Markets mask leader-laggard separation in Q3

UK-listed wealth managers enjoyed a big boost from markets in Q3. But when it comes to attracting & retaining client money, some are flying, some are struggling.

TheInvestors.blog is not investment advice. Please read the disclaimer here.

In early October, I set the scene for wealth managers’ Q3-25 trading updates. It might be worth a quick look at that for some pre-Q3 context and historical data. I wrote:

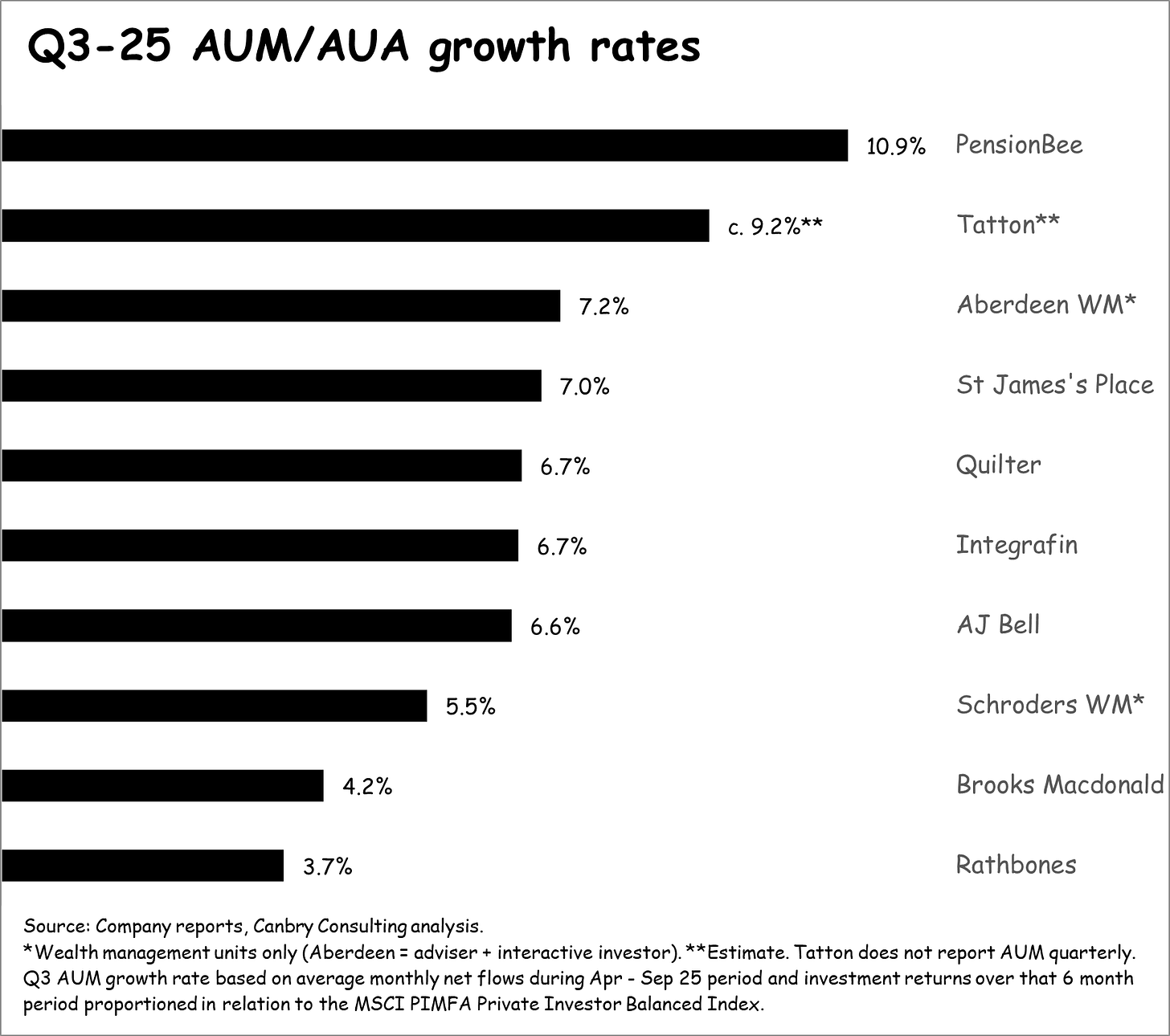

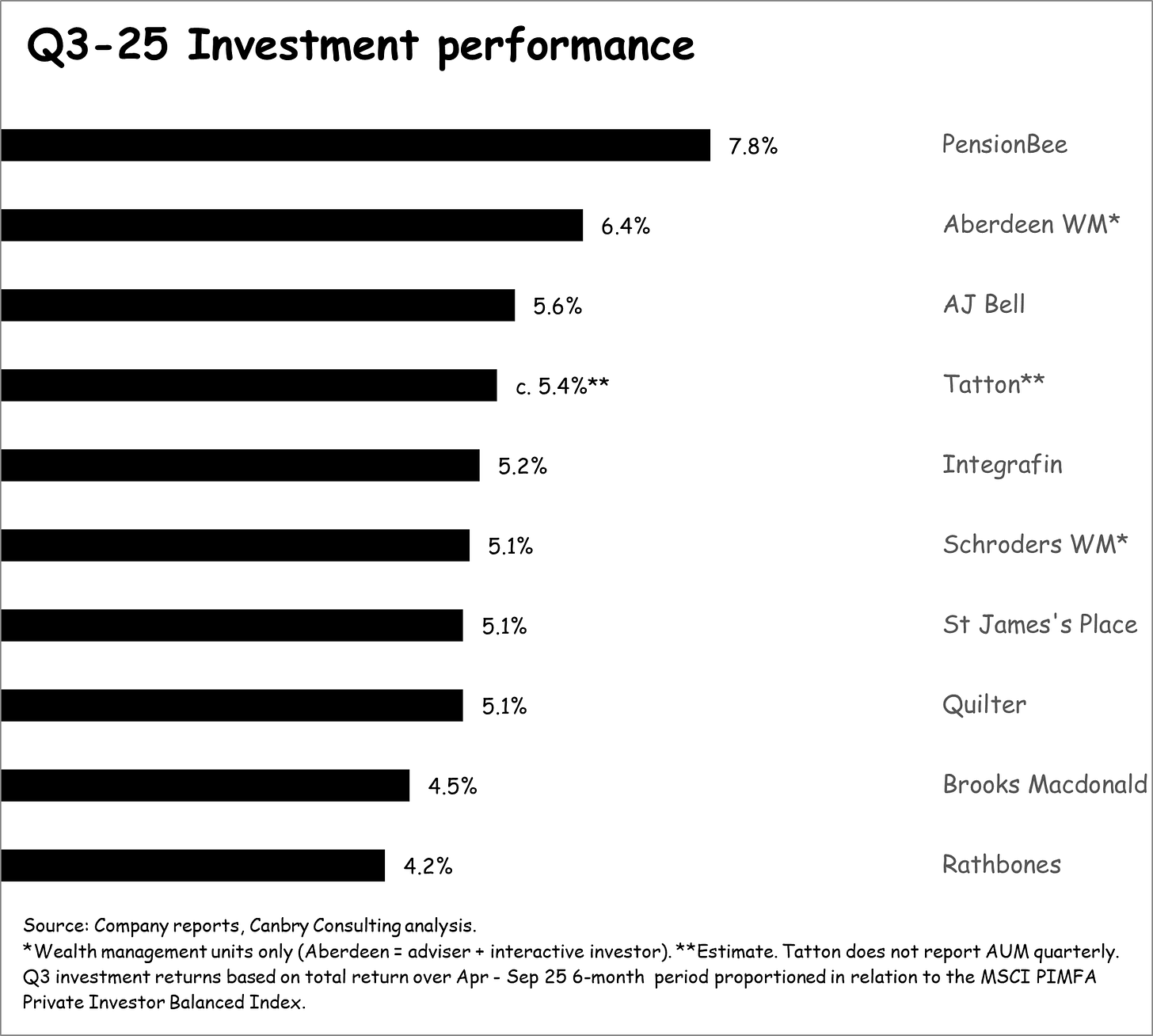

Markets have provided a solid tailwind in Q3 of 2025 (expect a 5-6% contribution to AUM). Net flows will show us who’s winning the battle for clients’ capital

Now that Q3 updates are in, let’s see what happened.

It was a solid quarter for AUM growth.

Rising markets gave all players a boost.

