TheInvestors.blog is not investment advice. Please read the disclaimer here.

My Equity Development research note covering Polar Capital’s H1-26 is out. Read the full note here.

Key to understanding Polar’s prospects…

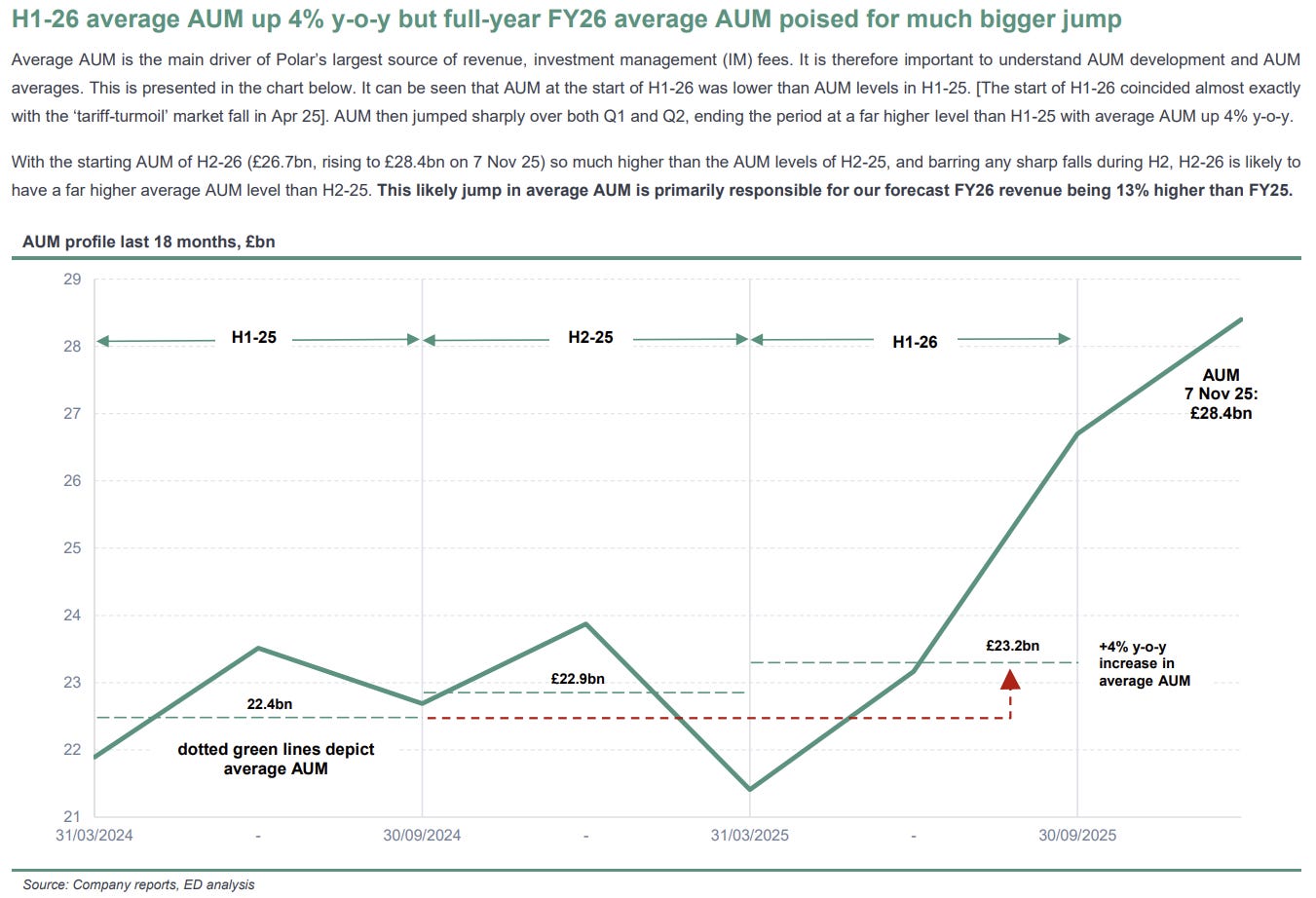

In the short term, is this chart. It shows Polar going into H2-26 at a far higher AUM level than last year. Absent a sharp fall in AUM during H2, it is likely to see a jump in average AUM over H2 which is its primary driver of revenue. That should also drive strong results in FY26 (ending 31 Mar 26) over FY25.

