Wealth managers' Q1 flows hold up

Amidst tariff worries and US market falls, UK investors just kept on feeding those ISAs and SIPPs. But try telling that to shareholders!

TheInvestors.blog is not investment advice. Please read the disclaimer here.

Q1 is an important quarter for UK wealth managers. It includes the run-up to the end of the tax year which is characterised by many investors ‘rushing’ to use up their ISA and SIPP allowances for that year. So, comparing Q1-25 to Q1-24 gives a good insight into the current state of play.

In the run up to ‘Liberation Day Tariffs’, and amidst US market falls, some may have expected a relatively weak quarter for wealth management flows with clients holding back on investments. Not so much. Perhaps surprisingly, flows were mostly stronger than in the previous year.

Now it’s certainly true that flows are not the full picture. The median move in assets under administration or management of the above group was actually down by 0.9%, driven by market moves which were down by a median 1.7%. Hardly a big deal, that’s going to happen sometimes. So it’s fair to say that Q1 mostly came and went without incident for wealth managers.

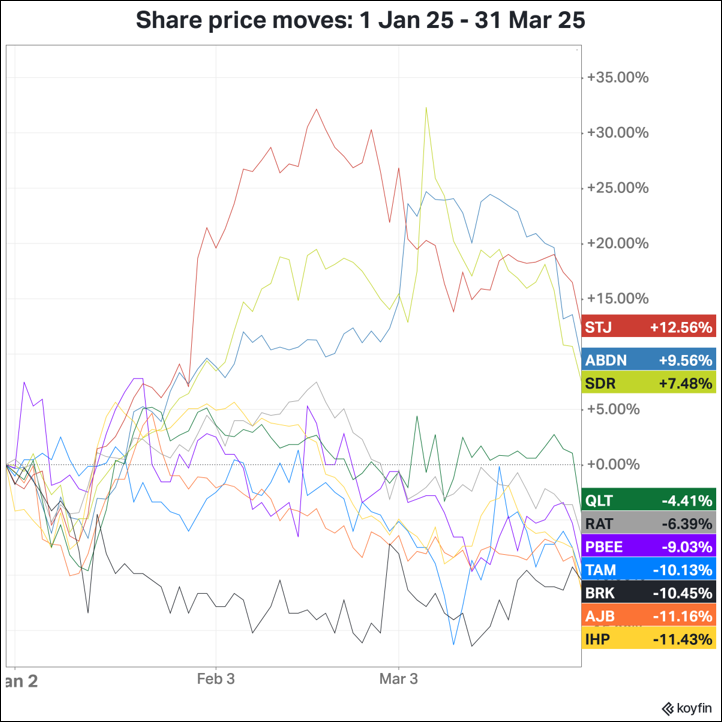

But for their share prices, that’s a different story. Q1 saw some pretty significant moves and disparity during a relatively ’boring’ quarter…

…with the big moves continuing into the far less boring Q2 as the tariff turmoil ramped up.

I can only reiterate what I said in my previous wealth management post …

… in UK wealth management, disparity makes for a stock-pickers' paradise!

Be sure to subscribe to TheInvestors.blog below to keep up to date with the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication.