UK Wealth Managers' 2025 in charts

A relatively solid year for fundamentals, but some huge and divergent share price moves, coupled with AI fears, makes for tricky valuation assessments

TheInvestors.blog is not investment advice. Please read the disclaimer here.

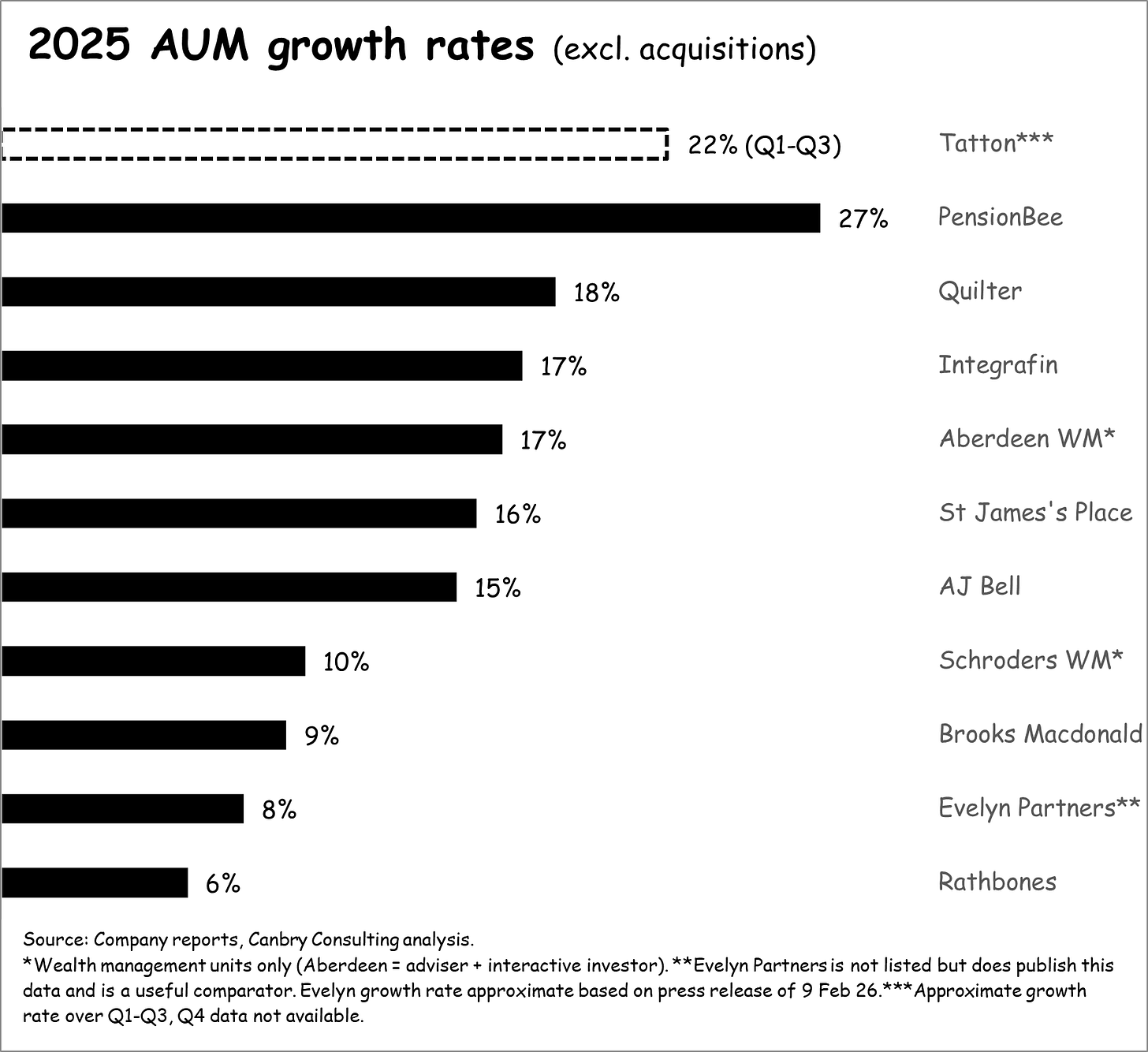

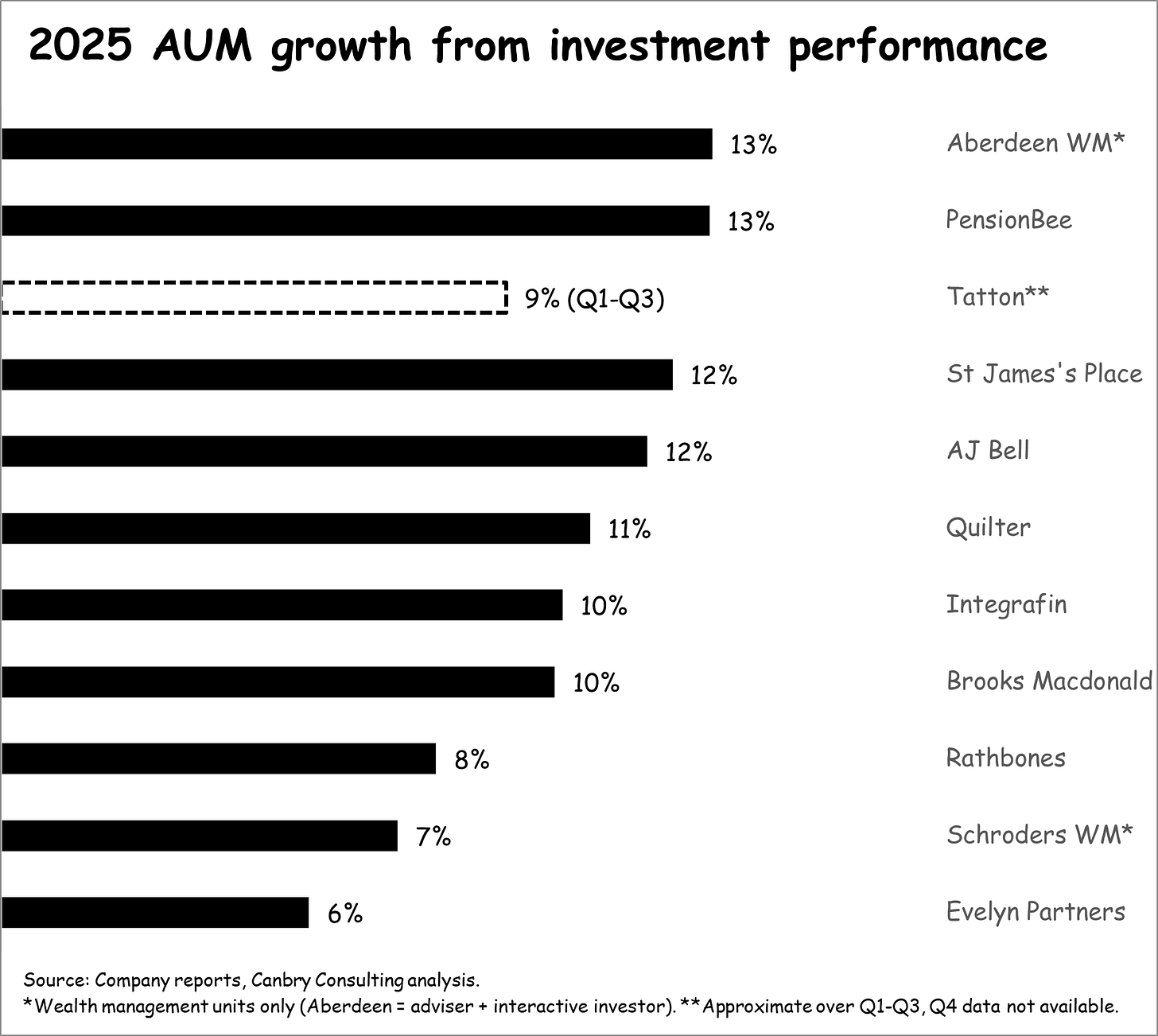

2025 was a year of solid AUM growth for the UK-listed wealth management sector.

