All eyes on Wealth Managers' Q3 flows

Markets have provided a solid tailwind in Q3 of 2025 (expect a 5-6% contribution to AUM). Net flows will show us who's winning the battle for clients' capital

UK-listed wealth managers are about to start publishing their Q3-25 AUM updates. Here’s a refresher of H1 and a few things I’ll be looking out for in Q3 updates

TheInvestors.blog is not investment advice. Please read the disclaimer here.

‘AUM’ is the abbreviation used in this post to cover a range of terms used by wealth managers, including: ‘assets under management’, ‘assets under administration’, assets under influence’, ‘funds under management’, and ‘funds under direction’.

Included in this wealth management peer group are the platforms: AJ Bell, an adviser + D2C platform; interactive investor, a D2C platform within Aberdeen’s wealth management segment; and Integrafin, an adviser platform.

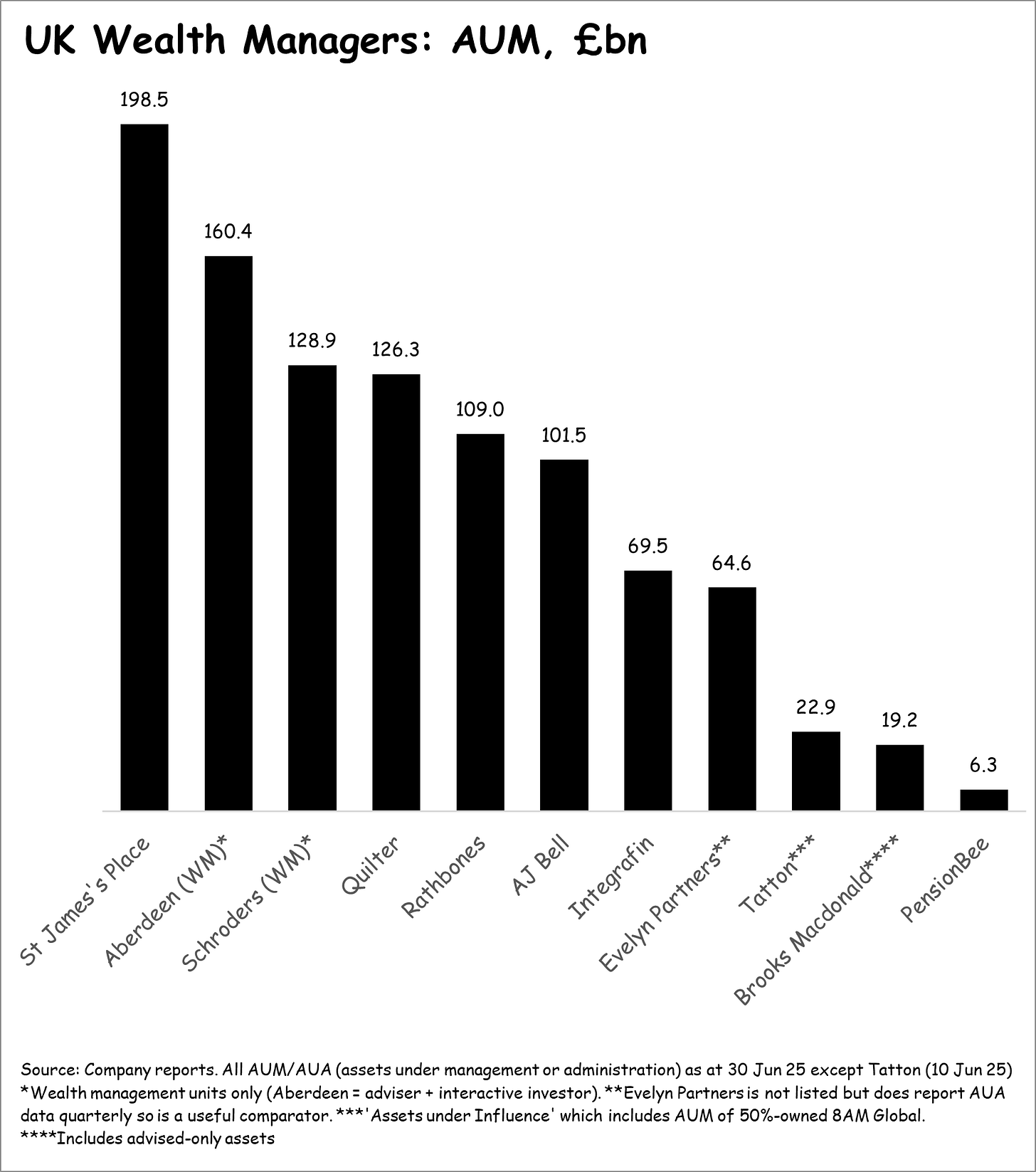

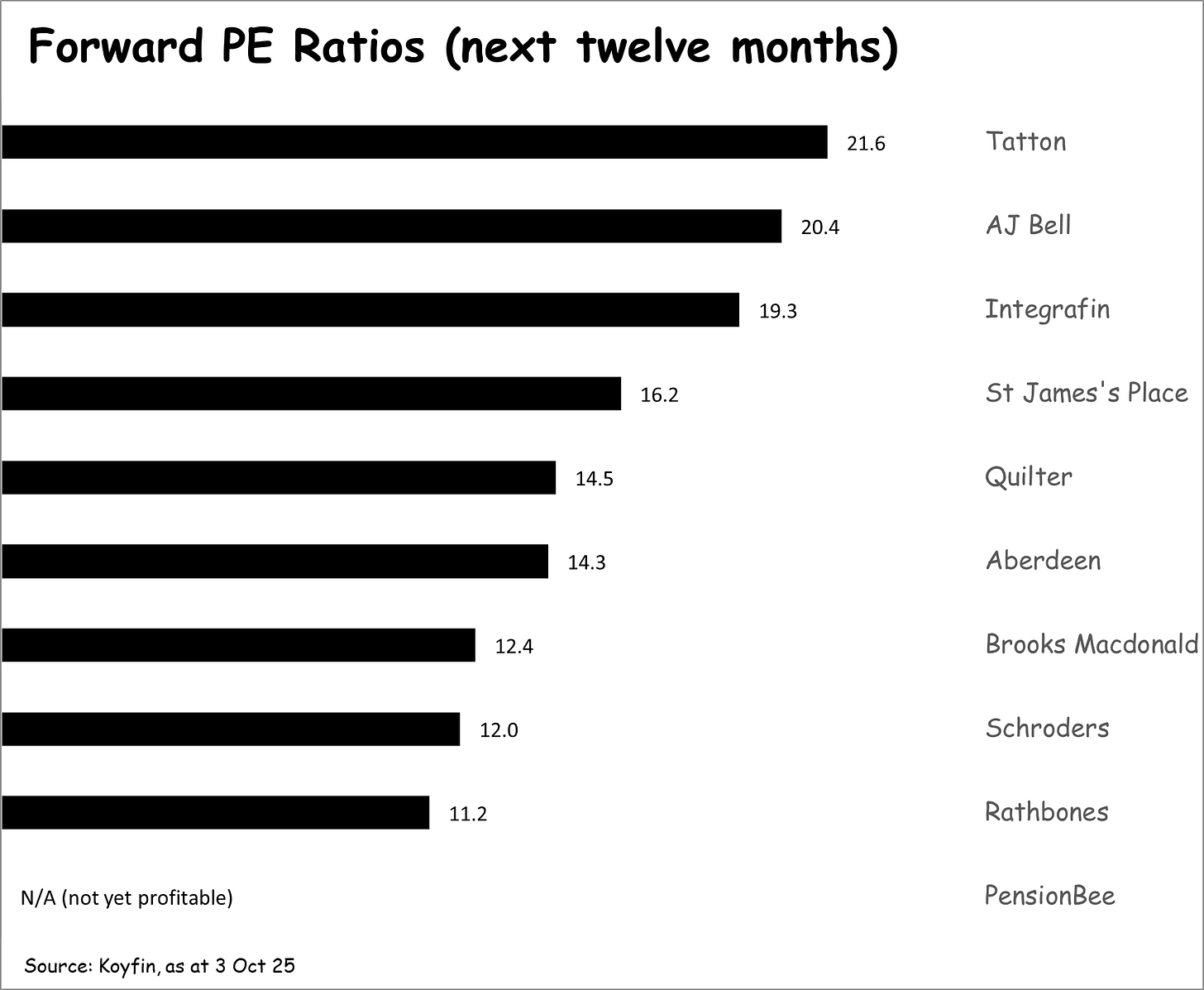

Sizes and valuations

Before diving into recent performance, it’s worth re-capping the size of each player, and their current valuations.

Mid-2025, AUM levels were as follows.

And forward PE ratios as follows:

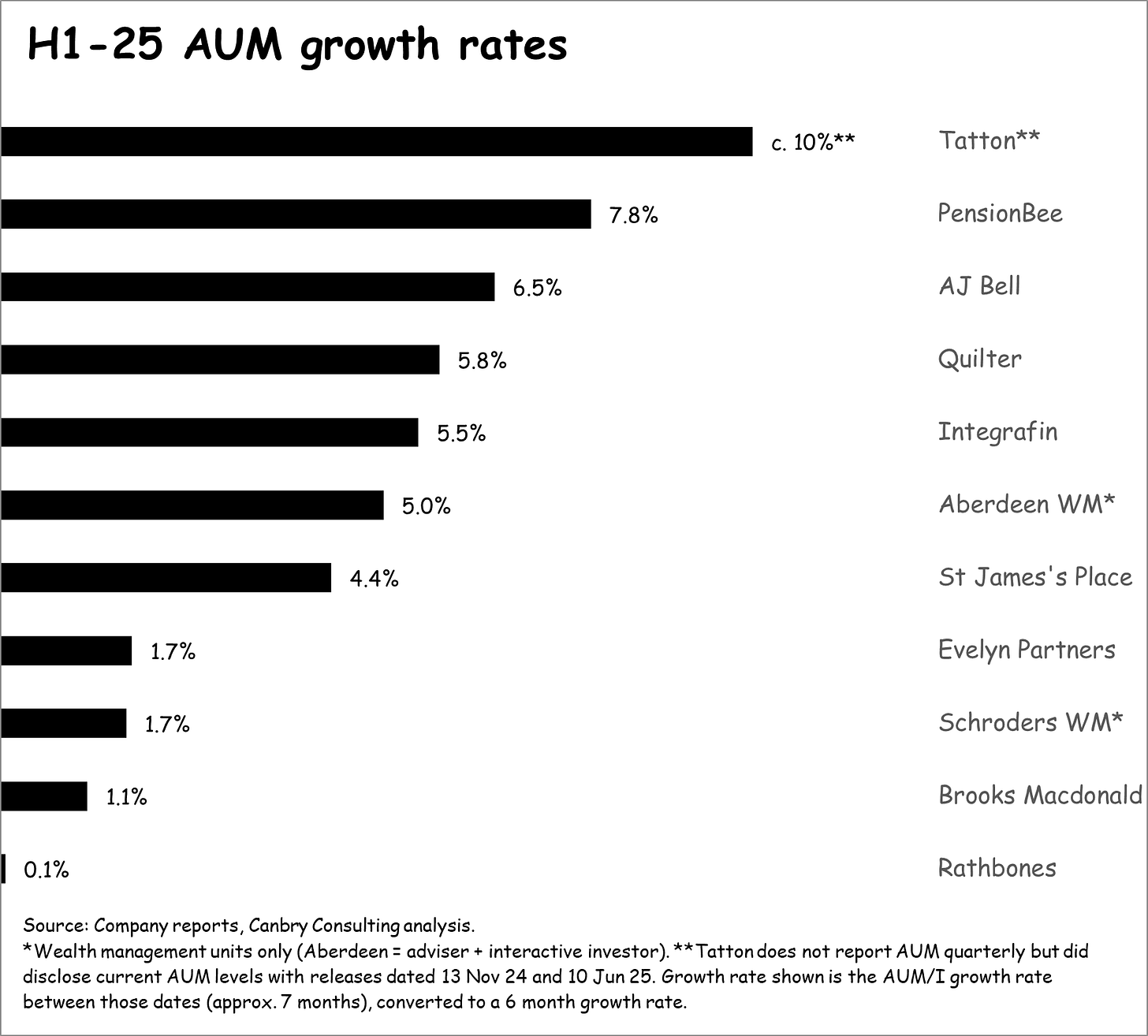

H1-25 AUM growth

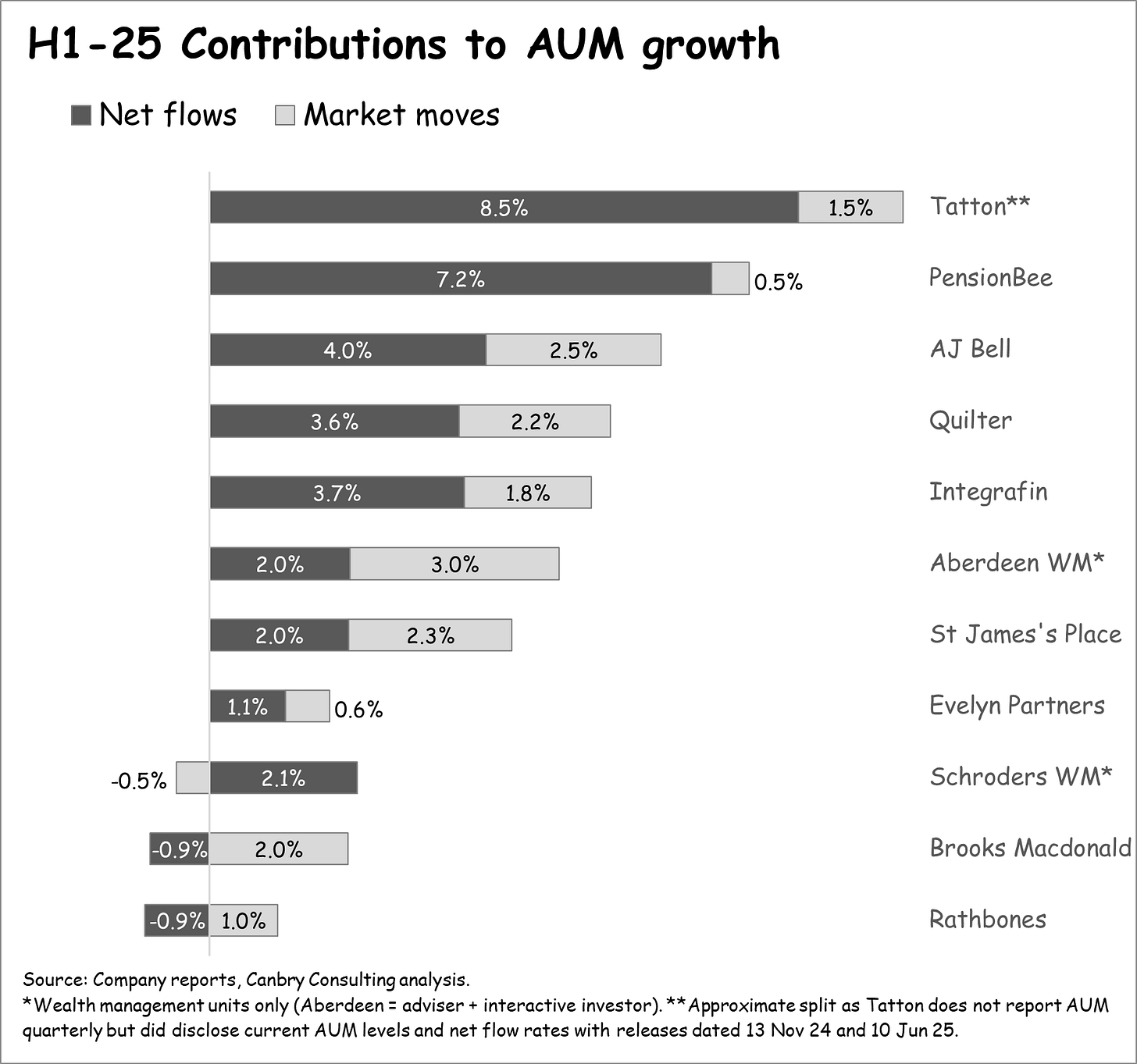

Growth was a mixed bag in H1. Tatton and PensionBee continued to be the growth leaders, with AUM up around 10% and 8% respectively. A mid-tier group recorded 4-7%. While growth was fairly anaemic for Evelyn, Schroders, Brooks Macdonald, and Rathbones.

Growth leadership was driven by strong net flows.

Looking forward to Q3, in terms of markets’ contribution to AUM growth, a good benchmark for wealth managers is the MSCI PIMFA Private Investor Balanced Index. This was up 5.8% in Q3, so a tailwind there.

Then for a few of the company’s above, here’s what I’ll be looking out for…

Tatton

More of the same! This is the high-flyer of the pack with the highest, but hardly excessive valuation (forward PE of c. 22).

AUM/I was c. £22.9bn in early-June with net inflow guidance of £200-£250m per month (about a 3% quarterly or 12% annualised growth rate from net flows). If that momentum is maintained and average market growth achieved, then AUM/I shouldn’t be far short of the £25bn mark at end-Sep. If Tatton signals it’s business as usual, that means it’s flying along. Tatton’s trading update is usually mid-October.

If you want to dig deeper, here’s my post from June covering FY25 (to 31 Mar 25).

PensionBee

This is now two stories. An existing (but still relatively early-stage) UK business, and a US business in its infancy.

For the UK, I’ll be looking for solid customer number and AUM growth. PensionBee added 10k new ‘invested customers’ in Q1 and 11k in Q2 on £7.6m of marketing spend over H1. Total invested customers were 286k at the end of Q2. So keep a lookout for customer number growth in the context of marketing spend. It should be closing in on 300k invested customers.

Net flows were £214m in Q1 and £209m in Q2 (around 14-15% annualised growth rate from net flows) so I’d like to see that momentum at least maintained. And PensionBee should have a stronger market tailwind than most wealth managers as its portfolios seem to have a higher equities allocation (a younger demographic with a long-term investment horizon for their pension pots).

For the US, we’re waiting for the first set of customer and AUA numbers to come in.

I’m less obsessed about the target of breakeven adjusted-EBITDA at this stage of growth. I’d like to see strong growth prioritised. See my previous post on that subject here:

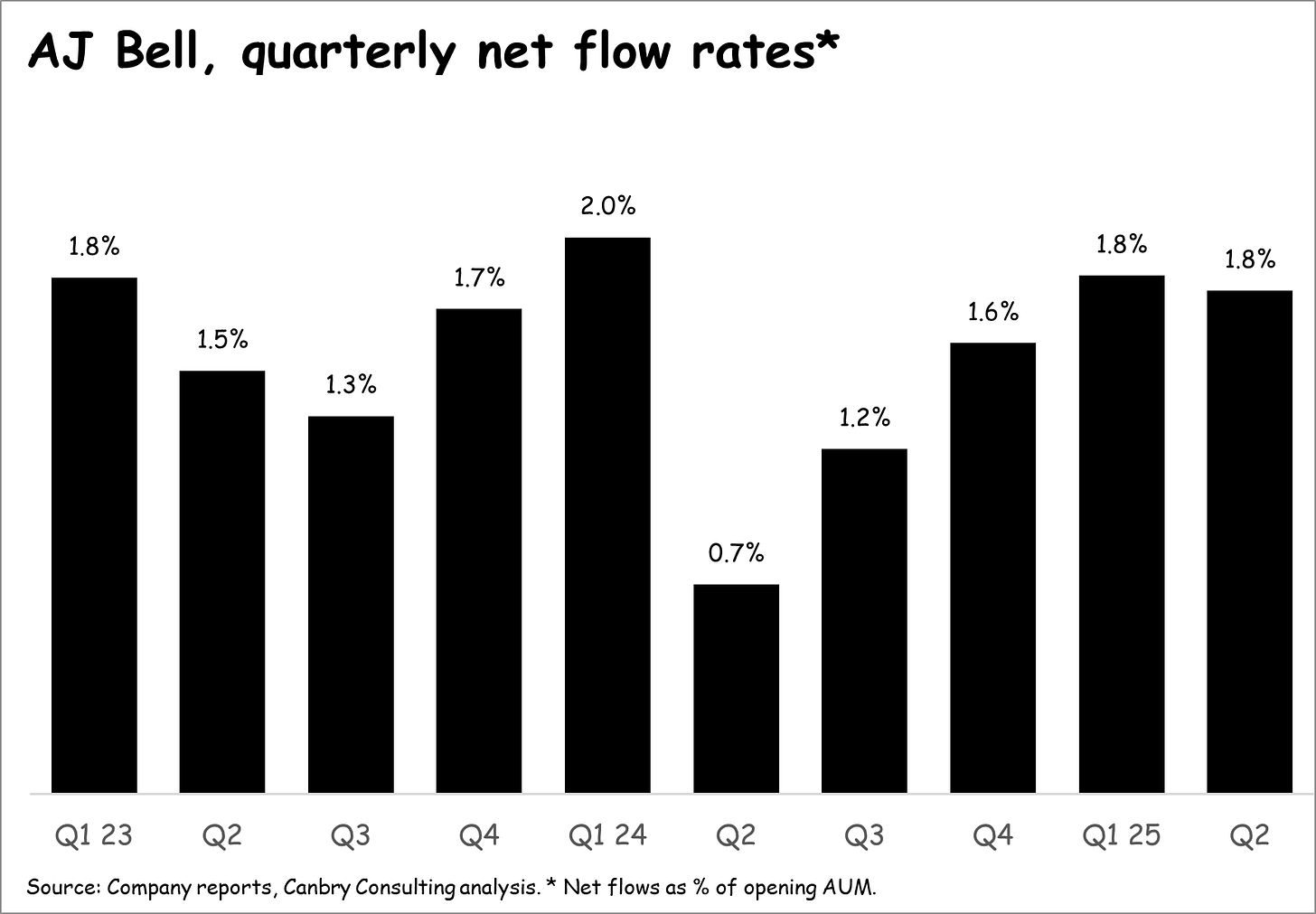

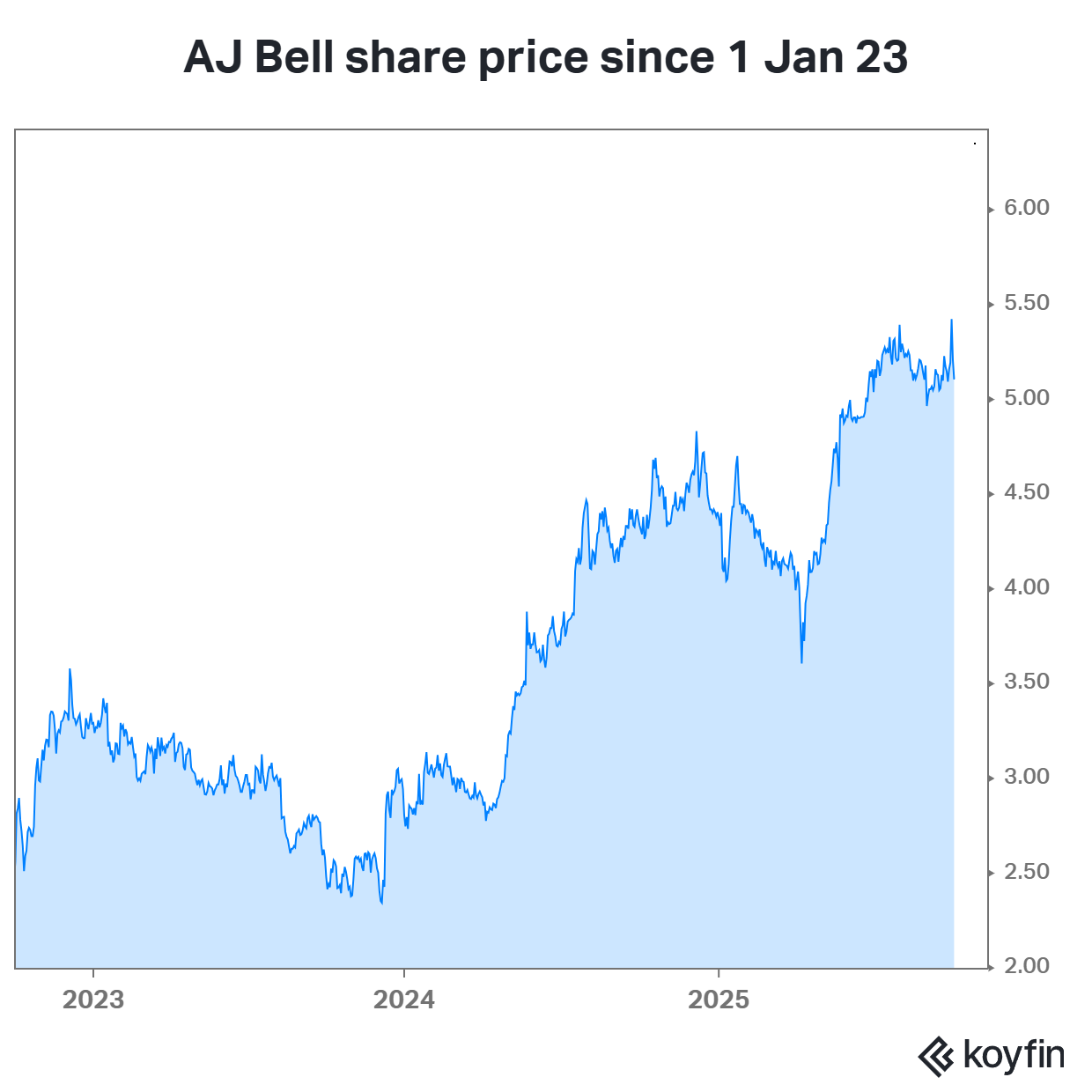

AJ Bell

A very strong performer in terms of net flows, share price, and valuation (2nd highest forward PE of c. 20).

Investors will just want to see momentum being maintained.

