investing space also put it ahead of the pack on investment returns.

Most other managers benefited from broadly positive equities markets.

But on the negative side, emerging markets fixed income specialist Ashmore experienced a small overall negative investment return, as local currency bonds in particular suffered from a stronger US dollar over the period.

And Foresight, while not splitting out net flows and investment returns on a quarterly basis, saw its infrastructure AUM fall 4% over the quarter, saying infrastructure assets had suffered downward valuation adjustments over the last year. And its relatively small Foresight Capital Management unit (which manages listed securities of real assets and sustainable equities), saw AUM fall by 19% in Q1 - suffering from a negative annual NAV performance.

Flows still weak, but signs of green shoots

The sea of green didn’t extend to net flows however, with most asset managers still experiencing very nervous clients, firmly in ‘risk-off’ mode.

There were two standouts though. First, City of London Investment Group (CLIG), which invests primarily in closed-ended funds including investment trusts, saw very strong flows into its international equities strategies drive overall positive flows at group level, following five consecutive quarters of negative net flows.

And second, Polar. While its positive net flow number doesn’t appear to be something to shout about at first glance, it marks a huge turnaround. In Q4-23, net outflows totalled -£1.1bn (-5.6% of AUM), changing to positive net inflows of +£56m (0.3% of AUM) in Q1-24.

To me, that turnaround was surprisingly late. As I wrote in my recent Equity Development note:

“… in the aggregate, investors withdrew capital from Polar over calendar-2023 (continuing the withdrawal trend of the technology stock rout of 2022), missing out on Polar’s stellar returns. That mismatch between returns and flows is telling and we think more consistent positive flows are bound to return to a quality active manager such as Polar, sooner rather than later.”

A mixed bag of recent share price moves

Regular readers of this newsletter will know that nearly all asset managers’ share prices have suffered badly since early-2022.

But along with the recent divergence in fortunes at AUM level, so too have share price movements diverged in 2024. Some are now being rewarded for strong recent performances (Polar, Man Group), some are bouncing off extremely sharp and protracted price falls (Liontrust, Premier Miton), while others are still suffering from more general negative sentiment towards the sector.

It looks a lot like investors haven’t quite made up their minds that fortunes have turned for asset managers. Some have clearly made a move to enter the market and believe that share price falls of some managers was over-done. But that’s not the consensus sentiment. Yet?

Subscribe to TheInvestors.blog below to keep up to date with further developments in the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication, and covered Impax Asset Management and Polar Capital as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Impax Asset Management here, and on Polar Capital here. (Please read this link for the terms and conditions of reading Equity Development’s research).