Markets provided a solid tailwind.

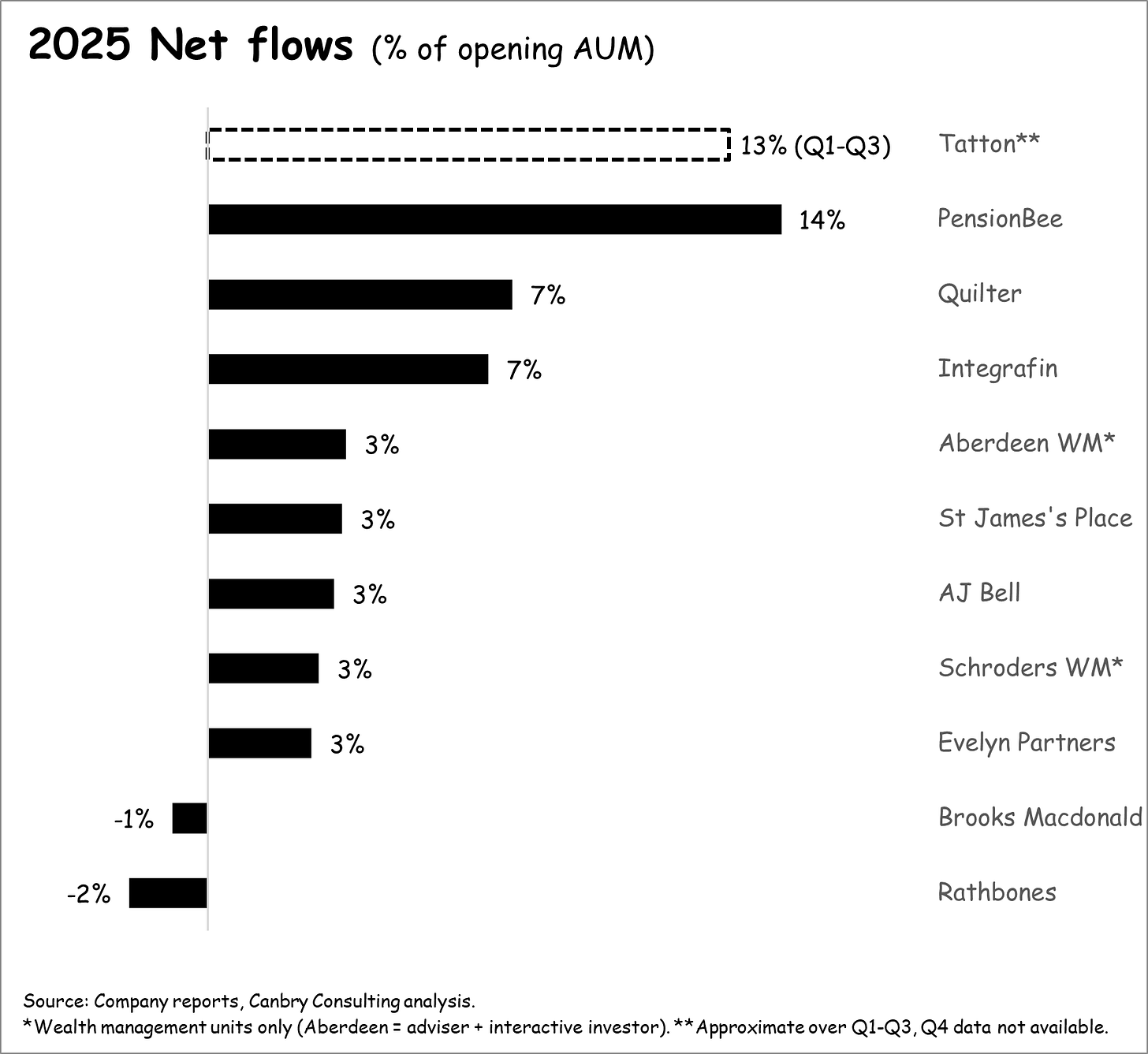

But there was huge disparity in net flows. Tatton and PensionBee are clear highflyers. Quilter and Integrafin had solid net flows. Flows were positive but not particularly strong for Aberdeen, St James’s Place, AJ Bell and Schroders. Brooks Macdonald and Rathbones suffered from net outflows.