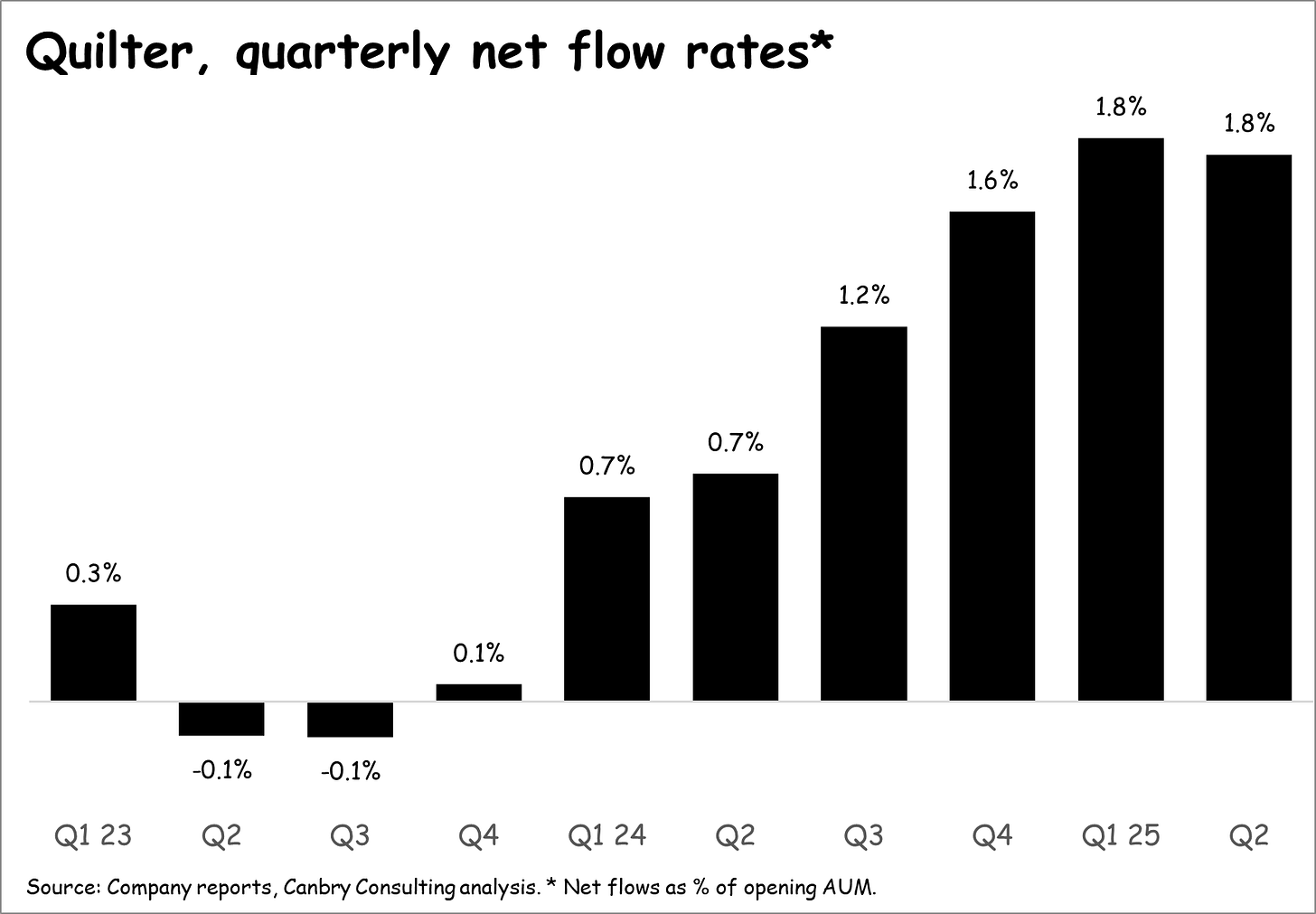

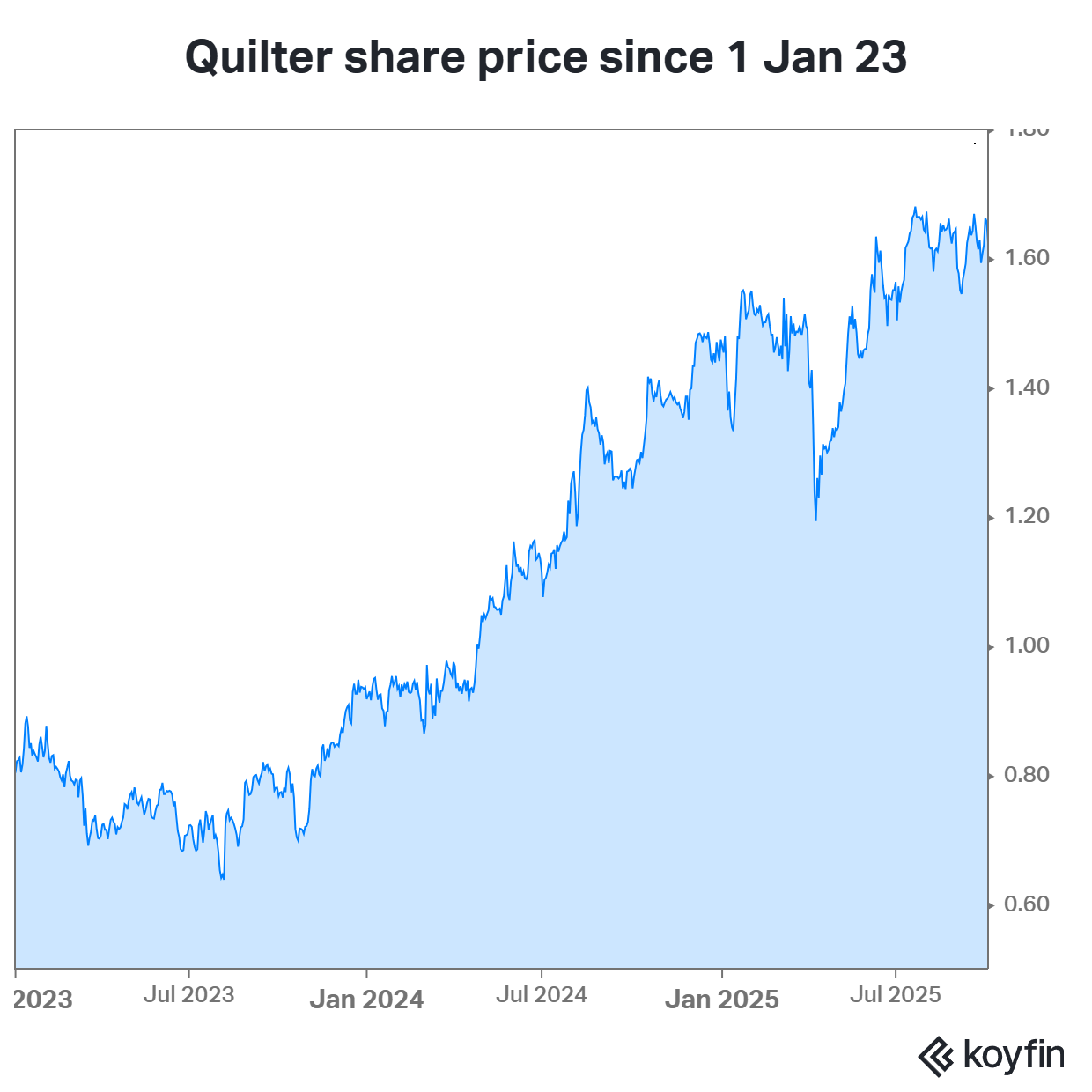

Quilter

A strong performance in the last 18 months or so. Net flows have turned around pretty dramatically.

And the share price has responded.

Quilter is looking like a quality outfit in the high-net-worth and affluent space. At a forward PE of around 15x it’s not cheap, but it is a strong performer. Investors need to be looking out for continued strong momentum.

Aberdeen & Schroders

While both of these are big players in the wealth management space, they both have far larger asset management units. Schroders’ asset management = c. 81% of AUM, Aberdeen c. 72% of AUM. So investors’ analysis should probably start on the asset management side.

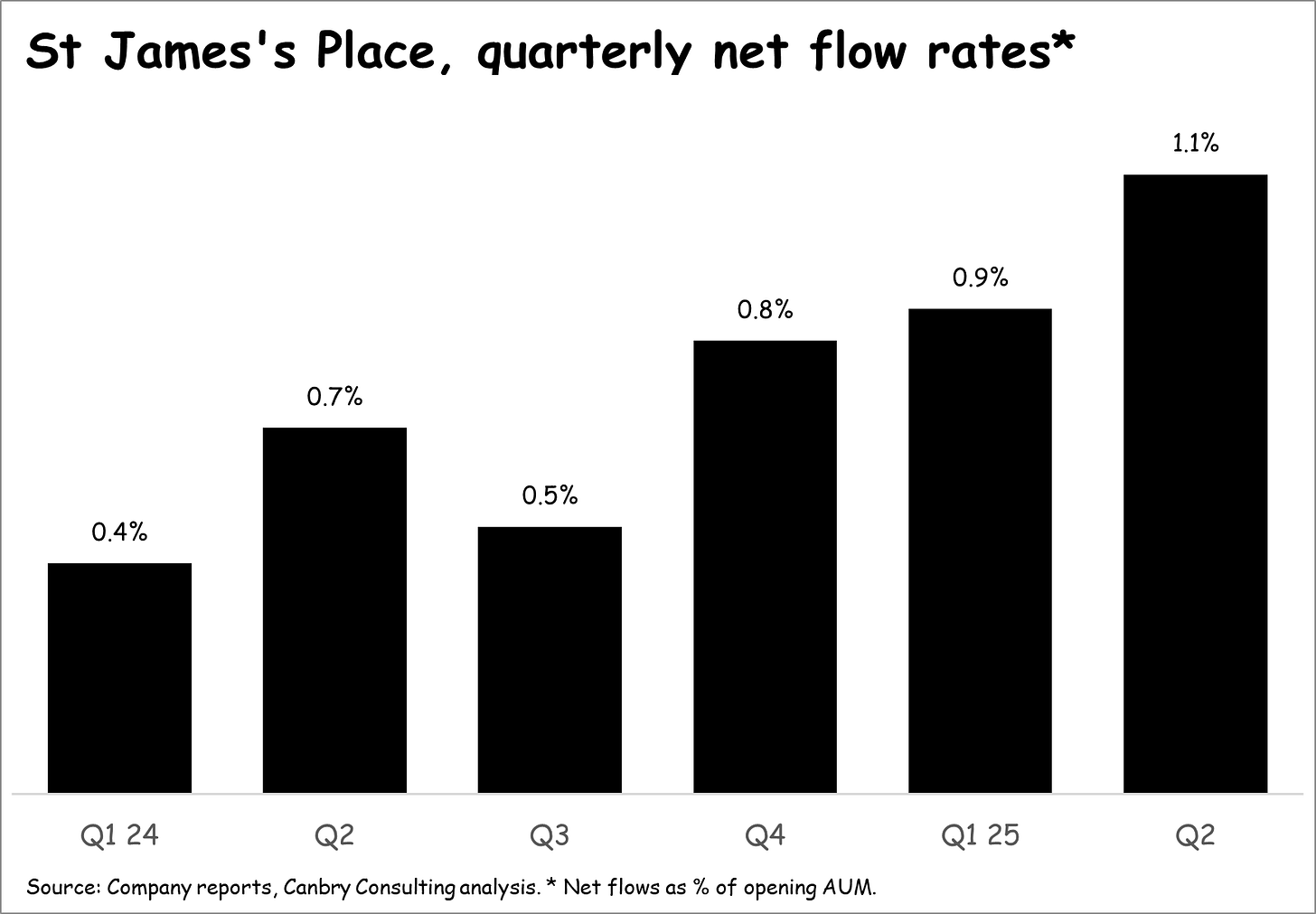

St James’s Place

SJP has staged a remarkable share price recovery since the depths of its fee scandal. The share price is more than 3X Apr 24 levels. Less regulatory uncertainty after a revamped fee structure, costs cuts and improving net flows have all contributed. Net flows have actually been remarkably strong for such a big player.

But a forward PE of c. 16x suggest investors expect pretty strong earnings growth, so it needs to keep that momentum up. Is there there more to juice out of the share price?

I suppose it depends mostly on its ability to keep winning new clients and for clients to keep on investing once they’re on board. Fees are still pretty heavy, and still complicated in my opinion (a great deep-dive by City Wire here). So the SJP offering has to be really top-class to keep that growth up. I just don’t know!

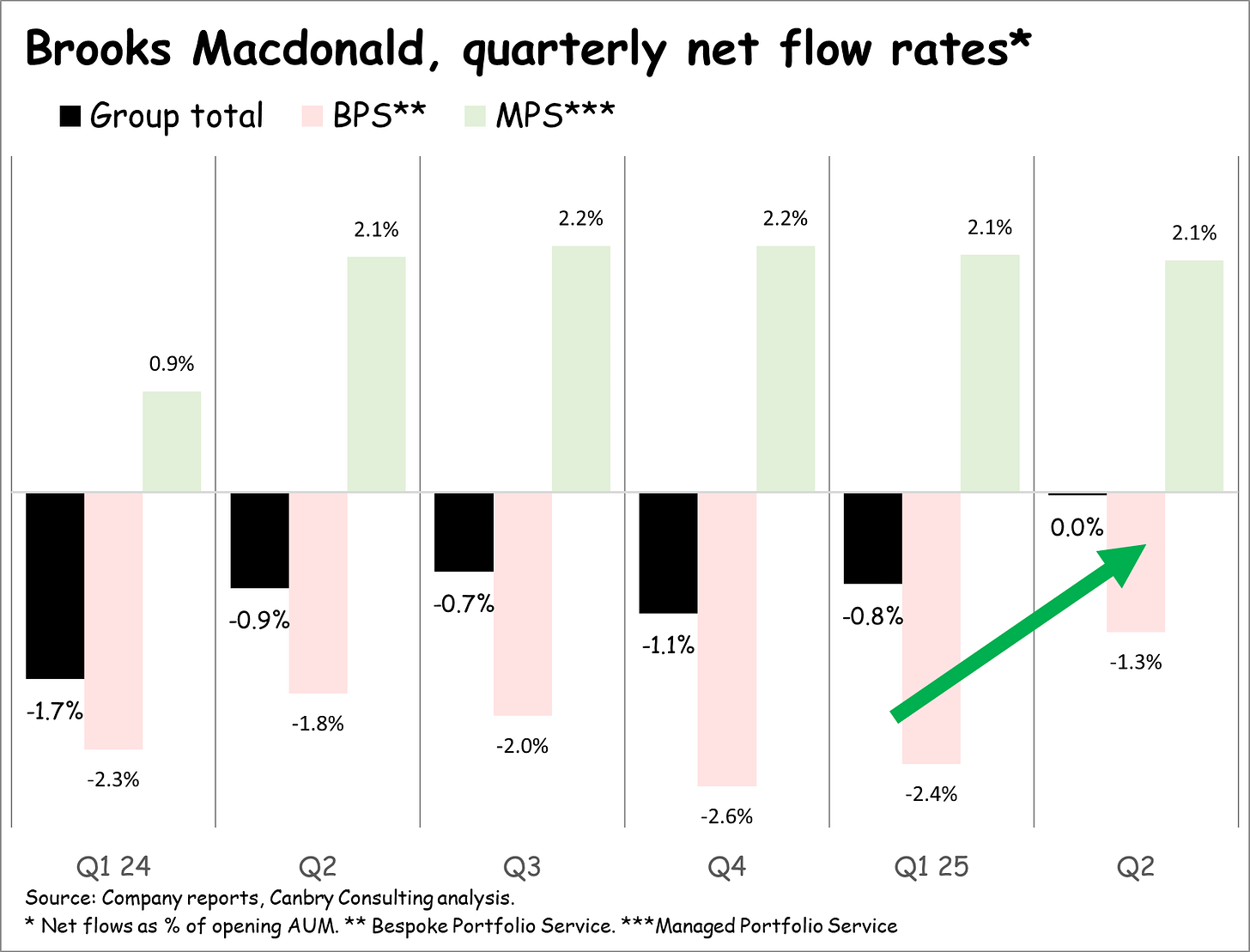

Brooks Macdonald

BM is going through a big shake up under CEO Andrea Montague. The international business (Channel Islands & Isle of Man) has been sold and the UK financial planning business has been beefed up with a series of acquisitions. So it’s totally focused on the UK now.

Key is a return to positive net flows after a tough period characterised by quite heavy outflows. It nearly got there in Q2 (see black bars below) so it will be hoping for a move into positive territory in Q3.

But especially important will be stopping the bleeding of its (previously?) flagship and higher-margin Bespoke Portfolio Service (BPS) product (around 44% of FUMA). It saw a welcome improvement in flows in Q2 (pink bars below).

The lower-margin but fast-growing Managed Portfolio Service (now around 36% of FUMA) has seen remarkably consistent inflows (green bars below), so I’ll be looking for Brooks to maintain this.