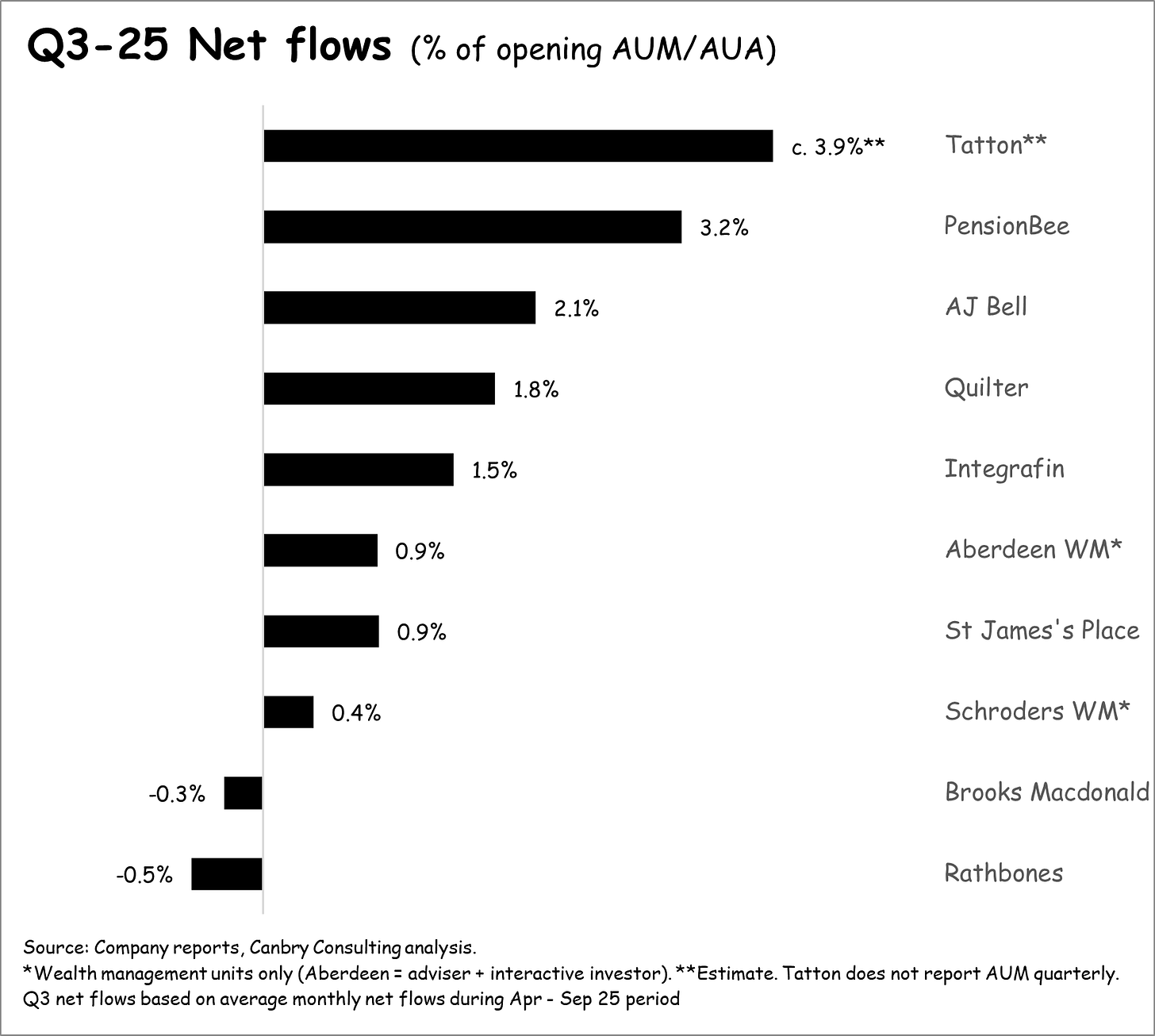

But net flows continued to be dramatically different across the sector.

Here’s a few pointers for those looking to dig into flows and prospects in a little more detail.

Tatton: I’d refer you to my recent Equity Development research note on this one. It’s flying high. Exceptional momentum, AUM +18% over H1-26

PensionBee: I covered the Q3 update in some detail yesterday. This is now two stories. An existing (but still relatively early-stage) UK business, and a US business in its infancy. Here’s the link:

AJ Bell: Going strong. CEO comment from the trading update: “a year of record growth, surpassing £100 billion in platform AUA and attracting over 100,000 new customers… record levels of platform customer growth and net inflows.

Quilter: Net flow turnaround over the last 18 months or so continues. CEO comment from the trading update: “Our business is demonstrating strong consistency, delivering in excess of £2 billion of net flows in each quarter of this year. Notably, our 2025 year-to-date core net inflows of £6.7 billion already comfortably exceed the £5.2 billion total for 2024.”

Integrafin: Growth continues. CEO comment from the trading update: “Net inflows in Q4 FY25 were up 28% year on year, bringing total FY25 net inflows to £4.4bn - an impressive 76% increase on FY24”.

Aberdeen: Interactive Investor going strong. Adviser business not so much. Trading update here. (Asset management is a bigger part of Aberdeen’s business)

St James’s Place: Solid quarter but with a word of caution from the CEO in the trading update: “with the third quarter having benefited from unseasonally high levels of client engagement and activity, and with the consumer environment uncertain, flows in the final quarter may therefore be less strong by comparison”.

Schroders: Wealth management is a much smaller part of the business (asset management far larger) and is undergoing some changes. CEO comment from the trading update: “We have simplified Wealth Management, regaining full ownership of Cazenove Capital in exchange for our stake in Schroders Personal Wealth.”

Brooks Macdonald: In my previous post I wrote: “Especially important will be stopping the bleeding of its (previously?) flagship and higher-margin Bespoke Portfolio Service product (around 44% of FUMA). It saw a welcome improvement in flows in Q2 … The lower-margin but fast-growing Managed Portfolio Service (now around 36% of FUMA) has seen remarkably consistent inflows.“ BPS flows were still negative in Q3 with MPS once again strong. So still work in progress. Trading update here.

Rathbones: Weak flows again but Rathbones has been digesting the very large Investec Wealth & Investment acquisition which has contributed to this. New CEO Jonathan Sorrell has just taken over. It’s all eyes on what he has in store! Trading update here.

Be sure to subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication and covered Tatton Asset Management as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Tatton here. And please read this link for the terms and conditions of reading Equity Development’s research.