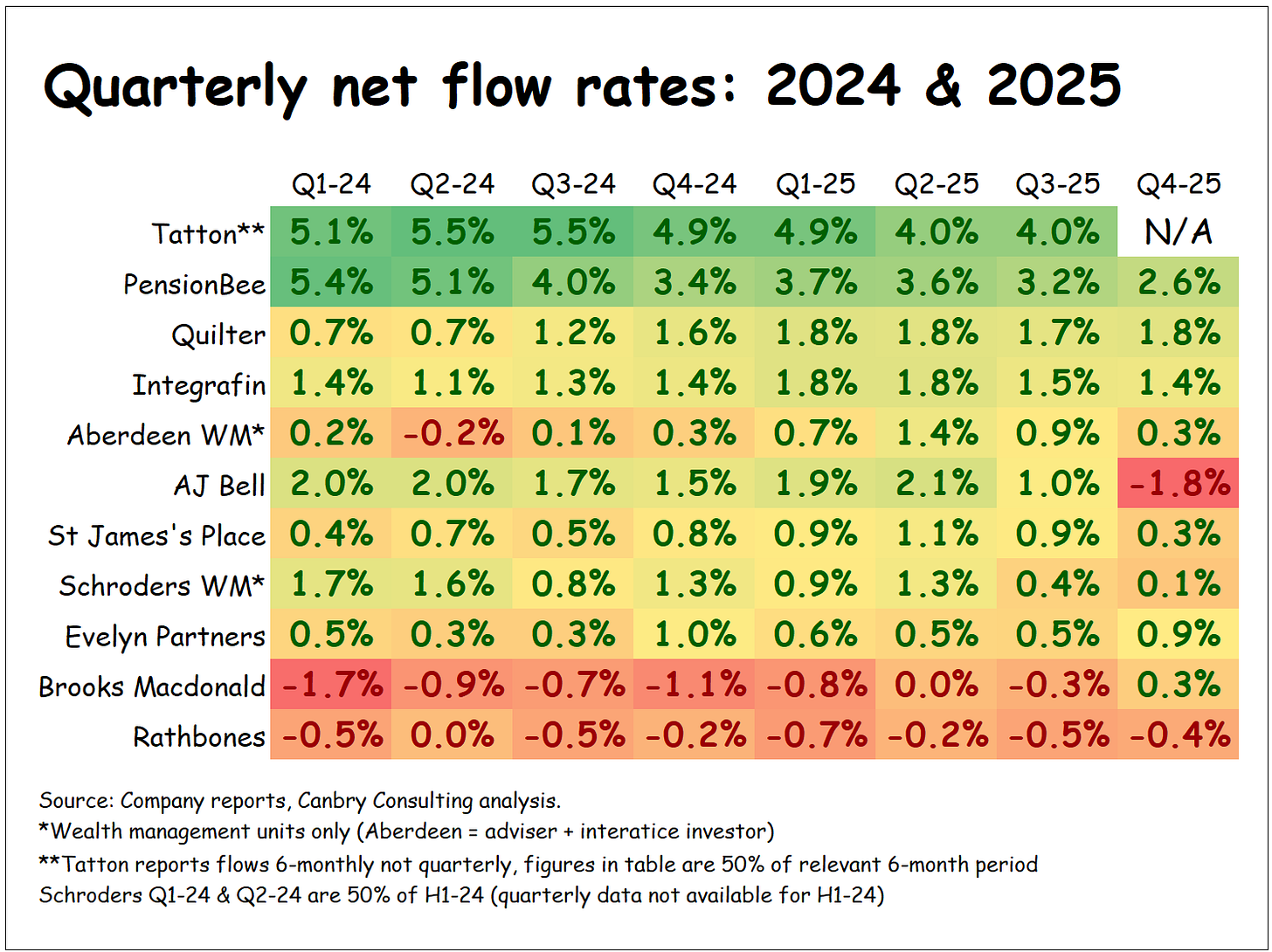

Quarterly net flow data (shown below as a ‘heat map’) provides far greater insights than the above annual view, highlighting trends of improving or weakening flows.

Tatton maintains the strongest flows by some distance, even though 2025 saw a slight cooling after a bumper 2024.

PensionBee flows are still strong, but net flow rate is slowing as AUM grows fairly rapidly off a small base (current AUM c. £7.4bn, next smallest AUM in this group is Brooks Mcdonald at c. £17.8bn excluding advised-only assets).

Quilter (with the third-largest AUM in this group: c. £141bn) has seen an impressive recovery in net flows since very weak flows in 2023 (0.1% annual net flow rate).

Q4-25 saw a sharp drop in net flow rates for AJ Bell, St James’s Place, Aberdeen, and (to a lesser extent) Schroders. This was mostly attributed to investor nervousness ahead of the UK budget. For example:

AJ Bell said: “Record gross inflows were moderated by temporarily elevated outflows, driven largely by uncertainty ahead of the UK Budget. Customers nearing retirement responded to speculation around potential pension tax changes, resulting in a £500 million increase in pension withdrawals compared with Q1 FY25.”

St James’s Place said: “The final quarter also saw elevated short-term outflows, as many clients accelerated tax-free cash (TFC) withdrawals from their pensions in anticipation of reduced TFC allowances. As we exited the quarter, we were pleased to see both outflow rates and client engagement normalise, and this has continued into the early part of 2026.”

Brooks Mcdonald appears to be making good progress in turning around the very weak flows of 2023 and 2024. Net flows were positive in Q4-25 after a protracted period of net outflows. This is especially impressive given the jump in gross outflows seen by others during this quarter.

Rathbones is still struggling with net outflows, but investor sentiment certainly seems to be turning (see below), following the integration of the large Investec Wealth acquisition and the appointment of a new CEO.

Share price moves differed hugely across the sector, with some relatively steady, and others extremely volatile.

St James’s Place recovered strongly after it’s huge c. 77% slump over 2022, 2023, and early-2024. But it was then hit again by the “AI will replace advisers” scare of early-Feb 26. The share price is c. 27% off early-2022 highs.

Rathbone’s share price had a strong year, with markets responding very positively to the appointment and early-tenure messaging of new CEO Jonathan Sorrell (announced Mar 25).

Quilter also had a strong year as business fundamentals, especially net flows, improved.

Other share price moves were relatively small.