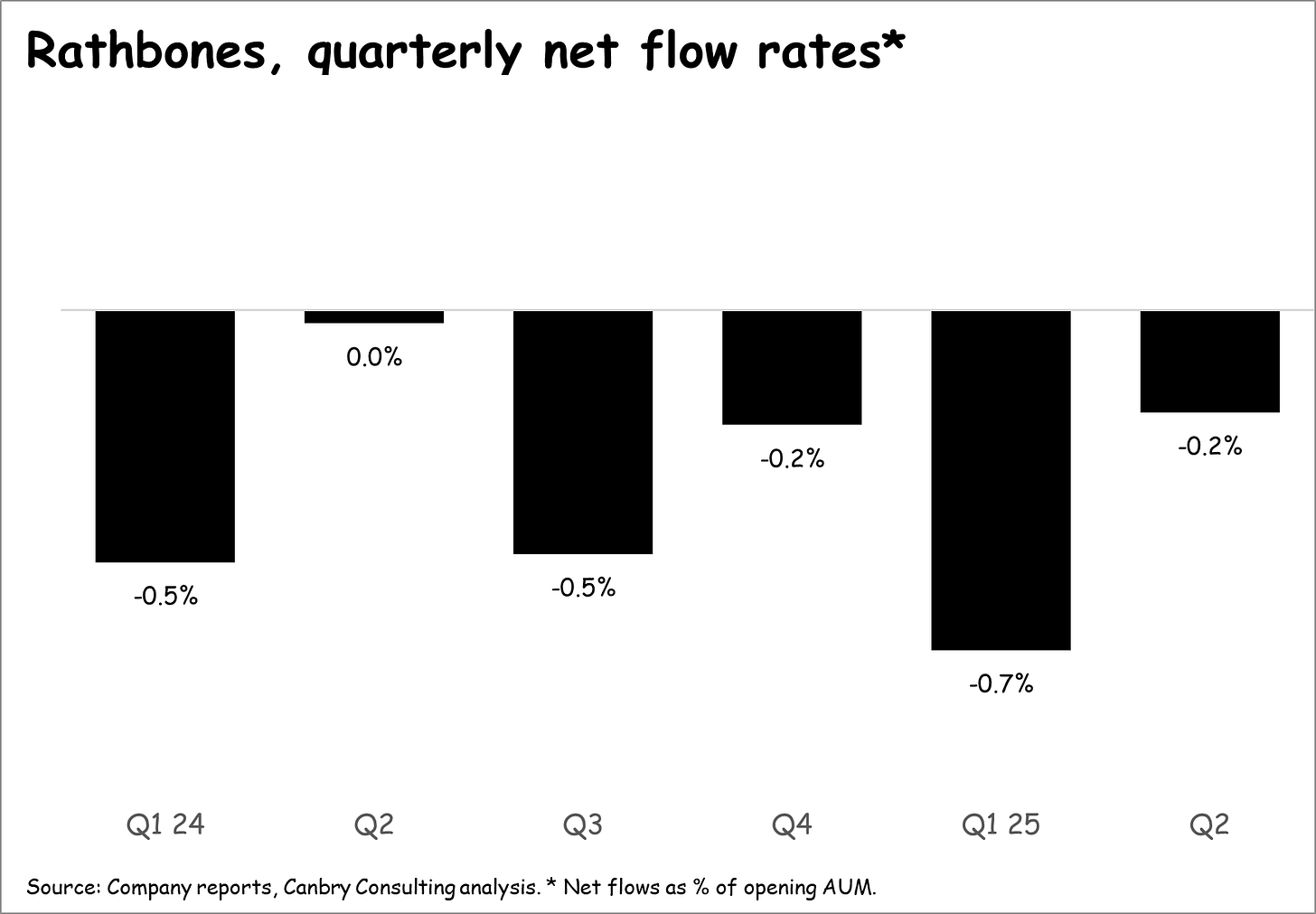

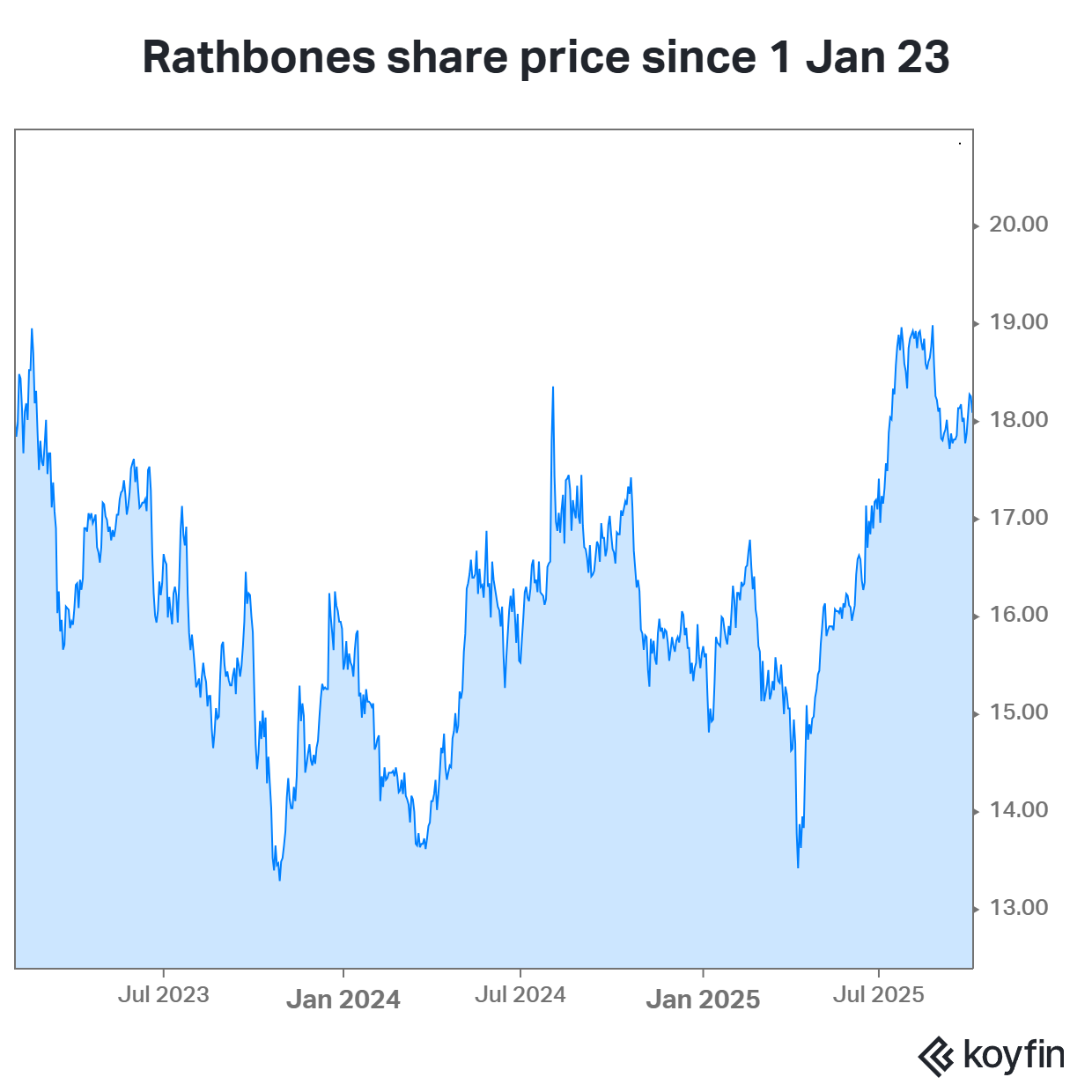

Rathbones

A laggard in terms of flows, valuation (forward PE = c. 11) and share price performance.

Admittedly, Rathbones has been digesting the very large Investec Wealth & Investment acquisition which has certainly contributed to the weak net flows.

In its interim results to Jun 25, CEO Paul Stockton said:

“The first half of 2025 marked a pivotal phase for Rathbones, as we successfully completed the planned client and asset migration of Investec Wealth & Investment (IW&I). This milestone increased run-rate synergies to £47.2 million as at 30 June 2025 and set the stage for the remaining synergies to be delivered in the second half of the year as we continue to realise further benefits of operating as a single, larger business… These results mark a turning point since the combination and enable the business to shift its focus from migration to the future opportunity ahead.”

Stockton will be retiring in September with Jonathan Sorrell taking over.

Sorrell joins Rathbones from Capstone Investment Advisors, the derivatives investment management firm, where he has been President from January 2020. Before that he was Chief Financial Officer and then President of Man Group.

It’s all eyes on what the new CEO has in store!

Be sure to subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication and covered Tatton Asset Management as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Tatton here. And please read this link for the terms and conditions of reading Equity Development’s research.

"Compared to both its peers and its benchmarks, Tatton has delivered strong performance. Over every time period that features in our analysis, Tatton has beaten the average return of rivals by a considerable margin."

https://citywire.com/wealth-manager/news/tattons-mps-assets-are-surging-does-it-deliver-performance-to-match/a2475146?re=135347&refea=46519&link_id=1956130