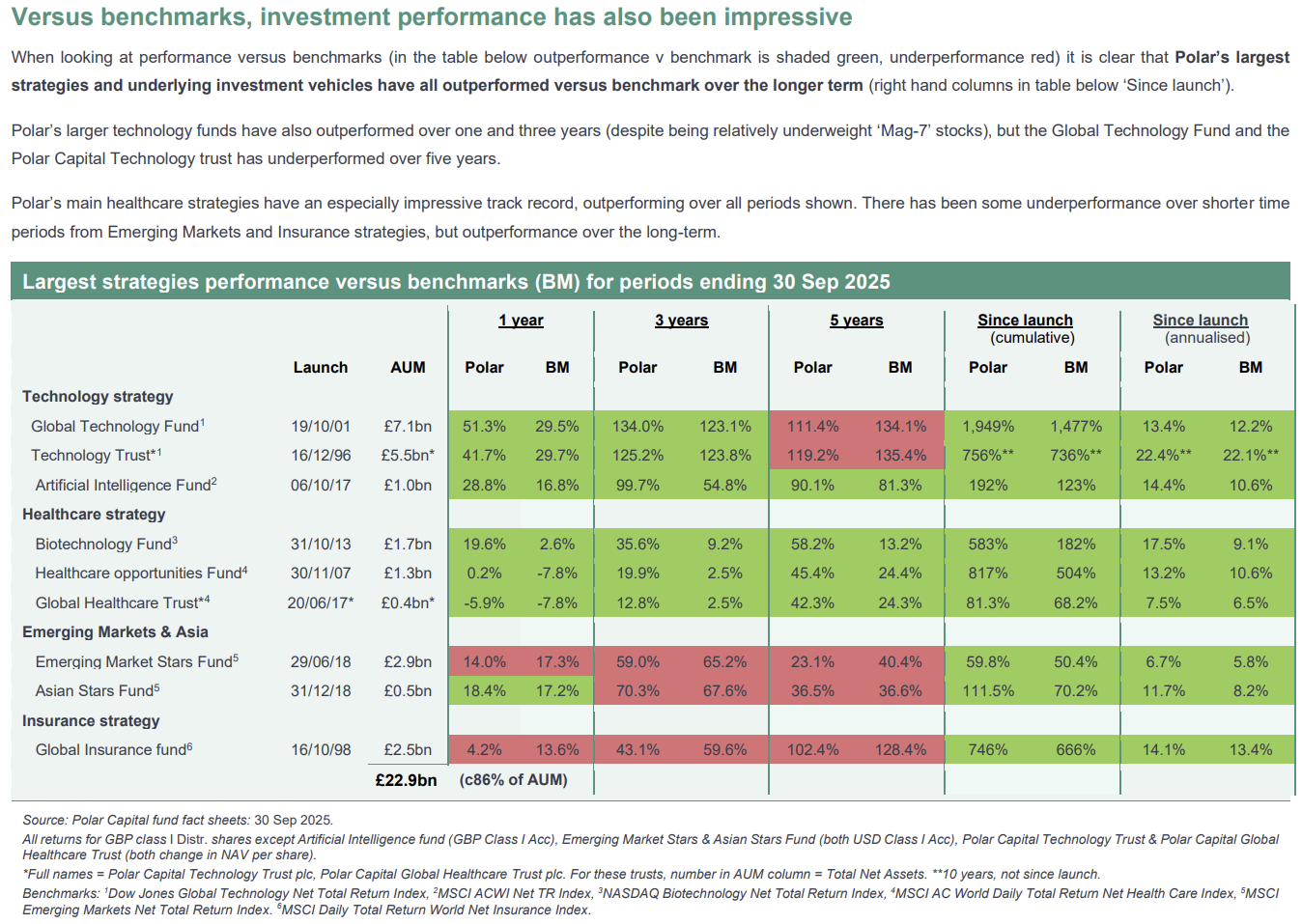

Over the longer-term, is this chart, which shows how its investment teams mostly outperform benchmark indexes, especially over the long term. That in turn should attract client capital. I was especially impressed by the technology team’s outperformance in the short term. Strong returns from the 'mag-7’ have had a huge influence on tech index returns. But Polar has comfortably outperformed benchmark indexes. That means its technology teams are uncovering highly attractive tech investment opportunities outside the mag-7. That’s why active managers exist.

Be sure to subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a Polar Capital and covered Polar Capital as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Polar here. And please read this link for the terms and conditions of reading Equity Development’s research.