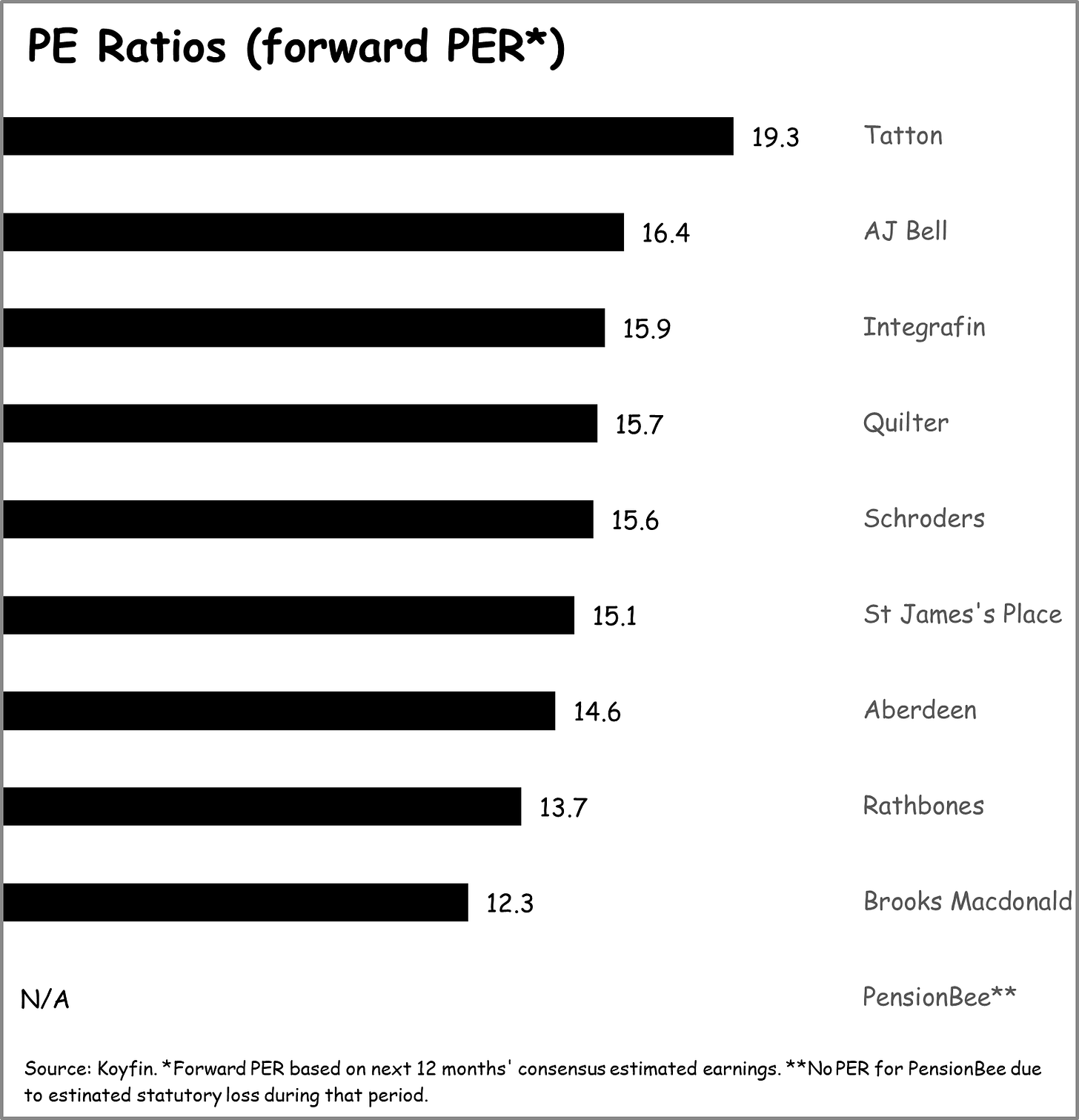

This has left forward-PE Ratios in a fairly tight range.

I’m not surprised by Tatton’s highest-in-sector PER, given its far superior growth and especially strong net flows. But the premium doesn’t appear particularly large. See my previous research on Tatton here.

And I’m not surprised by Rathbones and Brooks Macdonald having the lowest PERs, given their weaker net flows. But again, these are not huge discounts.

PensionBee is an outlier as it is still far earlier-stage than others in this group, and is not yet profitable on a statutory earnings basis (but it’s not far off). See my previous comments on PensionBee here.

What is clear, is that untangling investment opportunities in the wealth management space requires some deeper digging than a cursory overview of some of the “headline numbers” presented above. I’ll be doing some of that digging in future posts.

My next post covering this sector is to dig a little deeper into the relative valuation of Evelyn Partners which is to be acquired by Natwest. Only some of the latest financials of Evelyn have been disclosed, but there are a few clues we can take a look at to put that deal in context and compare it to current valuations of listed companies in the UK wealth management sector.

Be sure to subscribe to TheInvestors.blog below to be notified when these upcoming posts are published and to keep up to date with further insights into the UK asset and wealth management sectors.

And if you think TheInvestors.blog is worth telling others about and sharing, I’d be most grateful if you do.

Disclosure: At the time of writing, Paul Bryant was a shareholder in a number of the companies mentioned in this publication and covered Tatton Asset Management as an analyst on behalf of Equity Development Limited. Read Equity Development’s research on Tatton here. And please read this link for the terms and conditions of reading Equity Development’s research.